Bridge Financing

Learn what bridge financing means in Canadian real estate, how it works in holding deposits and documents, and why it's important for a secure property transaction.

May 22, 2025

What is Bridge Financing?

Bridge financing is a short-term loan that helps homebuyers cover the financial gap between buying a new property and selling their existing one.

Why Bridge Financing Matters in Real Estate

Bridge financing is especially useful in real estate markets where homeowners are buying and selling properties in quick succession. In Canada, many buyers find themselves needing to close on a new home before the sale of their current home is finalized. Bridge loans provide temporary funding to 'bridge' this gap, allowing buyers to access the equity in their current home for the down payment or closing costs on the new property.

These loans are typically offered for short periods—ranging from a few weeks to several months—and are secured against the current property. They usually come with higher interest rates than traditional mortgages due to their short-term nature and associated risks, but the convenience and flexibility they offer can be critical in competitive or fast-moving markets.

Lenders often require a firm sale agreement on the existing home before approving bridge financing. This ensures there’s a clear exit plan for repaying the loan. Without such a contract, qualifying for a bridge loan may be more difficult, especially if the buyer is already carrying a mortgage on both properties.

Understanding bridge financing can help buyers plan transitions between homes more effectively, avoid costly delays, and maintain negotiating power when purchasing new property.

Example of Bridge Financing

A homeowner in Calgary buys a new house that closes on June 1, but their current home won’t sell until July 15. They use bridge financing to access $100,000 of equity for the new down payment, repaying it once the sale closes.

Key Takeaways

- Provides short-term funding between buying and selling homes.

- Helps access home equity before current property closes.

- Common in fast-paced or competitive real estate markets.

- Carries higher interest rates and must be repaid quickly.

- Requires a firm sale agreement on the current home.

