On Wednesday, Montreal-based developer and property manager Canderel announced that it had been retained by Germany-based Deka Immobilien Investment GmbH as the property manager for 401 West Georgia and 402 Dunsmuir in Vancouver, the two downtown office buildings Deka acquired from Oxford Properties.

"We are delighted to continue our partnership with Deka as their trusted service providers with their 2nd major acquisition in Canada," said Canderel's SVP of Western Canada Bryce Margetts. "With the support of existing and new team members working out of our Vancouver office, we will be able to continue to provide a superior level of service to our tenants and partners, while delivering on Deka's long-term investment strategy."

The sale of the two buildings was first reported by Bloomberg in early-February for a purchase price of $300M and was announced by Deka in early-March.

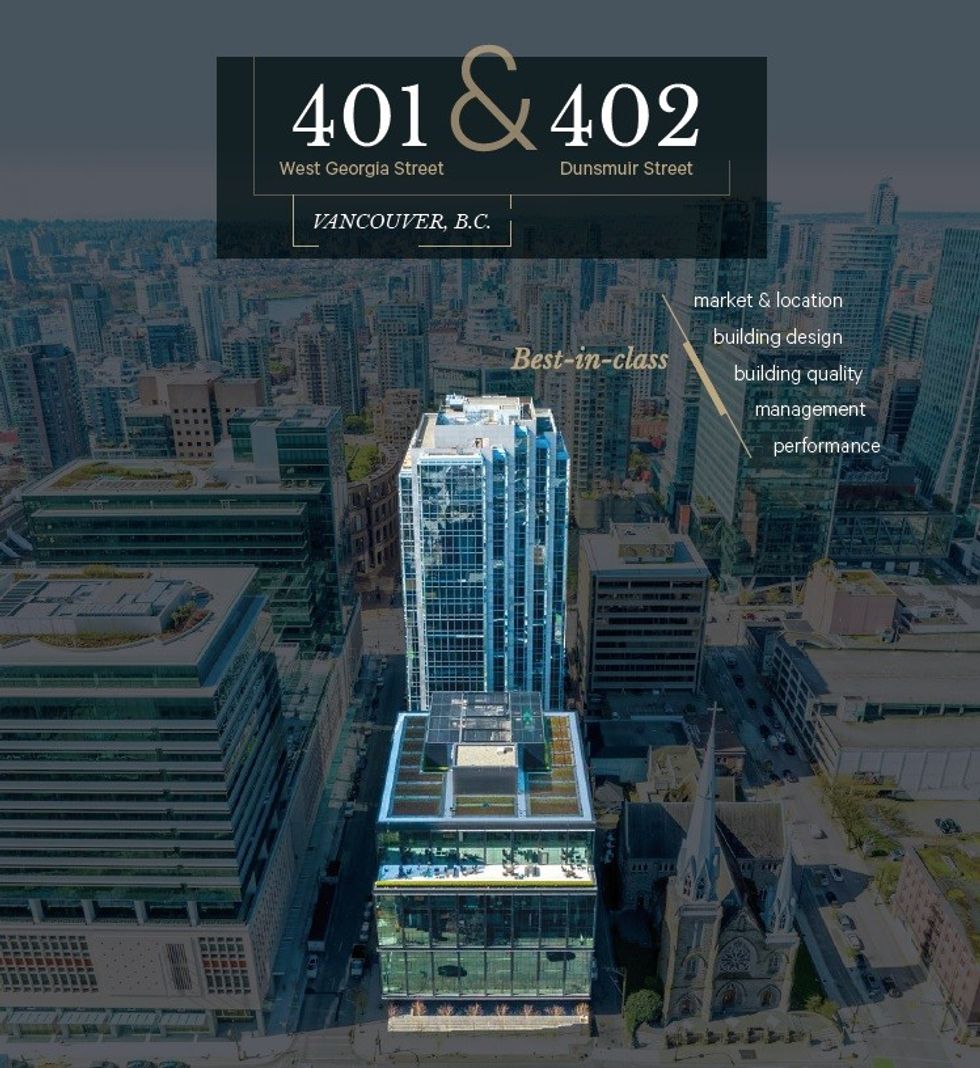

The two buildings, which were co-owned by the Canada Pension Plan Investment Board (CPPIB) and managed by Oxford Properties — the real estate investment arm of the Ontario Municipal Employees Retirement System (OMERS) — are located in the heart of downtown Vancouver, right next door to one another.

401 W Georgia Street is a 22-storey building that was originally constructed in 1985. The nine-storey 402 Dunsmuir was completed in 2020 as an expansion of 401 W Georgia. The two buildings occupy a 1.38-acre site and total to just over 416,000 sq. ft of Class A and Class AAA office space.

At the time the two office buildings were listed for sale, last June, 401 W Georgia was fully leased, with Aon Canada Inc., Unbounce Marketing Solutions, Richards Buell Sutton, and BuildDirect.com Technologies serving as the anchor tenants, while 402 Dunsmuir was fully leased to Amazon Web Services, who is also leasing all of the office space at The Post just across the street.

The property was listed by Tony Quattrin, Jim Szabo, Vincent Minichiello, and Carter Kerzner of CBRE Vancouver's National Investment Team, according to a sales brochure obtained by STOREYS.

The decision to list the two fully-leased buildings came as a surprise to many in the industry and was perceived by some as a sign of Oxford Properties' view of the office market. The sales brochure itself notes that "assets of this nature rarely become available." Owners of office assets were also waiting to see how the two office buildings would be valued, which would give owners a sense of the value of their own office assets, many in the industry have said.

Recently, Westbank sold its majority stake in their 24-storey Deloitte Summit office building at 400 West Georgia, just across the street, to Allied Properties REIT. The transaction saw $130.5M of a previous loan to Westbank converted into equity for Allied in exchange for a 90% undivided interest in the property. Allied announced the completion of the transaction on April 1 and says it will be taking over management on January 1, 2025.

The sale of the two Vancouver office buildings is the latest in a string of sales Oxford Properties and OMERS have been involved in over the past six months months.

In December, Oxford Properties announced that it had sold a majority of its industrial portfolio in the Greater Toronto Area to TPG for $1.3B. In January, it was reported that OMERS was looking for a buyer for LifeLabs, the medical testing company it acquired in 2007 that operates in British Columbia, Saskatchewan, and Ontario.

The two Vancouver office buildings are also not the first office buildings Oxford has sold in recent years. In August 2022, it also sold the Millennium Tower in Calgary to Aspen Properties and Hazelview Investments.

- NAIOP Vancouver Reveals Finalists For 2024 Commercial Real Estate Awards ›

- Vancouver's Pre-Pandemic Wave Of New Offices Are Completing. What Happens Next? ›

- Oxford Properties To Sell Two Vancouver Office Buildings, One Occupied By Amazon ›

- Molnar Group Selling Near-Complete Kaslo Office Project In Vancouver ›

- Metro Vancouver's Top Office, Industrial Transactions In Q2 ›

- Morguard Buys Stake In TD Greystone-Owned Telus Garden In Vancouver ›

- Oxford Buys CPP Out Of Trophy Office Towers In Vancouver, Calgary For $730M ›