Starting today, the rules on mortgage stress tests for homebuyers with uninsured mortgages are tightening.

This means, as of June 1, the minimum qualifying rate for uninsured mortgages -- residential mortgages with a down payment of 20% or more -- will rise to either the contracted rate plus two percentage points or 5.25%, whichever is higher, which is a slight increase from the previous threshold of 4.79%.

The stricter criteria applies to both insured mortgage borrowers (those who make a down payment smaller than 20% on their home purchase) and uninsured borrowers, who put down 20% or more.

Simply put, to pass the stress test, borrowers must have healthy enough incomes and debt servicing ratios to indicate they could pay their mortgage payments at the higher interest rate, regardless of the rate they get from their lender.

READ: New Rules to Mortgage Stress Test a Week Away – But Will They Have an Impact?

For context, current fixed and variable mortgage rates are as low as 1.7% – 2% for a five-year term, so the stress test will tack on at a minimum of 3% or higher. This translates to borrowers qualifying for a smaller mortgage amount.

Given that the stress test has been in place since 2019, the impact of the latest changes is said to be pretty minimal, which is reassuring news for new and renewing mortgage borrowers.

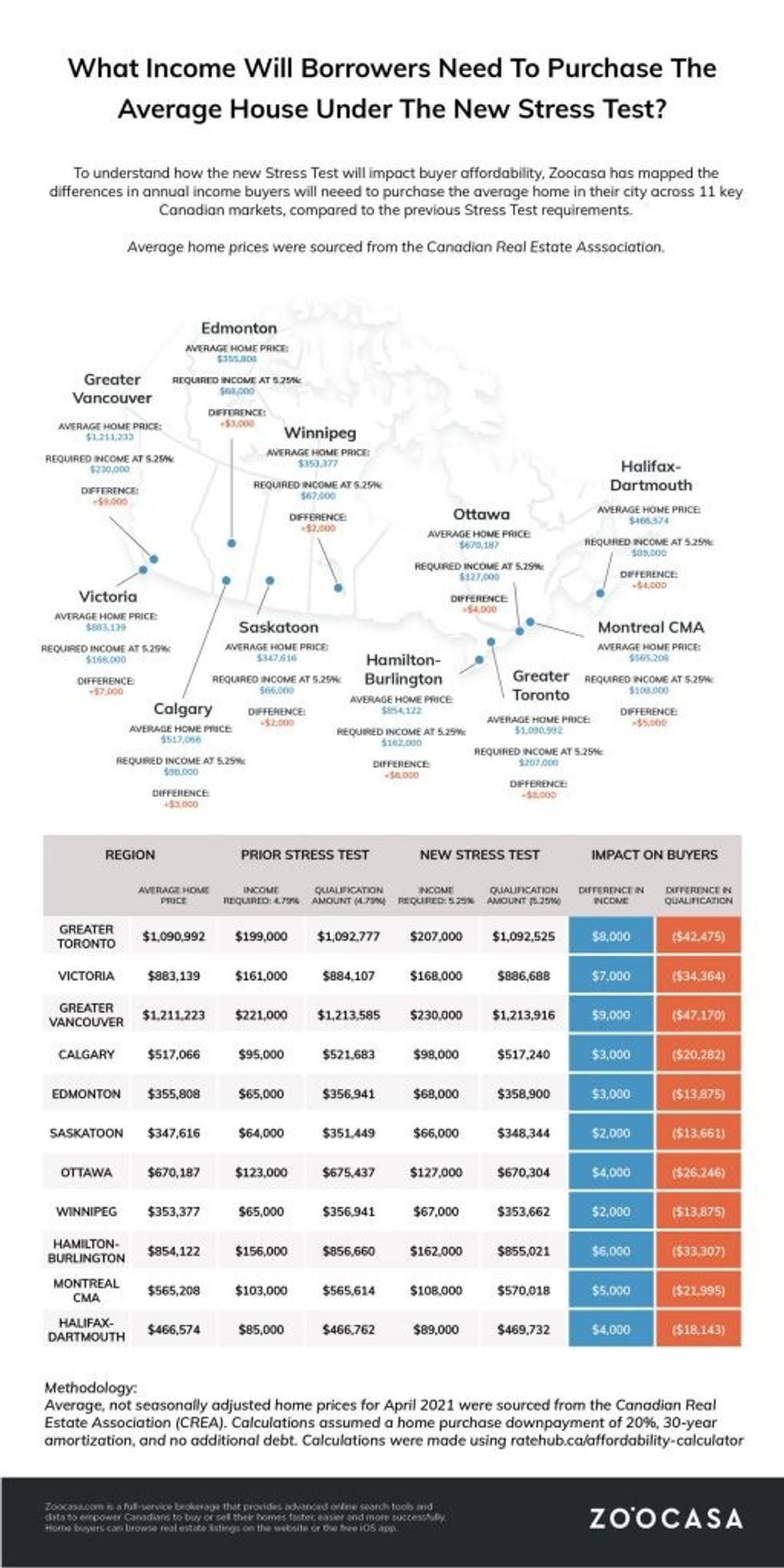

According to Zoocasa, a buyer looking to purchase the average-priced home in their respected city would face a dip in affordability of about 3.8%, with between $14,000 – $47,000 shaved off the amount they’d qualify for.

To make up for this difference, Zoocasa determined borrowers would need to supplement their incomes between $2,000 – $9,000 to qualify for the same size mortgage under the new stress test, depending on the city they’re purchasing in.

To determine these differences, Zoocasa calculated the income required to qualify for a mortgage large enough to purchase the average-priced home in 11 cities across Canada at both a mortgage rate of 4.79% and then at 5.25%. Zoocasa says it was assumed home buyers had no additional debt, were making a 20% down payment, and were amortizing their mortgage over 30 years.

Borrowers would see the largest dollar amount slashed from their qualification in Greater Vancouver, where the average home price was $1,211,223 in April. Zoocasa says Vancouver homebuyers would receive $47,170 less on their mortgage and would need to supplement their income by $9,000 to qualify for the same sized mortgage post-stress test.

Next was the Greater Toronto Area, where qualification would be reduced by $42,475 on the average home price of $1,090,992, resulting in a requirement of $8,000 in additional income.

