Assignment Clause

Discover what an assignment clause is in Canadian real estate, how it works in pre-construction deals, and what to consider before assigning your agreement.

May 22, 2025

What is an Assignment Clause?

An assignment clause is a provision in a real estate agreement that allows the buyer to transfer their contractual rights and obligations to another party before closing.

Why Assignment Clauses Matter in Real Estate

In Canada, assignment clauses are particularly relevant in pre-construction or off-plan real estate deals. They provide flexibility by allowing the original buyer (the assignor) to 'assign' or sell their purchase agreement to a new buyer (the assignee) prior to taking possession.Key details typically outlined in the clause include:

- Whether assignment is permitted

- Conditions for assignment (e.g., with or without the seller’s consent)

- Any associated fees (builder or developer fees can range from $1,000 to $5,000 or more)

Understanding the assignment clause helps prevent legal issues and financial losses, especially in fast-paced urban condo markets where assignments are common. Legal advice is recommended before entering or assigning such agreements.

Example of an Assignment Clause in Action

A buyer of a pre-construction Toronto condo assigns their contract to another purchaser after the unit appreciates by $50,000. The assignment clause in their agreement permits this with a $2,500 developer fee.

Key Takeaways

- Allows a buyer to transfer their purchase agreement.

- Common in pre-construction real estate.

- May require developer approval and fees.

- Useful in changing market or personal situations.

- Must be reviewed carefully with legal guidance.

