The federal government will table Budget 2025 this fall, and ahead of its release a new coalition of 13 developers has put out a suite of recommendations to address the housing crisis. Made up of big names in homebuilding like DiamondCorp, Fitzrovia, Mattamy, Menkes, RioCan, and Tricon, the Large Urban Centre Alliance is imploring the Feds to push the envelope on policies like the GST/HST New Housing Rebate and foreign-buyer ban.

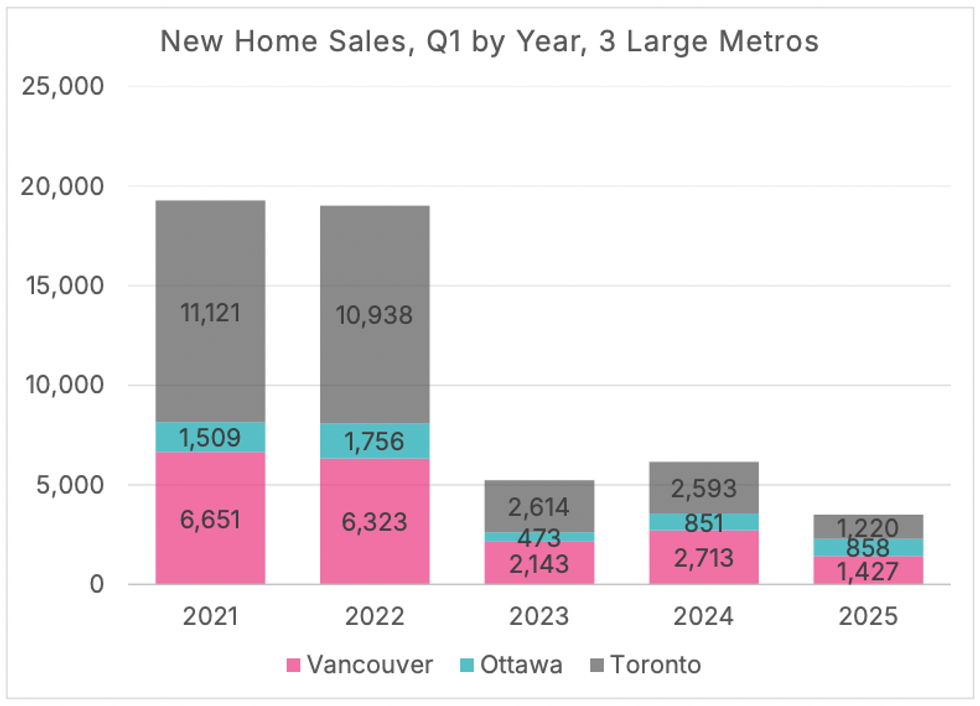

“New home sales in the Greater Toronto Area have all but evaporated,” says the pre-budget submission, which has been created in collaboration with the Building Industry and Land Development Association (BILD) and Missing Middle Initiative. “Relative to the first quarter of 2022, new and pre-construction home sales in the first quarter of 2025 were down 89% in the Greater Toronto Area, 77% in the Greater Vancouver Area, and 51% in the Ottawa Region.”

“Given the lag between new home sales and housing starts, new home construction is expected to remain exceptionally low in these three markets for the foreseeable future,” it adds. “Other large markets — Calgary, Edmonton, and Montreal — have not yet experienced the same level of weakness but remain vulnerable to similar pressures,” it adds. Combined, these six urban regions account for over 50% of Canada’s housing starts, making their recovery critical to meeting national housing targets.”

The submission also points out that while purpose-built rental construction has been on the rise (nearly quadrupling in the course of a decade), estimates from Canada Mortgage and Housing Corporation (CMHC) call for an additional 60,000 units beyond what’s currently projected. “In the GTA, rental demand is projected to outpace supply by 121,000 units over the next decade, on top of an existing deficit of 114,000 units accumulated from 2016 to 2024.”

Bearing those realities and the severity of the situation in mind, the Alliance is putting its weight behind 10 recommendations to help Canadian markets work towards their housing goals and brace against economic uncertainty, according to the submission. Of those, four have been identified as “immediate priority actions.” Those include:

- Expanding the GST rebate program currently available to first-time homebuyers on new homes up to $1 million to all buyers of new homes up to $1 million for a period of three years, while expanding the partial rebate for new homes between $1 million and $1.5 million from first-time buyers to all buyers;

- Implementing a model where development charges (DCs) are billed directly to buyers rather than builders, with protections embedded to prevent mid-stream DC increases;

- Exempting rental developments currently under construction that are not eligible for the GST rebate from GST and HST, and also exempting new and pre-construction properties from the foreign buyer ban, and;

- Putting more capital into the Apartment Construction Loan Program (ACLP) so that it can accommodate a larger volume of applications.

Senior Director at the Smart Prosperity Institute and Founding Director of the Missing Middle Initiative Mike Moffatt tells STOREYS that the priority actions were determined based on what could be “implemented very quickly, and what would have the most immediate impact.” He acknowledges that there are plenty of nods to existing government policy in the top four points, and notes that that’s entirely by design.

“Part of what we wanted to do is make sure that what we were recommending aligned with what the government is trying to do,” Moffatt says. “We're not saying, throw out everything you're doing and do something completely different, you know, because then there's going to be a lack of interest there. Instead, we’re building on what [the government is] doing and integrating these ideas with the other things that they're working on implementing.”

With respect to the remaining six recommendations, Moffatt says they’re no less important, but are anticipated to take more time to put into place. Those are as follows:

- Accelerating homebuilding by tying federal infrastructure funding to pro-housing supply municipal reforms (for example, accepting surety bonds in subdivision agreements and site plan agreements), and putting automated approval programs in place in a similar manner to Edmonton;

- Enforcing the conditions set out in Housing Accelerator Fund agreements by increasing the variety of housing types;

- Stimulating more global capital in Canadian real estate by exempting real estate and housing-related infrastructure investment from the Excessive Interest and Financing Expenses Limitation (EIFEL) rules, and reviewing OSFI mortgage stress test rules to ensure they suit the current economic environment;

- Investing in more missing-middle rental housing and ensuring that the proposed MURBs tax provision will apply to rental projects that begin construction on or after January 1, 2026;

- Increasing capital for the MURB and establishing an incentive program for investors willing to sell their non-purpose-built rentals in favour of investing in projects eligible for the MURB incentive, and;

- Allowing for condo construction to be financed after investor dollars have been put towards MURB-eligible projects, allowing banks to reduce pre-sale requirements on new developments through federal backstop facilities.

“A lot of it does pull from other jurisdictions,” notes Moffatt. “Recommendation 3 is similar to [what's in place] in Australia. Recommendation 7, around exempting real estate and housing-related infrastructure from EIFEL rules, that's something that currently exists in the United States. Recommendation 5 explicitly advocates for the kind of approval systems that they're currently using in Edmonton. And some of the MURB recommendations build off how the program used to work in the 1970s.”

More broadly, Moffatt’s hope is not just that the federal government will take the Alliance’s submission into consideration, but that it will help to “trigger a larger conversation” about the housing challenges facing major Canadian cities. “We're hopeful that it's not just the recommendations that get discussed,” he says, “but also how dire the situation is, particularly in the GTA and Greater Vancouver area — and, to a lesser extent, Ottawa — and the decline we're likely to see in housing starts over the next few years unless there [are] changes coming.”