Operating Costs

Explore operating costs in Canadian real estate: what they include, how they’re passed to tenants, and how they impact profitability and valuation.

June 16, 2025

What are Operating Costs?

Operating costs are the recurring expenses associated with owning and managing a property, including taxes, insurance, utilities, repairs, and property management fees.

Why Operating Costs Matter in Real Estate

In Canadian real estate, operating costs influence rent levels, investment returns, and budgeting for both commercial and residential properties.

Typical operating costs include:

- Property taxes

- Building insurance

- Utilities (heat, water, electricity)

- Maintenance and repairs

- Management fees

In commercial leases, these costs are often passed through to tenants in full or in part, depending on lease structure (e.g., triple net or gross).

Understanding operating costs helps buyers, tenants, and landlords accurately project cash flow and value properties effectively.

Example of Operating Costs in Action

The landlord includes snow removal and building insurance in the operating costs billed back to the retail tenant under their net lease.

Key Takeaways

- Includes recurring property-related expenses

- Affects profitability and tenant charges

- Varies by lease type and property use

- Must be factored into financial planning

- Important for both owners and tenants

Related Terms

- Net Lease

- Triple Net Lease

- Gross Lease

- Property Management

- Budgeting

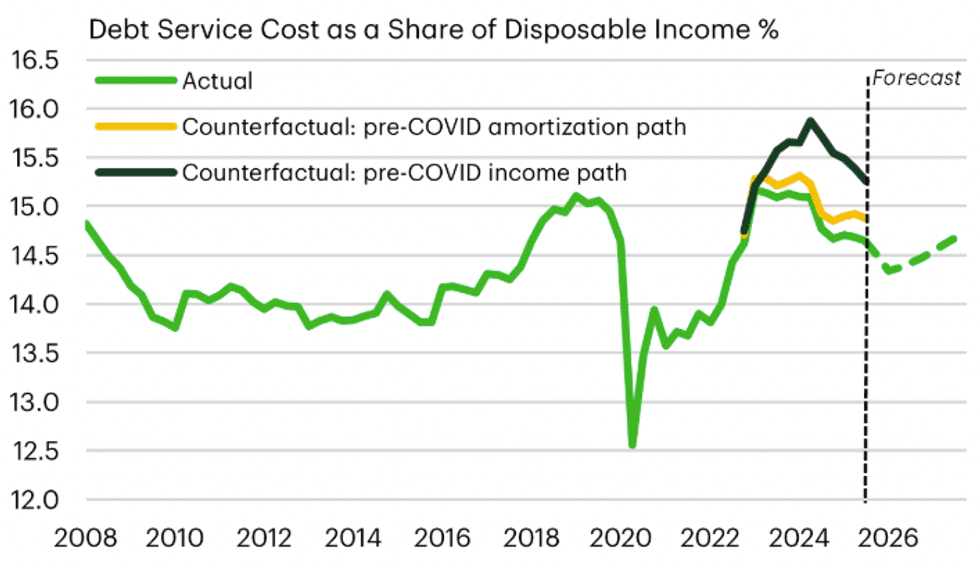

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics

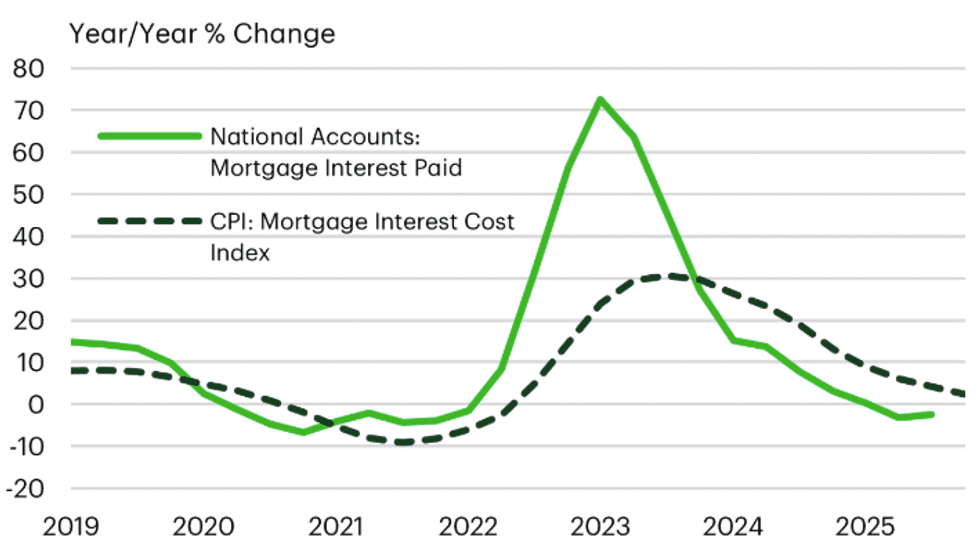

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics

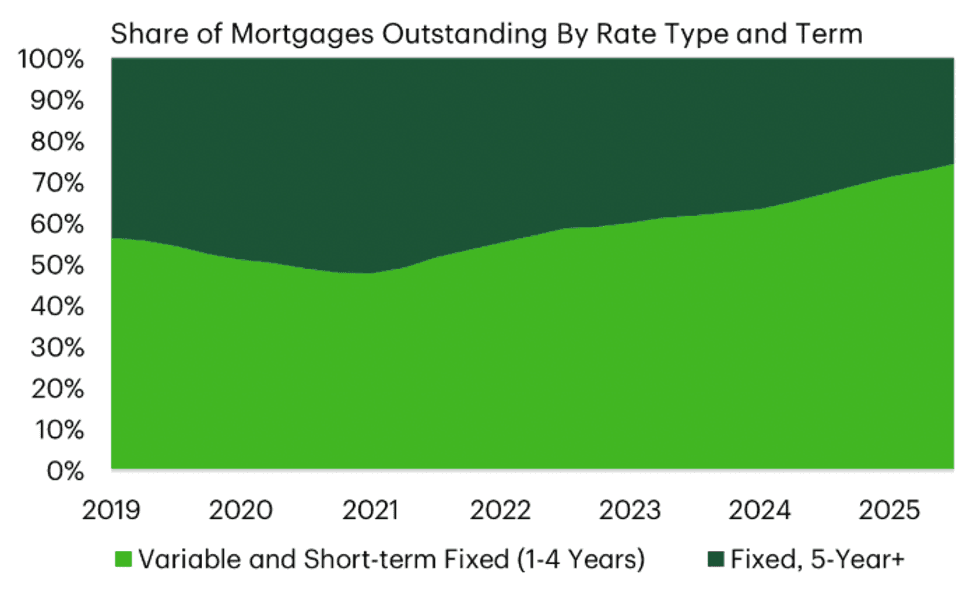

Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Manuela Preis/Instagram

Manuela Preis/Instagram