Related Terms

- Assignment Sale

- Pre-Construction Condo Purchase

- Purchase Agreement

- Deposit

- Closing Date

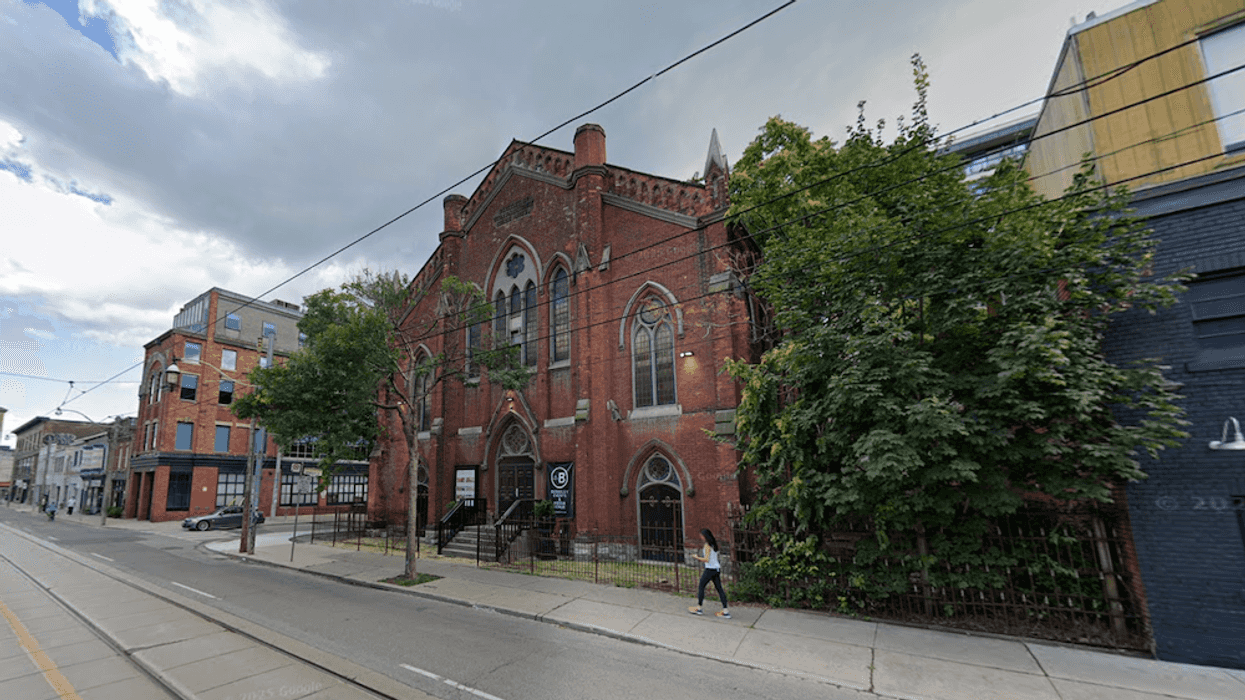

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

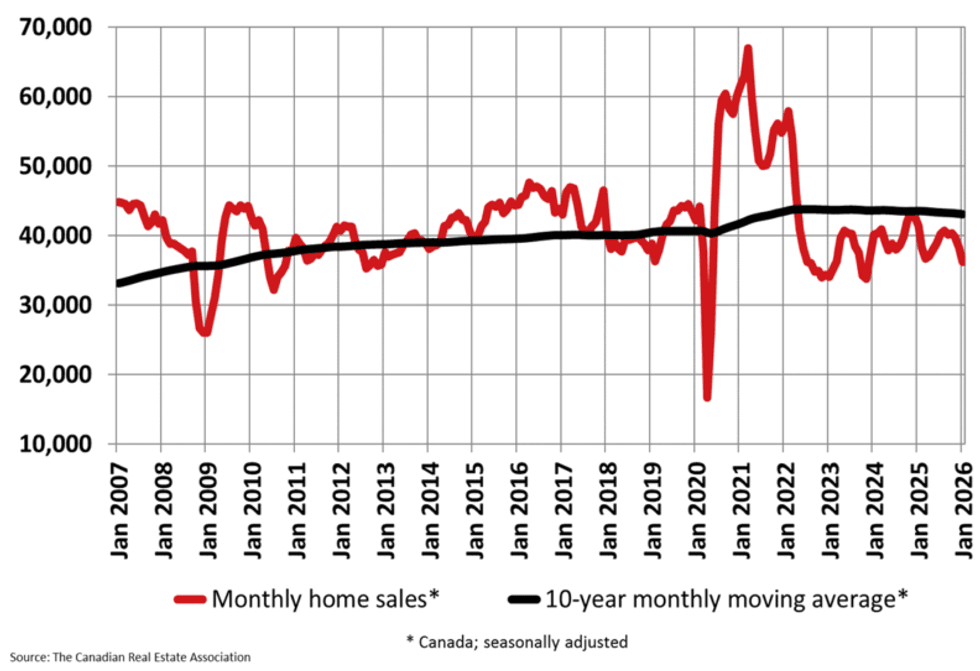

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

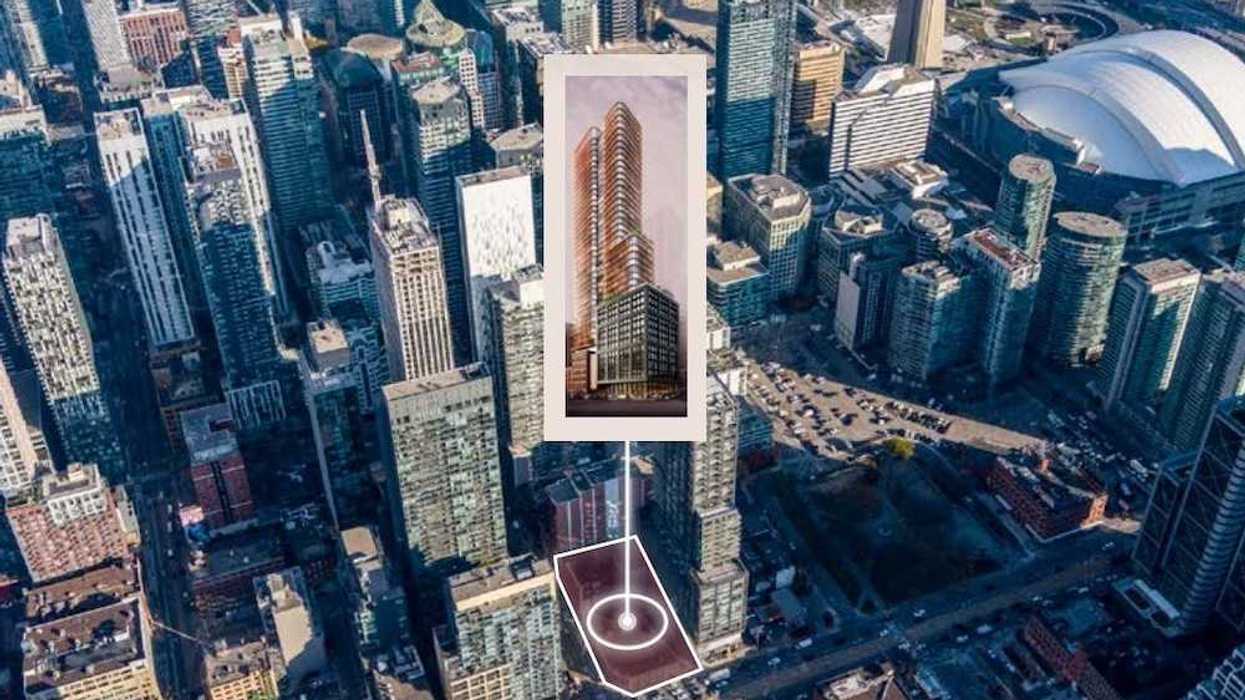

401-415 King Street West. (JLL)

401-415 King Street West. (JLL)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.