The supply of housing in the resale market is increasing, which is providing prospective buyers with more options while also bringing the market to a healthy balance, says the Real Estate Board of Greater Vancouver (REBGV).

According to new monthly statistics published on Thursday, October recorded a grand total of 1,977 home sales — well below the 10-year October average of 2,832. The October number is a slight increase from the 1,912 sales recorded in September, however.

After seeing 5,446 new listings hit the market in September, October saw just 4,664, but the total nonetheless represents a 4.8% increase compared to the 10-year October average of 4,449 as well as a 15.3% increase compared to the October 2022 total of 4,043.

Despite the decrease in new listings from September to October, the number of total active listings increased from 10,810 to 11,034, which is relatively in line with the 10-year October average of 11,526.

In terms of prices, the composite residential benchmark price is now at $1,196,500, after being at $1,203,300 in September.

By property type, the benchmark price is now $2,001,400 for single-detached homes, $1,100,500 for townhouses, and $770,200 for condominiums, all three of which represent increases compared to October 2022.

Buyers or Sellers

With the aforementioned statistics, we can identify the sales-to-new-listings ratio and sales-to-active-listings ratio — two quantitative indicators that can give us a sense of whether the market is currently favouring buyers or sellers.

For the sales-to-new-listings ratio, a ratio of 40% or lower is considered a buyers' market, a ratio of 55% or higher is considered to be a sellers' market, and anything in between is considered a balanced market.

With 1,977 home sales and 4,664 new listings recorded in October, the sales-to-new-listings ratio is now 42.4% after coming in at 35.1% in September, indicating a balanced market.

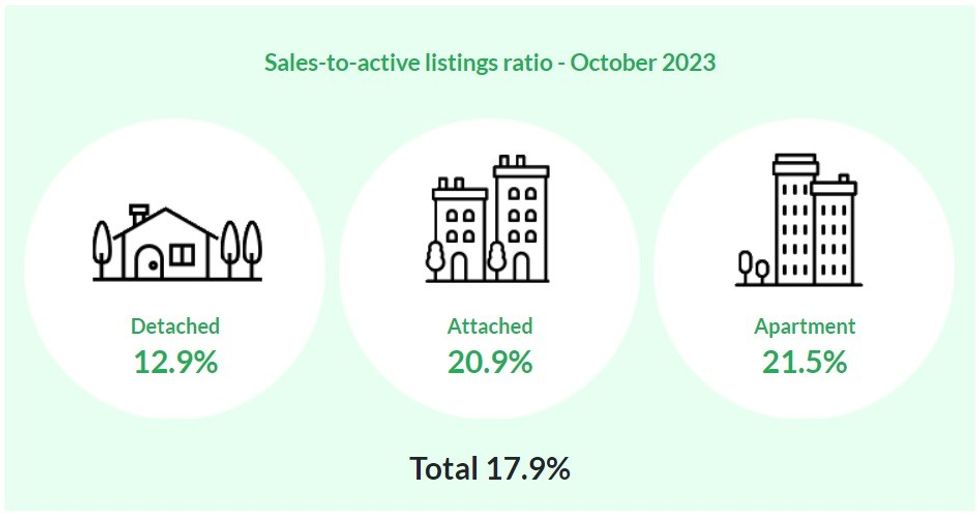

For the sales-to-active-listings ratio, a ratio of 12% or lower is viewed as favouring buyers, a ratio of 20% or higher is viewed as favouring sellers, and anything in between is viewed as a balanced market.

With 1,977 home sales and 11,034 total active listings after October, the sales-to-active-listings ratio is now 17.9%, after coming in at 17.7% in September, reaffirming that the market is fairly balanced at the moment.

Similar to last month, there is a noticeable difference depending on property type, however, with the market much closer to a buyers' market for single-detached homes (12.9%), and a sellers' market for townhouses (20.9%) and condominiums (21.5%).

Analysis

"With more supply in the form of resale inventory, and weaker demand in the form of slower sales, we’ve seen market conditions overall adjust towards more balanced conditions," said REBGV's Director of Economics and Data Analytics Andrew Lis. "It's noteworthy that the multifamily segment remains more active than the detached segment at this time," Lis said. "While the highest borrowing costs we've seen in over a decade continue to constrain affordability, a silver lining for buyers is that price increases have abated with these more balanced market conditions, meaning purchasing power is holding steady for the moment."

While borrowing costs are not as at unprecedented highs, they are higher than what many are used to, or comfortable with. The Bank of Canada has paused increases with its last two announcements, and some believe rate decreases may begin in the first half of the next year.

In a recent forecast, the BC Real Estate Association said that if this is the case, the housing market could see a strong rebound in the second half of the year.

Before then, however, they also said they were expecting 2023 to finish with home sales at 4.8% below 2022 and home prices at 1.9% below 2022.

The Bank of Canada's next rate announcement will be made on December 6.