Underused Housing Tax

The Underused Housing Tax is a federal 1% annual tax on vacant or underused homes owned by non-resident, non-Canadian entities.

September 30, 2025

What is the Underused Housing Tax?

The Underused Housing Tax (UHT) is a federal annual 1% tax on the value of vacant or underused residential property owned by non-resident, non-Canadian individuals or corporations. Certain exemptions apply for Canadian citizens, permanent residents, and qualifying uses of the property.

Why the Underused Housing Tax Matters in Real Estate

The UHT matters in real estate because it aims to address housing supply challenges by discouraging property speculation and foreign ownership of underused homes. It also generates federal revenue and supports broader housing policy goals.

Example of the Underused Housing Tax in Action

A foreign investor owns a vacant condo in Toronto valued at $800,000. Without qualifying exemptions, they must pay $8,000 annually under the Underused Housing Tax.

Key Takeaways

- Federal tax on underused or vacant housing by non-residents.

- Set at 1% of property value annually.

- Aims to discourage speculation and improve supply.

- Exemptions available for citizens, residents, and qualifying uses.

- Applies nationwide, separate from provincial or municipal taxes.

150 Slater Street in Ottawa. (Regional Group)

150 Slater Street in Ottawa. (Regional Group) 150 Slater Street in Ottawa. (Regional Group)

150 Slater Street in Ottawa. (Regional Group)

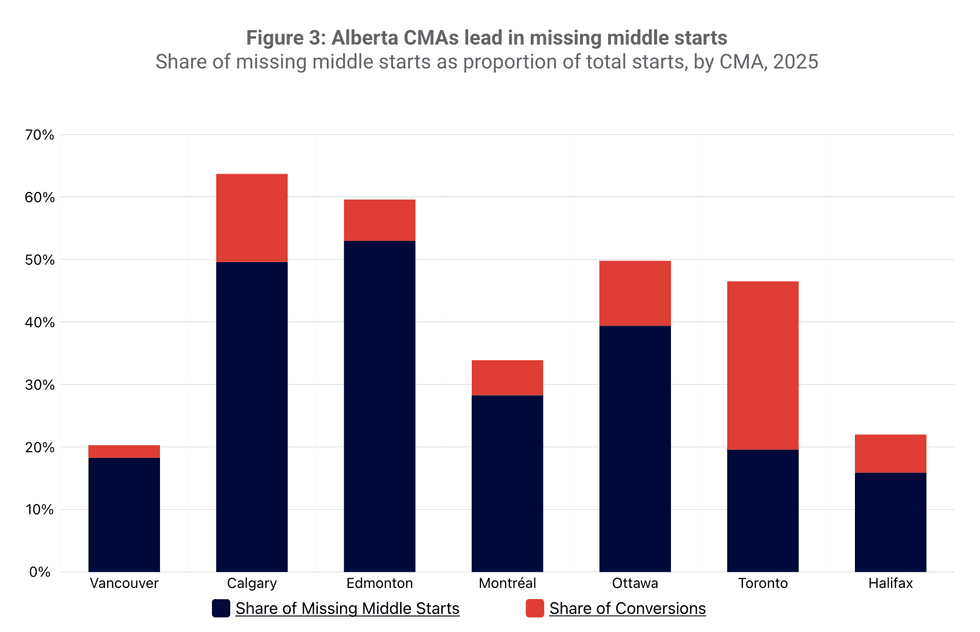

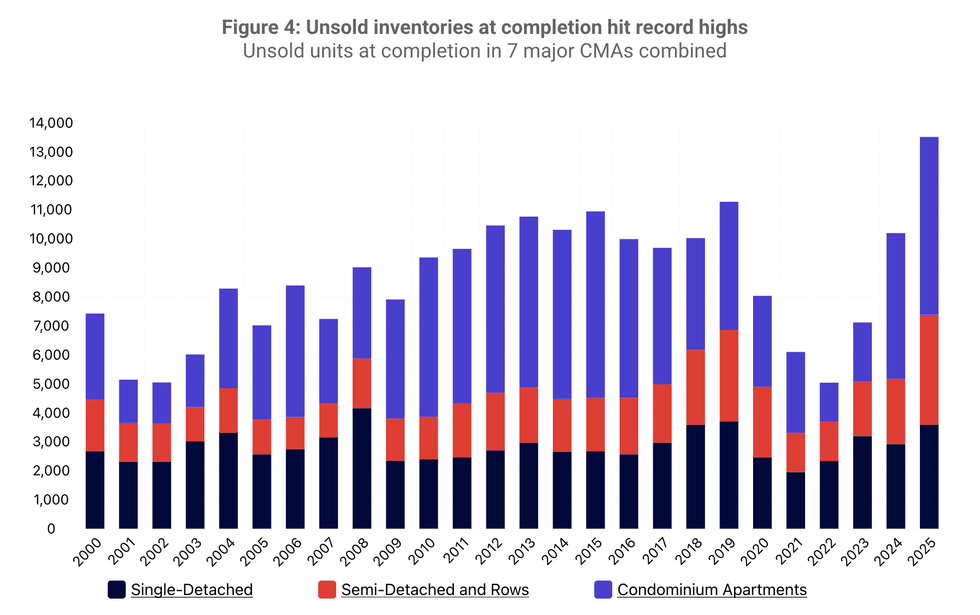

Spring 2026 Housing Supply Report/CMHC

Spring 2026 Housing Supply Report/CMHC Spring 2026 Housing Supply Report/CMHC

Spring 2026 Housing Supply Report/CMHC

Manuela Preis/Instagram

Manuela Preis/Instagram

Renderings of the 65-storey tower previously proposed for 145 Wellington Street West. (Partisans with Turner Fleischer / SKYGRiD)

Renderings of the 65-storey tower previously proposed for 145 Wellington Street West. (Partisans with Turner Fleischer / SKYGRiD)