The closing date of a real estate transaction is typically much anticipated – not only is the ownership of the property officially legally transferred from the seller to the buyer, but it brings an end to what can be an anxious period for buyers, who’ve had to satisfy a number of conditions, such as securing mortgage financing and insurance, in order to make the deal whole.

READ: Single-Family Home Sales in GTA up 126% in January Year-Over-Year: Report

Before the keys can be handed over, however, there are still a few expenses buyers need to shell out for. These closing costs must be paid upfront in cash, unlike the mortgage which is amortized and paid in installments over time.

A number of cash outlays are required on the day the home transaction closes including the down payment, PST on your mortgage loan insurance premium, land transfer tax, legal fees, title insurance and other miscellaneous costs.

Down Payment

While your lender will provide your mortgage funds to your real estate lawyer on closing day to pass along to the seller, the buyer must have the cash down payment ready to go, minus any amount that has already been paid as part of their initial deposit. Buyers must pay a minimum of 5% for homes priced at $500,000 and below, and 10% for any portion of the purchase price between $500,000 and $999,999. Homes priced at $1 million or more require a minimum 20% down payment.

Mortgage Loan Insurance, Insurance PST

Home buyers paying less than 20% down on their home purchase are required to take out mortgage loan insurance, which protects their lender from financial loss should the homeowner default on their home loan. The premium for this insurance can be paid in a lump sum upon closing, though it is far more common for the cost to be rolled up in with the mortgage.

Buyers should also be aware that the PST of 8% is charged on this insurance coverage and is due at closing.

READ: 94% of Torontonians Experience Barriers to Homeownership: Report

Land Transfer Tax (LTT)

Home purchases in Ontario are subject to a provincial land transfer tax. Outside of the down payment, this is likely the largest outlay to be paid at the time of closing. The Ontario land transfer tax is calculated based on increments of the home’s purchase price:

First $55,000: 0.5%

Amounts over $55,000, up to and including $250,000: 1.0%

Amounts over $250,000, up to and including $400,000: 1.5%

Amounts over $400,000, up to and including $2,000,000: 2.0%

Amounts exceeding $2,000,000: 2.5%

Home buyers in the City of Toronto pay municipal land transfer tax (MLTT) in addition to the Ontario LTT. The MLTT follows the same rate structure as the provincial tax.

Fortunately for first-time home buyers, there are hefty LTT rebates available at both the provincial and municipal level. First-time buyers in Ontario can receive a rebate of up to $4,000, which means purchasers of homes prices below $368,333 will not have to pay the provincial LTT. First-time buyers in the City of Toronto can receive a rebate of up to $4,475 off their MLTT, in addition to the provincial rebate.

Legal Fees, Disbursements, Title Insurance

Legal costs include a number of services, such as registering the transfer of the property and registering the mortgage. Your lawyer will also facilitate the purchase of title insurance, which protects the buyer from any other claims made toward the property. It can also include the ordering of the property survey, should the buyer wish to obtain one.

Other Costs

If building a brand-new home, buyers will need to pay 13% in HST, though they can receive provincial rebates depending on the end value of the home.

How Much Will Buyers Pay on Closing Day Across Ontario?

