Deposit

Explore what a deposit means in Canadian real estate transactions, how much is typical, and why it’s a vital part of making a serious offer on a home.

May 22, 2025

What is a Deposit?

A deposit is an upfront payment made by a homebuyer to show their good faith and commitment when submitting an offer on a property. It forms part of the total purchase price.

Why Deposits Matters in Real Estate

In Canadian real estate, the deposit is a critical part of any offer to purchase. It demonstrates the buyer’s seriousness and is held in trust – typically by the seller’s brokerage – until closing.

If the transaction goes through, the deposit is applied toward the purchase price. If the buyer backs out without a valid reason under the contract, the seller may be entitled to keep the deposit as compensation. Conversely, if the seller defaults, the buyer may be entitled to a refund.

The amount of the deposit is negotiable but usually ranges from 1% to 5% of the purchase price, depending on market conditions. In competitive or high-value markets, larger deposits can strengthen an offer and signal financial readiness.

Buyers should ensure the deposit funds are readily available, as delays can breach the terms of the Agreement of Purchase and Sale. Legal and real estate professionals help structure deposits to protect both parties and reduce transaction risk.

Example of a Deposit

A buyer submits a $30,000 deposit along with their offer on a $750,000 home in Calgary. The deposit is held in trust and later applied to the purchase price on closing day.

Key Takeaways

- An upfront payment showing a buyer’s commitment to a property purchase.

- Held in trust and applied toward the final sale price.

- Helps protect sellers from buyer default.

- Amount varies but often ranges from 1% to 5% of the purchase price.

- Must be submitted promptly as per contract terms.

Related Terms

- Agreement of Purchase and Sale

- Conditional Offer

- Firm Offer

- Closing Date

- Good Faith

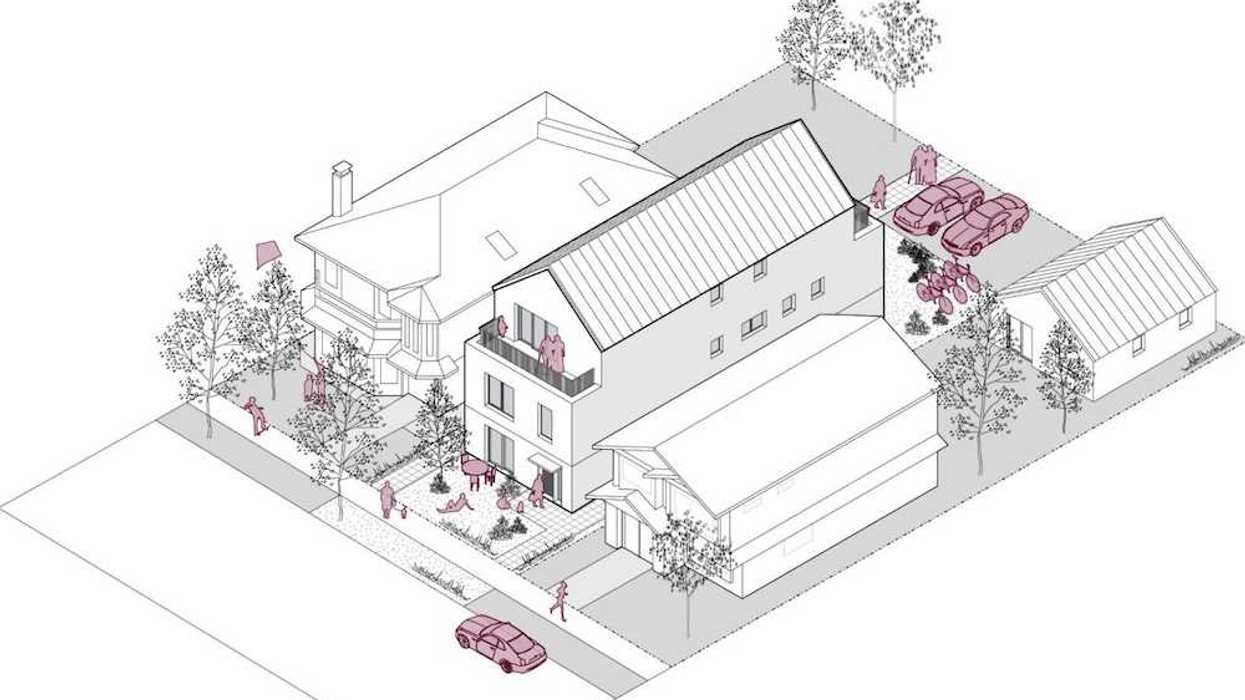

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

The Yonge Corporate Centre at 4100-4150 Yonge Street. (Europro)

The Yonge Corporate Centre at 4100-4150 Yonge Street. (Europro)

Jon Sailer

Jon Sailer