Related Terms

- Down Payment

- Home Equity Loan

- Firm Offer

- Closing Date

- Mortgage Pre-Approval

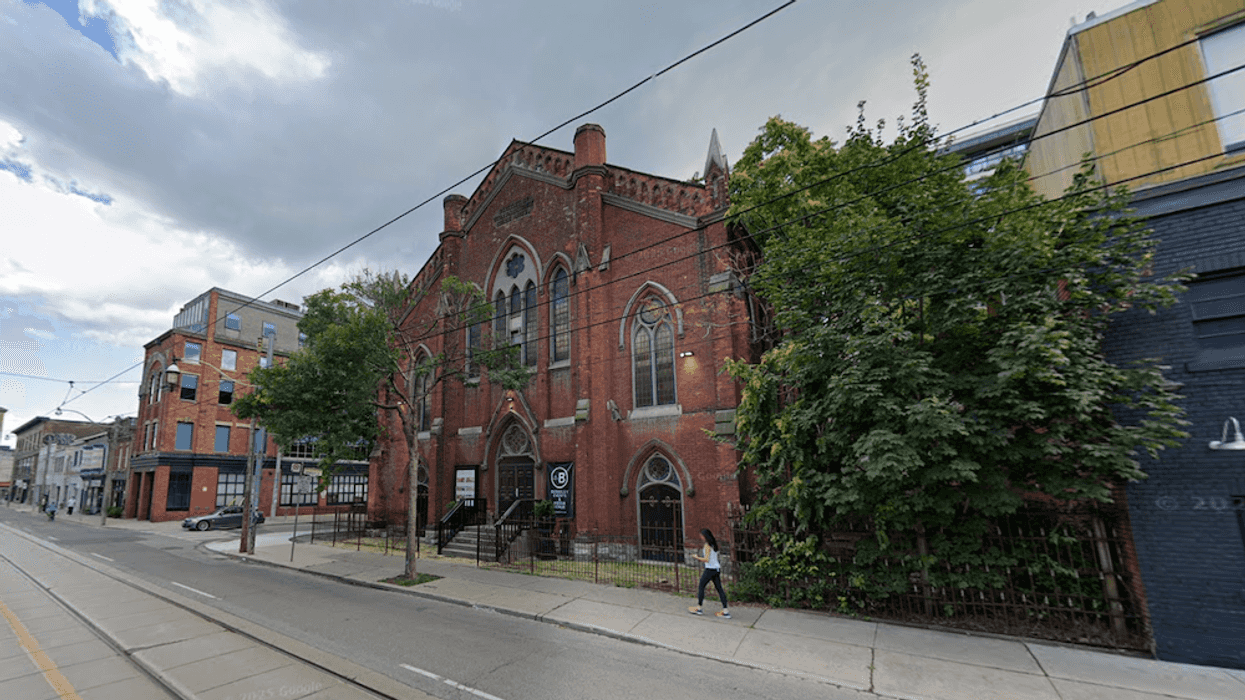

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

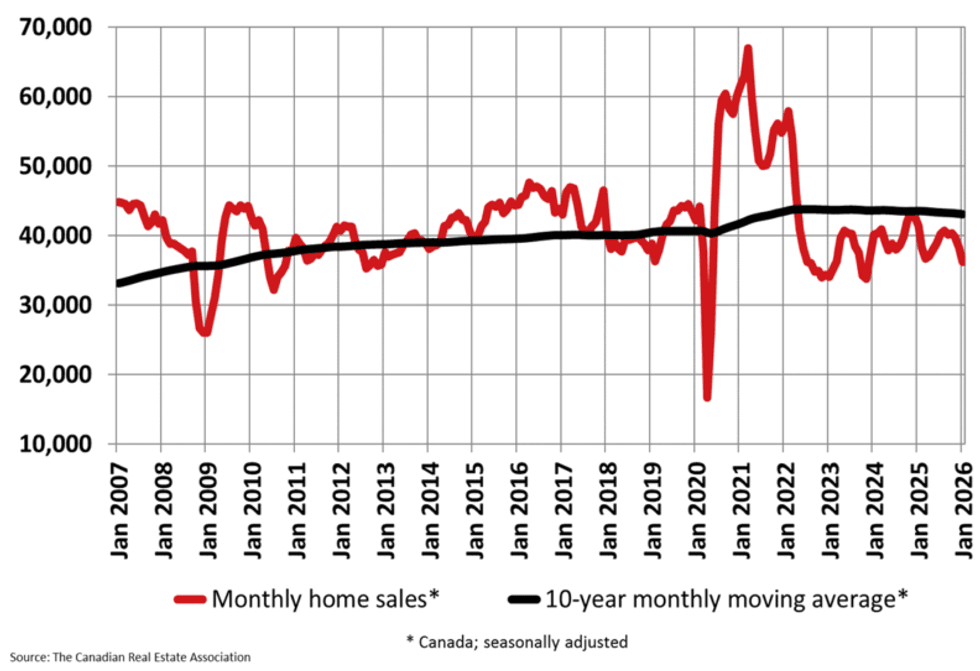

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

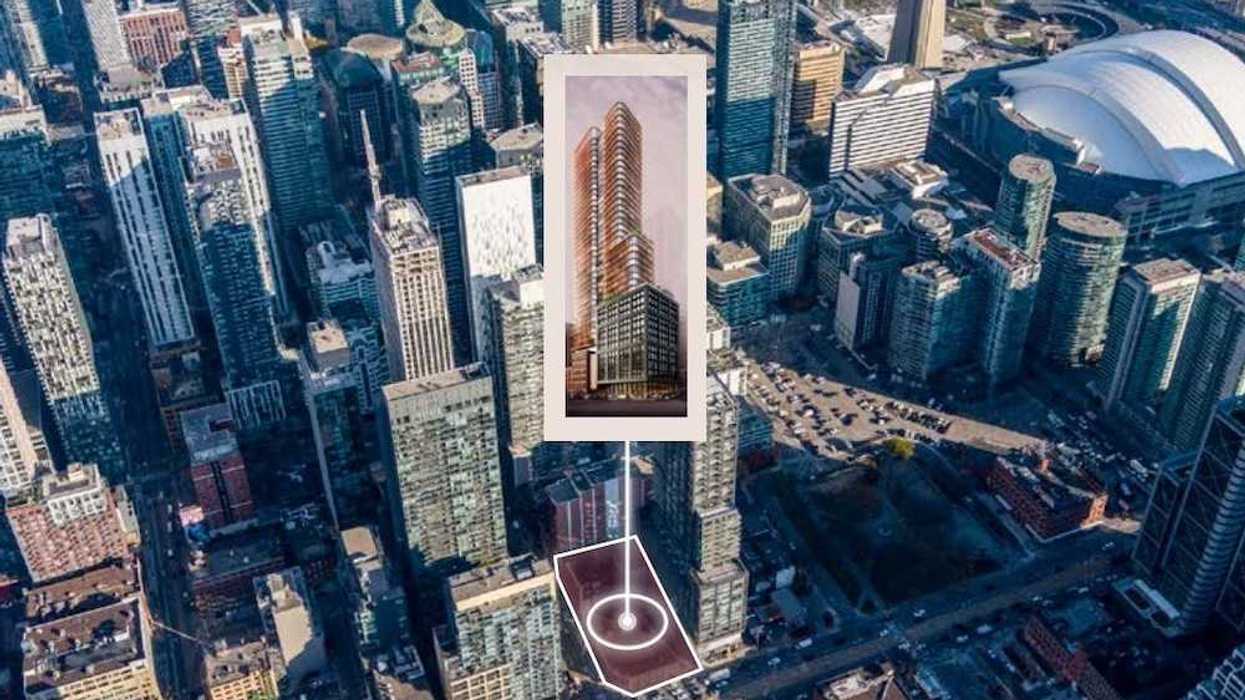

401-415 King Street West. (JLL)

401-415 King Street West. (JLL)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.