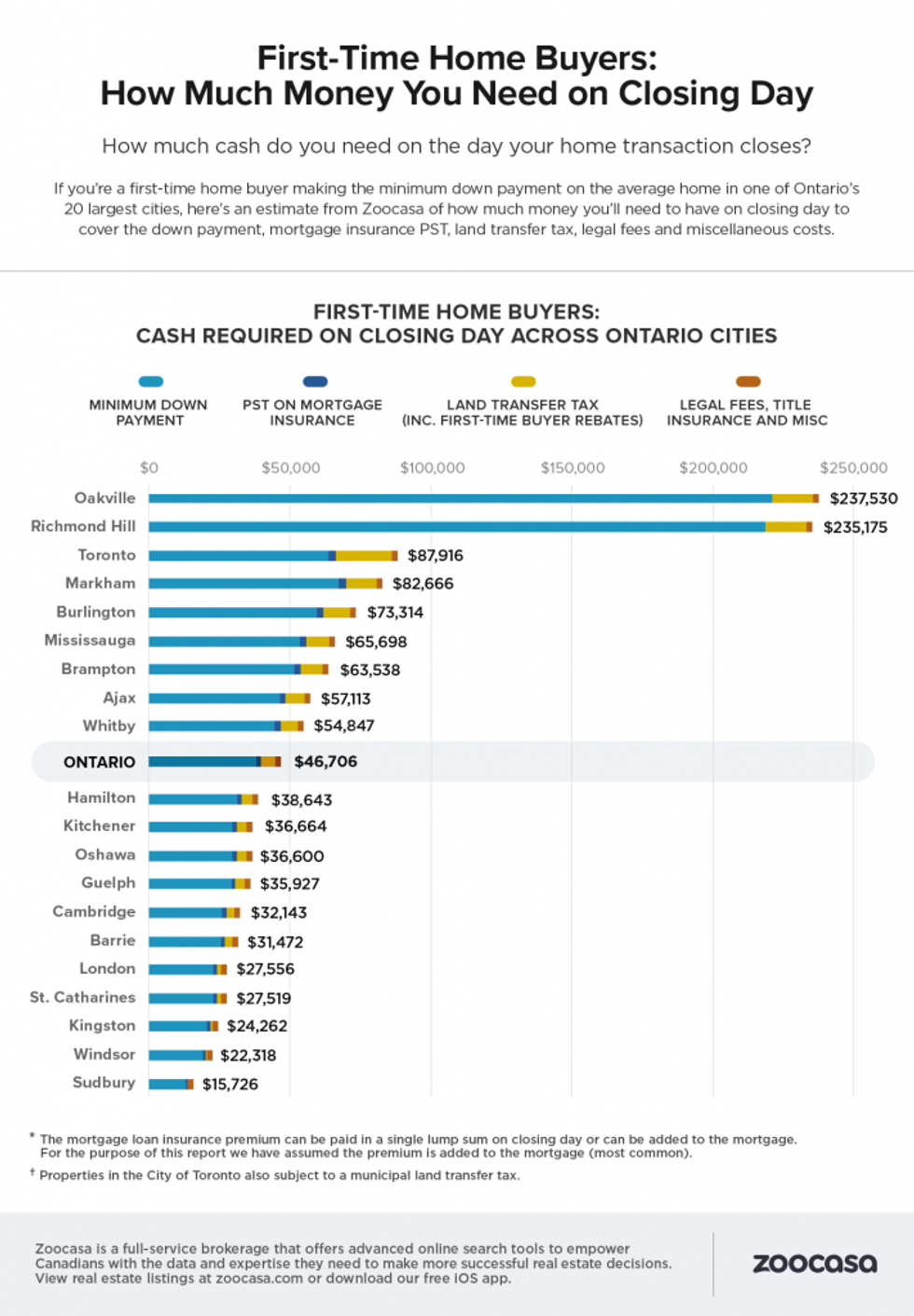

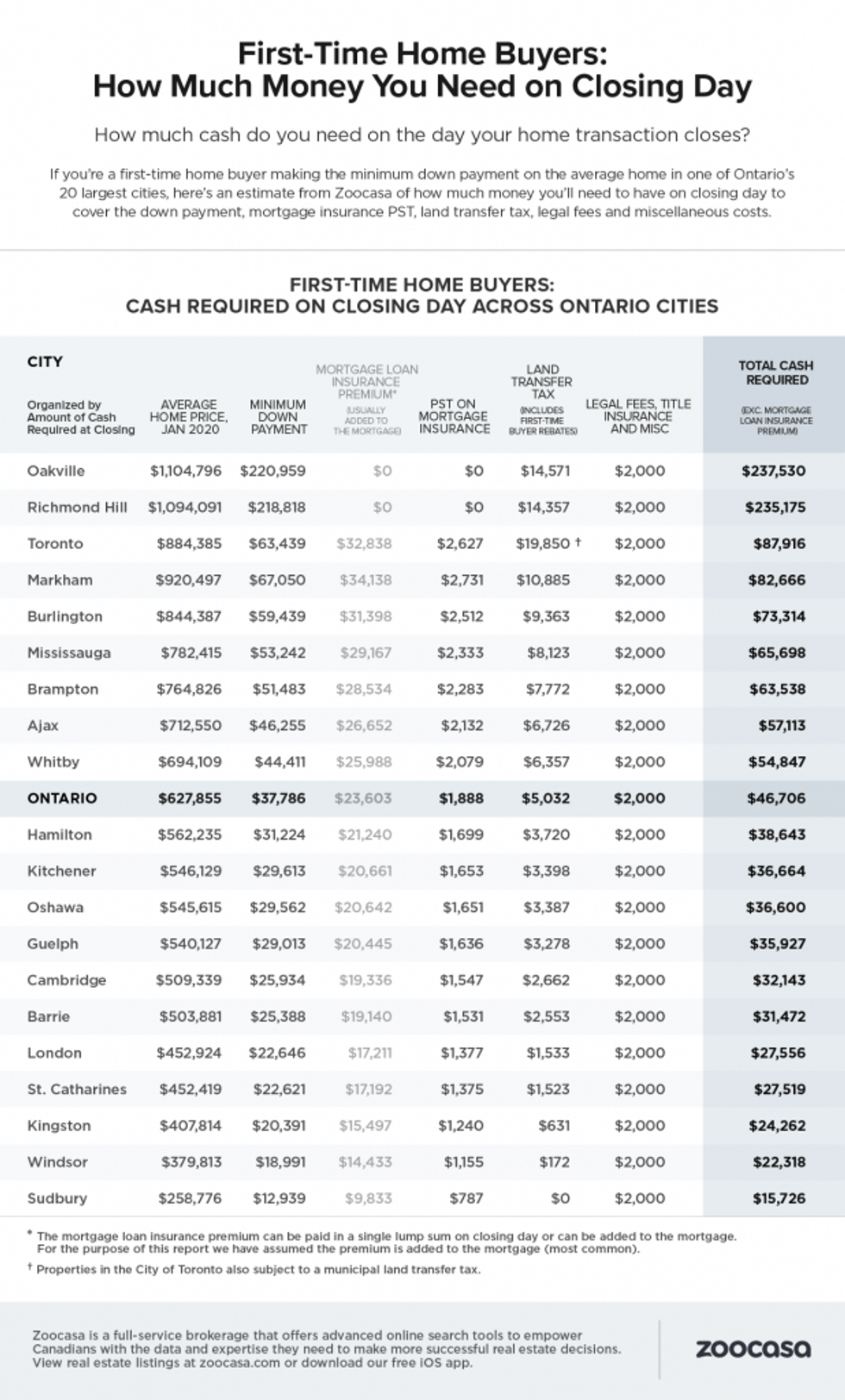

As housing markets and home prices range widely across the province, so too does the amount buyers can expect to pay upon closing. To find out how these costs range, Zoocasa compiled estimates based on average home prices in 20 major markets across the province. Calculations assume the minimum down payment is made (and includes the initial deposit amount), that all LTT rebates for first-time home buyers have been applied, and that mortgage default insurance costs have been rolled into the mortgage, and hence do not need to be paid on closing day.

According to the study, home buyers can expect to pay the most on closing day for Oakville real estate, as the local average home price is comparatively higher than in other Ontario markets at $1,104,796, requiring the full 20% down payment of $220,959. Although no mortgage loan insurance premium is required due to the 20% minimum down payment, buyers will still pay $237,530 to close their home transaction.

The second most expensive market is Richmond Hill, where the average home price comes to $1,094,091. That requires a down payment of $218,818, and a final closing bill of $235,175. The City of Toronto market is the third most expensive. The average price of homes for sale in Toronto is $884,385, which requires a minimum down payment of $63,439. However, City of Toronto buyers are also subject to municipal land transfer tax. Meaning – even with first-time home buyer rebates factored in – they face the highest total LTT bill of anyone in the province, at $19,850, contributing to a closing outlay of $87,916.

