Judging by the new rezoning application signs popping up around Kitsilano, Fairview and Mount Pleasant, it appears that the Broadway Plan is humming along, at least for the city and developers. As of the start of this month, 36 applications to rezone properties within the Broadway Plan had been submitted to the City of Vancouver, including two that have been approved, according to a City spokesperson.

It doesn’t mean there’s been a rush to buy properties, however. Although there are signs of an uptick in sales activity this year, sales transactions in the area remain slow, say real estate brokers. It means that several of those applicants are likely long-time landowners or developers who’ve been working for several years on rezoning a site, prior to submitting an application. There have only been a handful of sales over $5M since January 2022 in the Broadway Plan, says Macdonald Commercial Managing Director Tony Letvinchuk.

One of the few recent sales higher than $5M was the apartment building at 2175 W. 7th Ave., across from St. Augustine’s School, in Kitsilano. Gracorp Properties has applied to rezone the site for a 20-storey rental building with 20% of the floor area for below-market rental units. The property sold for $16M and completed in January, according to Altus Group, but the buyer would have been in discussion with the City for some time. A pair of heritage houses at 2156 and 2172 W. 14th Ave. are also the subject of a proposal for an 18-storey tower for 171 rental units with the 20% below-market requirement. That proposal is a contentious one because it’s a high-rise tower surrounded by low-rise duplex housing. To the chagrin of urban designers, that incongruity of high-rises is allowed within much of the plan.

Housing activists are concerned about the potential loss of affordable housing. Last month, the City cited three rezoning applications for rental towers more than 20-storeys high at 1190 W. 10th Ave., 1665-1685 W. 11th Ave., and 1365 W. 12th Ave., all of them rental buildings that will result in displacement of tenants. The City’s tenant protection policy would kick in, which would be an added cost for developers who are already facing hefty construction costs and fees.

Letvinchuk says the purchasers of large development sites would have been in negotiations with city hall long before closing on any deal. So, the current activity within the plan is mostly projects that have been in the pipeline for a while.

“There are well-capitalized developers already in the Broadway Plan, and there are projects that are in the midst of moving forward, and we are starting to see some ‘missing teeth’ on Broadway as buildings come down, getting ready for eventual redevelopment,” said Letvinchuk.

And a lot of the activity currently underway is more likely the result of a years-long process, agrees Mark Goodman, Principal of Goodman Commercial. He says there are signs of movement in the market, but it’s generally slow going. He knows of a site he sold a decade ago that finally has a rezoning sign erected on it.

“A lot of these owners have had these assets for 10, 15 or 20 years and are going through the rezoning process under the Broadway Plan now, so by no means do the applications mean transactions,” says Goodman.

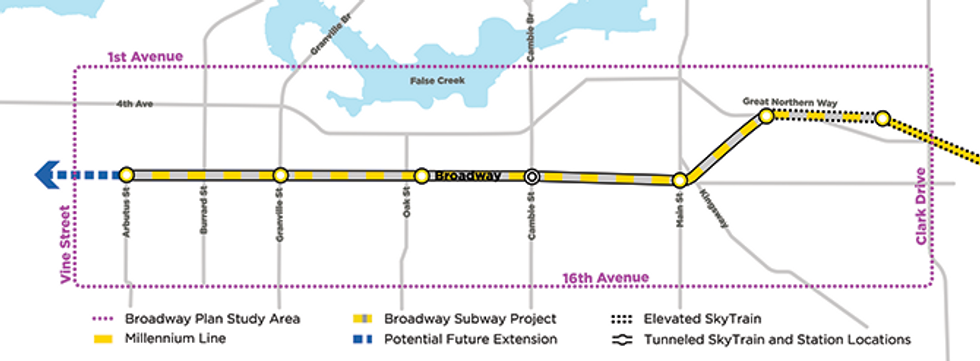

Some deals aren’t firm yet, with developers inquiring at the City about the potential for a rezoning before they commit, he says. The City’s plan for the 500-block area around the Broadway subway line, from Clark Drive to Kitsilano, is a 30-year build out, so it was never going to transform the city immediately.

