Equity

Understand what equity means in Canadian real estate, how it's built over time, and why it’s an essential part of homeownership and financial planning.

May 22, 2025

What is Equity?

Equity is the difference between a property’s current market value and the outstanding balance of any mortgages or liens on it. It represents the homeowner’s ownership stake in the property.

Why Equity Matters in Real Estate

In Canadian real estate, building equity is one of the main financial benefits of homeownership. As property values increase and mortgage balances decrease over time, the owner’s equity grows. This can be leveraged for various purposes, including refinancing, securing a home equity loan, or selling the property for a profit.

Equity also provides a financial cushion during market downturns or unexpected life events. A homeowner with substantial equity may be better positioned to weather short-term declines in property value or borrow against their home in times of need.

Equity can grow through:

- Regular mortgage payments (reducing principal)

- Property appreciation

- Renovations or upgrades that add value

Monitoring equity is crucial for financial planning and long-term wealth building. Tools like mortgage statements, appraisals, and HELOC assessments help track equity over time.

Example of Equity in Action

A homeowner in Halifax owns a house valued at $800,000 with $500,000 remaining on their mortgage. Their equity is $300,000.

Key Takeaways

- Represents the owner’s stake in their home’s value.

- Increases through mortgage repayment and property appreciation.

- Can be used to access loans or support retirement planning.

- A key metric in real estate investing and borrowing.

- Crucial for financial stability and long-term wealth.

Related Terms

- Home Equity Loan

- Appraisal

- Mortgage Principal

- Market Value

- Refinance

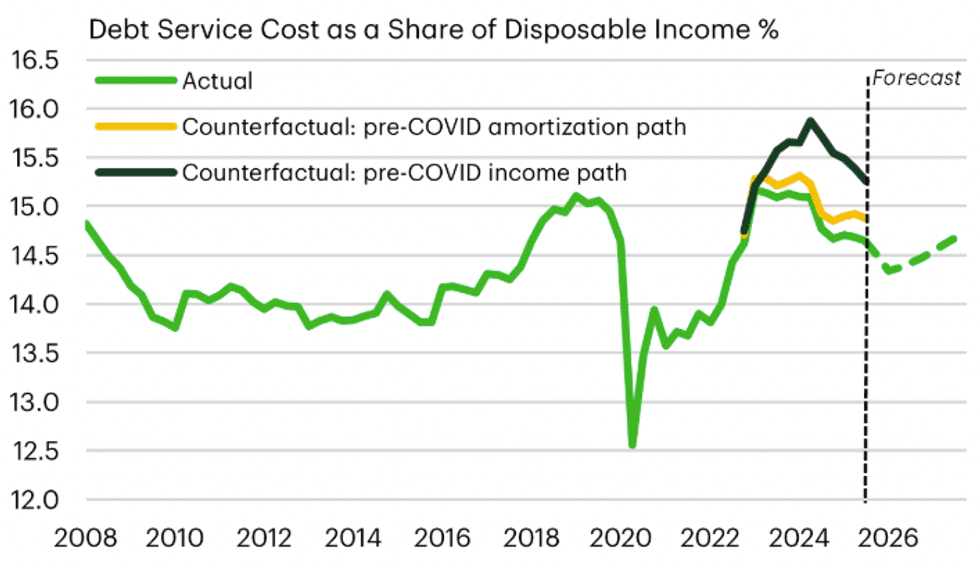

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics

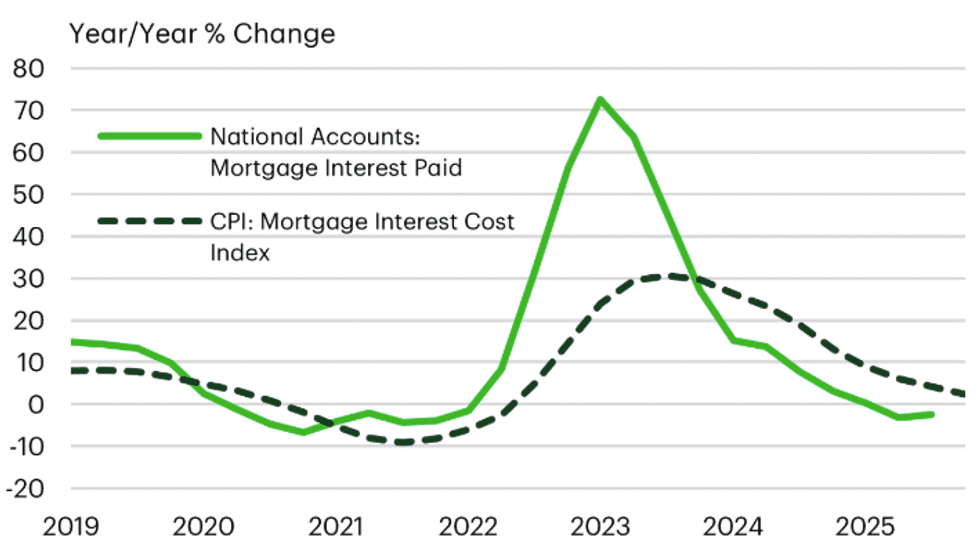

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics

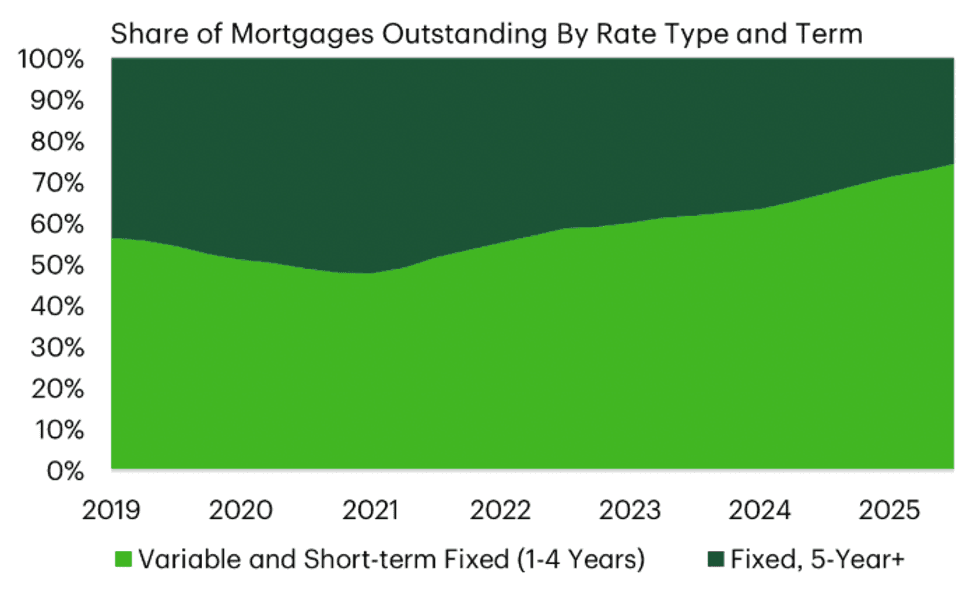

Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Manuela Preis/Instagram

Manuela Preis/Instagram