Finance

Opinion

Op-Ed: If We're Serious About Sixplexes, We Need To Get Serious About DCs

We are facing an unprecedented affordability crisis, and there is no logical justification for a tax that directly raises rents and home prices, writes lawyer and tech entrepreneur Liam Gill.

Jun 24, 2025

Construction

GTA Homebuilding Slowdown Could Cost 41,000 Jobs, $10B In Investment: Report

In the case that new home construction continues down its current path, the negative impacts to GTA residential construction jobs and the broader economy would be nothing short of remarkable.

Development Projects

BGO Joins Anthem On 2-Acre Coquitlam Rental Project After $22M Purchase

Anthem Properties acquired the 1184 Inlet Street property in Coquitlam, located near Lafarge Lake, back in 2021 for $22,350,000.

Development Projects

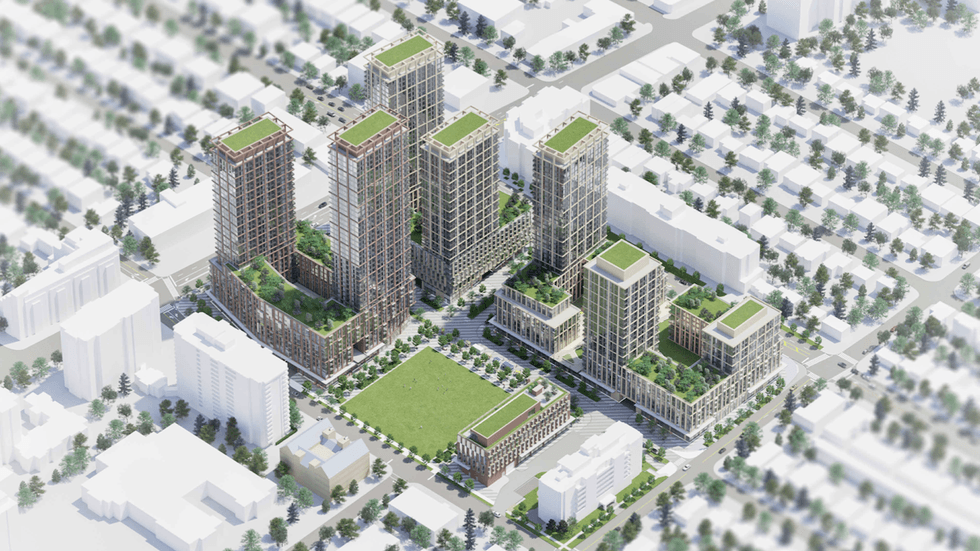

RioCan, Milestone Bringing 8-Building Master Plan To Lawrence Plaza In Toronto

The proposed master plan will consist of eight buildings from six to 40 storeys, as well as 2,693 new homes that are poised to be rental in tenure.

From Great To Even Greater: Oviedo Properties Announces BridgeCity Redesign

The project’s fresh direction is focused on improving the overall experience, from the streetscape to the amenities, bringing the masterplan into stronger alignment with today's (and tomorrow's) market preferences.

Policy

"Room To Be More Bold": Why We Need To Expand The FTHB GST Rebate

Because the current rebate is proposed to apply exclusively to first-time home buyers, some point out that its impacts would be muted.

Retail

Primaris REIT Buys 65-Acre CF Lime Ridge Mall In Hamilton For $416M

Primaris REIT (TSX: PMZ.UN) is acquiring an 100% ownership stake in the Lime Ridge Mall located at 999 Upper Wentworth Street in Hamilton, Ontario.

Development Projects

Cold Plunges, Hot Potential: This Mountain Spa Fund Has Investors Paying Attention

Wellness tourism is booming. Nordic spas are trending. And in Western Canada’s beloved mountain towns, demand for immersive, nature-connected experiences is vastly outpacing supply.

Economy

Bank Of Canada Holds Interest Rate For Second Time In A Row

This marks the second consecutive pause from the Bank of Canada, and leaves the policy interest rate at 2.75%.

Finance

Newly Launched Financing Model Makes It Easier To Access Your Home Equity

The Home Equity Partners Inc. has debuted a HESA model in Canada, giving GTA homeowners the opportunity to access flexible financing by tapping into their home’s value. The best part? It doesn't involve taking on debilitating debt.

Multifamily

Fiera Buys Quarry Park Towers For $120M In Top Q1 Transaction In Calgary

The acquisition of DeVille at Quarry Park was announced by Fiera Real Estate in January, but financial details were not disclosed.

Office

Oxford Buys CPP Out Of Trophy Office Towers In Vancouver, Calgary For $730M

CPP Investments sold its 50% stakes in Vancouver's Marine Building, MNP Tower, Guinness Tower, and The Stack, plus Calgary's Centennial Place, Eau Claire Tower, and 400 Third.

Economy

Where Every Big Bank Stands On Wednesday's Interest Rate Announcement

The Bank of Canada will make its latest interest rate decision this week, and trade uncertainty continues to be high of mind as economists place their bets.

Industry

RioCan Demands Payment From Hudson’s Bay, Files For Receivership Of Joint Venture

RioCan REIT (TSX: REI.UN) and Hudson's Bay formed the joint venture in 2015 and it has become HBC's primary real estate subsidiary.

Load more