“We are certainly hearing more about the Broadway Plan, but I think it’s a confluence of factors and timing stuff that started years ago coming to fruition now. There are a couple of deals, such as a strata windup that finally closed at Burrard and 12th,” says Goodman. “By no means is this like explosive activity. I think things are ‘moving along’ is a better description of what’s happening in the Broadway Plan. In other words, these fear mongers who were saying ‘the whole city will change overnight with towers and congestion everywhere and we are all going to be walking in shadows,’ no, that is not happening at all. It’s moving at a snail’s pace, as does most development here in Vancouver.”

Letvinchuk says the Broadway Plan area is “a jigsaw puzzle” for developers who need to not only negotiate a deal but work with the City to determine potential density and costs, such as requirements for a certain number of family-sized units and below market units, and City levies.

Also, the City’s enhanced tenant relocation and protection policy for the Broadway Plan area means any tenants displaced by redevelopment must be compensated, and if it’s a building filled with long-term tenants, the lump sum payouts can add up.

“Over the past 12 months, there are just so few trades in the Broadway Plan area, and while there are development challenges with certain aspects of the plan, developers are on the sidelines for land acquisitions generally at the moment,” said Letvinchuk.

He cites a “land sales bulge” from 2016 to 2018 when a lot of land purchases were made, and a lot of those are under construction today. That’s also the time when the City of Vancouver created policies for 20% below-market rent and work-force housing because they made financial sense, he says.

But it’s been a roller coaster since then, says Letvinchuk, with an uptick in sales in 2021 with the interest rate drop, and then a massive decrease in sales last year, with the interest rate hikes.

“The dearth of land sales is telling us developers and investors are not willing to wade into the market waist-high and take the risk by making land acquisitions at prices expected by sellers, as the development numbers generally don’t work at the moment.”

Only the developers with deep pockets can land bank, he added.

In dollars, sales have dropped from more than $5B in 2022 to less than $2B in 2023, according to Altus Group. The Goodman Report shows 73 multi-family building sales in Metro Vancouver last year, compared to 130 sales in 2022. In 2021, 161 buildings sold.

Last year was one of the slowest years in a decade, says Goodman. But he senses a turnaround as interest rates stabilize.

“I think we are out of that period. Usually, we feel what’s happening before the public does and now when we send out a [listings] blast, we are getting way more calls. Lots of people are asking for proposals. It’s still tougher to do deals because people are cap-rate sensitive much more than before, and it’s harder to make the numbers work, but liquidity in the market seems to be returning.”

Architect Brian Palmquist, whose City Conversations newsletter keeps tabs of Broadway Plan development, doesn’t believe it’s moving along as slowly as the industry experts are saying.

He estimates that the City’s numbers are low and that there are at least 61 proposals underway for mid-rise and high-rise buildings in the area. Those proposals already comprise more than one-quarter of the target for 30,000 new homes within the Broadway Plan, he says.

The discrepancy between the City’s 36 rezoning applications and his estimate is likely because some of the proposals were initiated prior to the Broadway Plan and the City isn’t counting those, he says. As well, he says some of the proposals he’s counted haven’t made it to the formal application stage but have only been announced. Palmquist believes his numbers are more accurate than the city’s, and he says there are likely more informal proposals he’s not aware of.

Goodman said that on the flip side, however, some rezoning applications could also get cancelled if the numbers don’t pencil out.

“For a developer, the longer the closing, the better, because they are able to do the [rezoning] work, but they don’t have to service a mortgage. So, it’s a very important time for a developer and in some cases, they may have option to extend the closing. Each deal is different. The point I’m making is that although a rezoning application is in doesn’t mean the deal is closed, but most likely it is firm. It's nuanced.”