Buyers in Saskatoon and Winnipeg will be the least affected when qualifying for a mortgage at the new stress test threshold due to the overall lower average home prices in those markets, which are currently $347,616 and $353,377, respectively. Qualification amounts in each would be reduced by $13,661 and $13,875, requiring an income increase of $2,000 to qualify for the same size mortgage.

The Office of the Superintendent of Financial Institutions (OSFI) confirmed the changes to the stress test in May after it reviewed submissions on the plan that it first proposed in April.

“Effective June 1, the minimum qualifying rate for uninsured mortgages (i.e., residential mortgages with a down payment of 20 percent or more) will be the greater of the mortgage contract rate plus 2 percent or 5.25 percent,” said OSFI in a release.

It didn’t take long for the Department of Finance to follow suit, confirming it will apply the same higher qualifying rate to insured mortgages (those with less than 20% down). Essentially, all buyers — regardless of down payment – will have to qualify at 5.25%.

The changes come amid a time when it's never been cheaper to get a mortgage in Canada, coupled with increased household savings and FOMO, which has helped to drive the price of homes to record-breaking highs.

As demand continues to grossly outweigh supply, bidding wars and homes selling well over their listing price have become the norm. Subsequently, the average home price in Canada soared 41.9% in April to $696,000, with average home prices easily topping the million-dollar-mark in the most in-demand markets.

This has resulted in homebuyers having to bid higher to win their homes, with many having to take out larger mortgages to do so.

The issue now is that when interest rates do inevitably rise, these new homeowners may struggle to keep up with their mortgage debt -- a scenario the Bank of Canada says is a significant vulnerability to the economy.

In the central bank’s Financial System Review (FSR), Governor Tiff Macklem said the most significant domestic vulnerabilities are those linked to imbalances in the housing market and high household indebtedness. While these are not new, Macklem says they have intensified because of the unusual circumstances caused by the pandemic.

The bank said the share of highly indebted households taking out mortgages has increased significantly and now represents 22% of all new mortgages -- this is higher than during the 2016-2017 real estate boom when spiking mortgage debt triggered stricter national lending rules.

Additionally, highly indebted borrowers are making down payments on their mortgages that are less than 20% of the home’s purchasing price. The bank said this combination has been “associated with a greater risk of falling behind on debt payment.”

At this time, it remains unclear whether the central bank will introduce any additional methods to cool the market as the economy continues to recover from the pandemic. In the meantime, buyers will need to adhere to this new affordability requirement when budgeting for their home purchases.