Check out the infographic below to see how estimated closing costs range across Ontario for first-time home buyers if they were purchasing the average-priced home in each city.

Methodology

Average home prices for Jan 2020 were sourced from each city’s regional real estate board or and the Canadian Real Estate Association.

The minimum down payment is due on closing day and is calculated as follows:

- Purchase price of $500,000 or less: 5% of the purchase price

- Purchase price of $500,000 to $999,999: 5% of the first $500,000 of the purchase price, 10% for the portion of the purchase price above $500,000

- Purchase price of $1 million or more: 20% of the purchase price

The mortgage loan insurance premium can be paid on closing day, or added to a the home’s mortgage amount. The mortgage insurance premium for a loan based on a 5% down payment (i.e. loan-to-value ratio of 95%) is 4% of the total loan, i.e. 4% x (home value – down payment).

The PST on the mortgage insurance premium in Ontario is 8% and is due on closing day.

Ontario land transfer tax (LTT), excluding the rebate for first-time home buyers of up to $4,000, is calculated as:

- Amounts up to and including $55,000: 0.5%

- Amounts from $55,000.01 to $250,000: 1.0%

- Amounts from $250,000.01 to $400,000: 1.5%

- Amounts from $400,000.01 to $2,000,000: 2.0%

- Amounts over $2,000,000: 2.5%

Eligible first-time buyers in Ontario can receive a LTT rebate of up to $4,000.

Home buyers in the City of Toronto are also subject to a Municipal Land Transfer Tax (MLTT). Rates follow the same structure as the Ontario LTT. Eligible first-time buyers in the City of Toronto can receive a LTT rebate of up to $4,000. (edited)