On Wednesday, the Bank of Canada held its policy interest rate at 5%, as most experts expected, but that may not directly translate to a boost for British Columbia's housing market just yet.

"Sales activity will likely remain below normal through the end of 2023 and for much of 2024," said the British Columbia Real Estate Association (BCREA) in its Q4 forecast published on Wednesday.

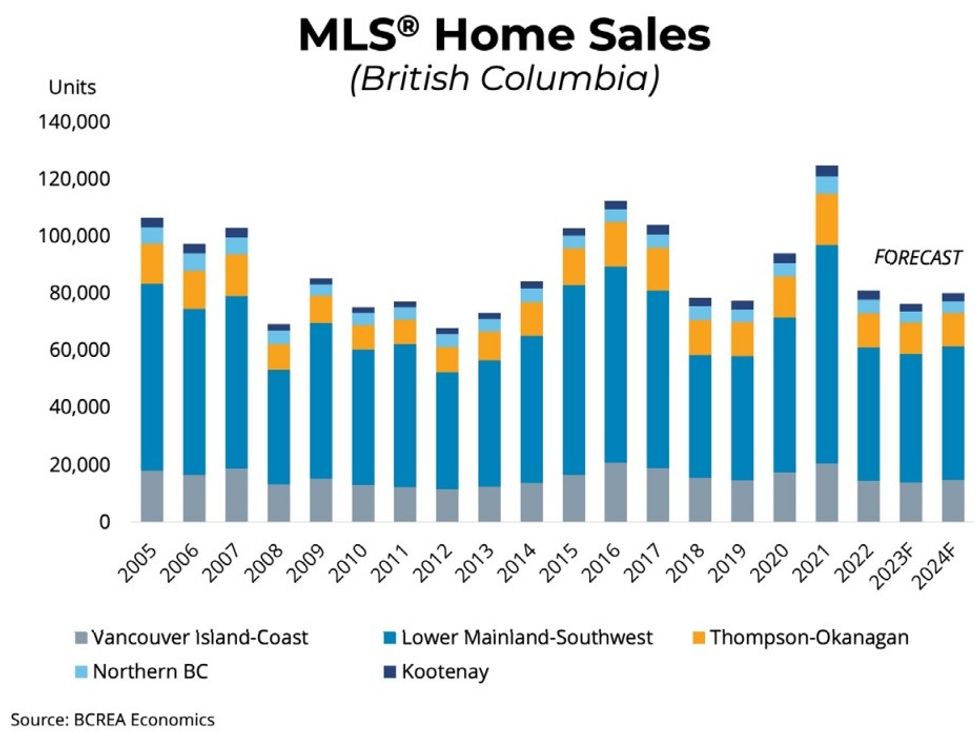

BCREA is projecting a total of 76,700 sales in 2023, which would represent a 4.8% decrease from 2022. However, the expectation is that home sales will then rebound next year, seeing a 4.8% increase to 80,375.

The housing market has mirrored the actions of the Bank of Canada over the past two years, BCREA points out, and there is currently no reason to expect that to change — at least within the next year.

"It appears that the Bank of Canada is at, or at least very near, the end of its tightening cycle and may begin lowering its policy rate late next year," says BCREA. "If mortgage rates decline as expected in 2024, it certainly will provide some relief to potential buyers. However, both fixed and variable mortgage rates will be much higher over the next two years than the rates borrowers have been accustomed to over the past decade. Additionally, continued slow economic growth and a cooling in the labour market may further constrain demand."

Regionally, home sales are projected to see the biggest drop-off this year in the BC Interior and Northern BC, with decreases of over 10% compared to 2022. In the Greater Vancouver region, home sales are projected to finish the year at 3.5% below 2022 before rebounding by 3.6% in 2024. For the Fraser Valley, home sales are expected to finish just 0.4% below 2022 before increasing by 3.4% next year. The only regions expected to finish this year better than last are Chilliwack (2,600 units, up 0.7%) and Powell River Sunshine Coast (350 units, up 8.7%).

On the supply side of the equation, new listings have normalized so far in the second half of the year, after trending down in the earlier half, resulting in a "modest uptick" in total inventory. BCREA notes, however, that with just over 30,000 active listings, our inventory is still well short of the 45,000 benchmark that's considered healthy for the market.

Housing starts are relatively strong right now and on track to reach 50,000 this year, with more and more projects that were on hold in the past two years now breaking ground. However, BCREA is expecting new construction to decline, despite the provincial housing targets that have been set for 10 municipalities (and more, to be announced later this year). BCREA says it is expecting developers to delay projects as a result of high financing rates, scarce labour, and uncertain market conditions.

Housing prices have almost been following the opposite trajectory, seeing a significant increase through the first half of the year — recovering around half of the decline seen in 2022 — before flattening in recent months. BCREA forecasts home prices to finish 2023 roughly 1.9% lower than 2022, then increase slightly next year as a result of a strong recovery in the second half of 2024.

All in all, BCREA expects 2024 to be a continuation of 2023.

"With the year coming to an end, many of the big economic questions for 2023 remain frustratingly unanswered," they said. "While interest rates have risen significantly, we have not crossed the threshold into a recession just yet, and inflation, though down from its peak, remains stubbornly above its 2% target. As a result, the much hoped-for relief on interest rates is likely on hold until late 2024 or early 2025."