Guarantor

Understand what a guarantor is in Canadian mortgage financing, how it differs from a co-signer, and what legal and financial responsibilities are involved.

May 22, 2025

What is a Guarantor?

A guarantor is someone who agrees to be legally responsible for a mortgage or loan if the primary borrower fails to meet repayment obligations.

Why Guarantors Matter in Real Estate

In Canadian real estate, guarantors help strengthen a mortgage application without necessarily being added to the property's title. Unlike a co-signer, a guarantor usually acts as a financial backup rather than a joint applicant.

Key points include:- Guarantors are liable for the loan in case of default

- Their income and credit are considered in underwriting

- They are not typically owners of the property

Lenders may require a guarantor when the borrower has limited income, thin credit history, or is self-employed. Legal advice is recommended due to the financial risk involved.

Understanding the role of a guarantor helps families and applicants navigate lending support and legal exposure in high-stakes transactions.

Example of a Guarantor in Action

A parent acts as a guarantor for their child’s mortgage, improving approval odds without being added to the home’s title.

Key Takeaways

- Provides financial backing for a mortgage.

- Not usually listed on property title.

- Increases loan approval chances.

- Liable if borrower defaults.

- Carries legal and credit implications.

Related Terms

- Co-Signer

- Mortgage Qualification

- Credit Score

- Debt Service Ratios

- Legal Liability

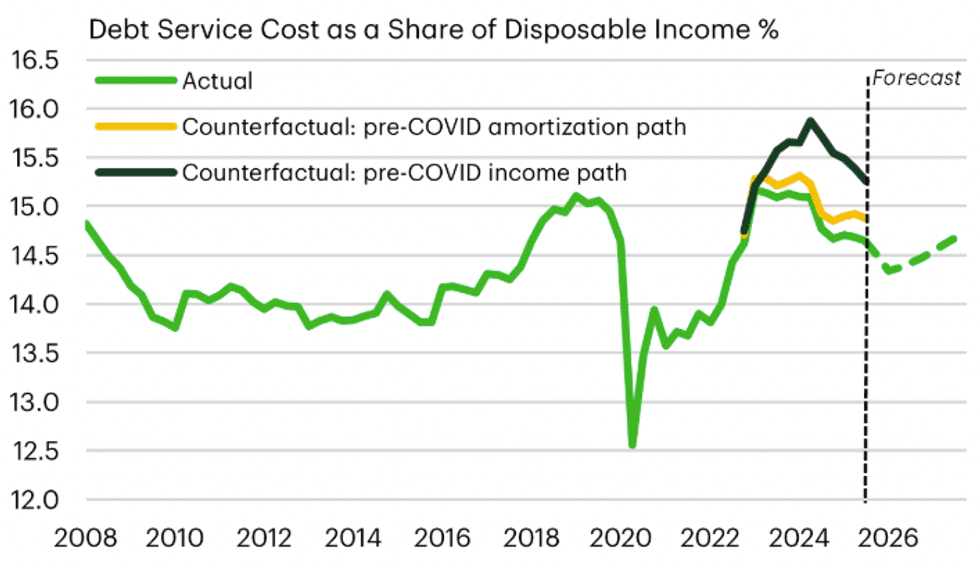

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics

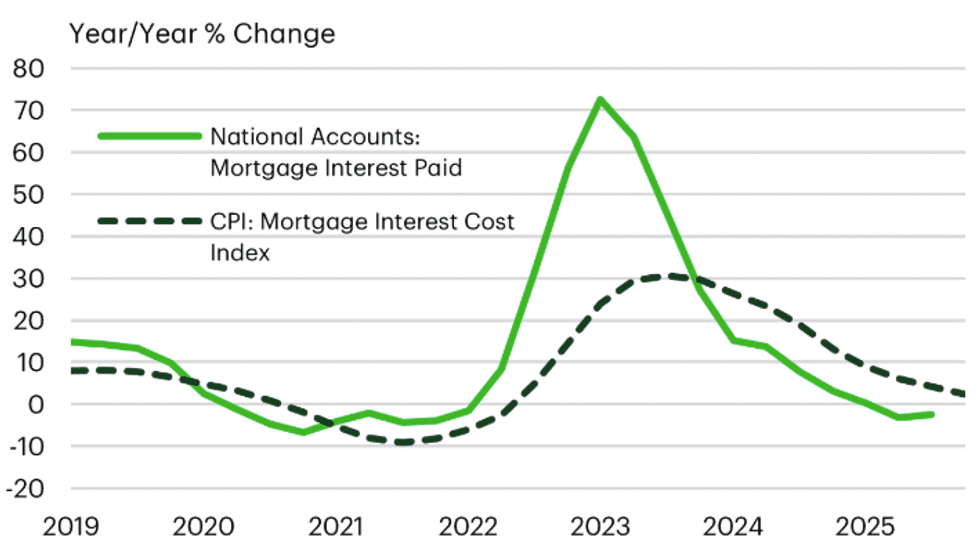

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics

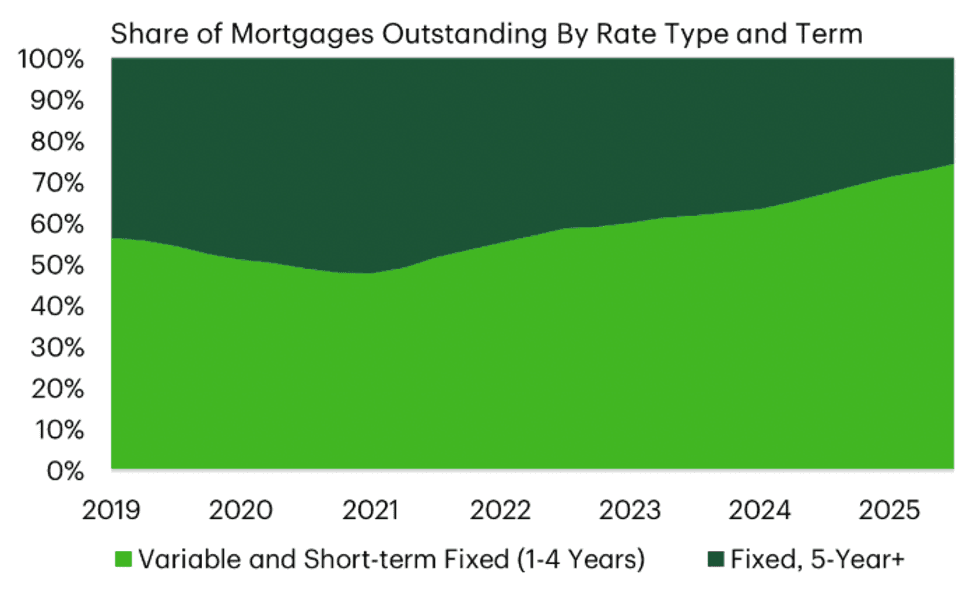

Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Manuela Preis/Instagram

Manuela Preis/Instagram