Amid Canada's red-hot housing market, where prices continue on their upward trajectory, the Bank of Canada is now warning that a number of households have taken on a significant level of mortgage debt and are posing what the central bank says is a significant vulnerability to the economy.

In the central bank's Financial System Review (FSR), released Thursday, Governor Tiff Macklem said the most significant domestic vulnerabilities are those linked to imbalances in the housing market and high household indebtedness. While these are not new, Macklem says they have intensified because of the unusual circumstances caused by the pandemic.

Macklem said as consumer preference changed amid the pandemic, combined with low-interest rates that make borrowing more affordable, there are now signs Canadians are buying more single-family homes, particularly in suburbs and outlying areas of major Canadian cities, with the expectation prices will continue to rise.

The average home price in the country has jumped over 30% during the pandemic, with prices accelerating at a faster pace in the Toronto suburbs and smaller Ontario cities.

READ: The Number of Consumer Insolvencies in Canada Spikes to Highest Level in a Year

"Our analysis suggests that in some markets, price expectations have become extrapolative — meaning people may be rushing to buy partly because they expect prices to keep rising. This behaviour can exaggerate near-term house price increases relative to fundamental demand," said Macklem. (In other words, FOMO.)

However, these rising home prices have led to many households taking on significantly more mortgage debt than their income, putting them in a difficult position if the economy takes a downward turn.

Though, the bank has introduced measures that stoked demand for real estate, including holding interest rates at record lows over the past year and promising not to raise rates for some time.

Previously introduced mortgage stress tests and higher interest rates had slowed the accumulation of household debt and improved the quality of mortgage borrowing leading into 2019. But since mid-2020, the bank says this trend has reversed. Some households have taken on significantly more mortgage debt, which is reflected in an increase in the share of new mortgages with high loan-to-income ratios.

The bank said the share of highly indebted households taking out mortgages has increased significantly and now represents 22% of all new mortgages -- this is higher than during the 2016-2017 real estate boom when spiking mortgage debt triggered stricter national lending rules.

Additionally, highly indebted borrowers are making down payments on their mortgages that are less than 20% of the home's purchasing price. The bank said this combination has been "associated with a greater risk of falling behind on debt payment."

“The quality of new mortgage borrowing deteriorated during the pandemic,” reads the report.

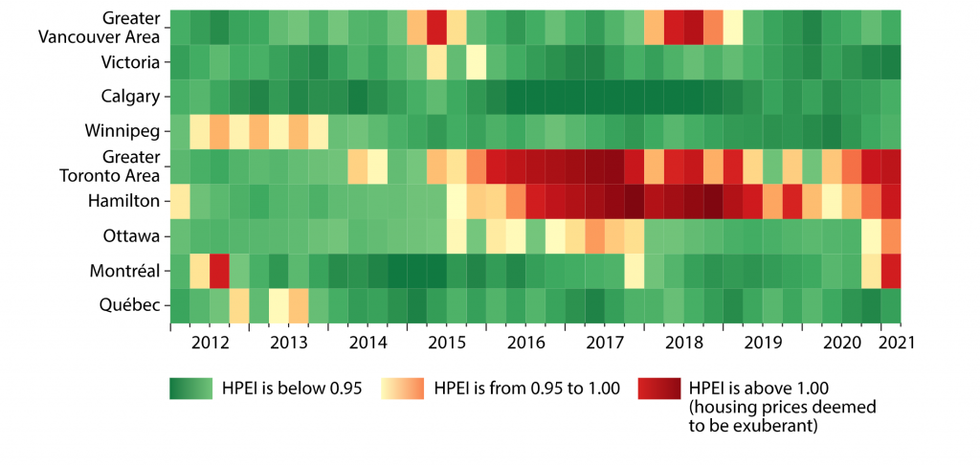

The central bank also included a "House Price Exuberance Indicator" (HPEI) in the report to "detect periods of extrapolative expectations across Canadian cities," or the expectation that home prices will continue to rise.

According to the indicator, as of the first quarter of 2021, the HPEI identified three cities showing signs of house price exuberance: the Greater Toronto Area, Hamilton, and Montréal, with Ottawa on the cusp of displaying extrapolative expectations.

The bank noted that the house price exuberance in some cities appears to be driven mainly by people buying a home to live in rather than by investor demand or house-flipping activity.

In addition to housing market vulnerabilities, the bank also highlighted potential risks around corporate debt and business insolvencies as government support is withdrawn in the coming months.

The bank said it is also monitoring financial risks related to climate change and cyber-attacks.

As for the financial system itself, the bank said the Canadian financial system has proved resilient through the pandemic, thanks to a well-capitalized banking sector and strong support for households and firms from governments and the Bank of Canada.

The bank says Canadian financial markets recovered quickly from early liquidity stress and that the bank’s liquidity facilities are no longer required. As such, the bank remains confident in the ability of the system to withstand a severe negative shock.