Despite unstable economic conditions, the real estate market in Metro Vancouver is expected to remain relatively steady in 2023, with home sales projected to near what the region saw in 2022, according to a new market outlook from the Real Estate Board of Greater Vancouver (REBGV).

After hitting a record -- pandemic-induced -- high in March 2021, home sales in Metro Vancouver ended 2022 at near-historic lows, even when taking into account the usual seasonal variation, and finished the year with a total of 29,261 sales.

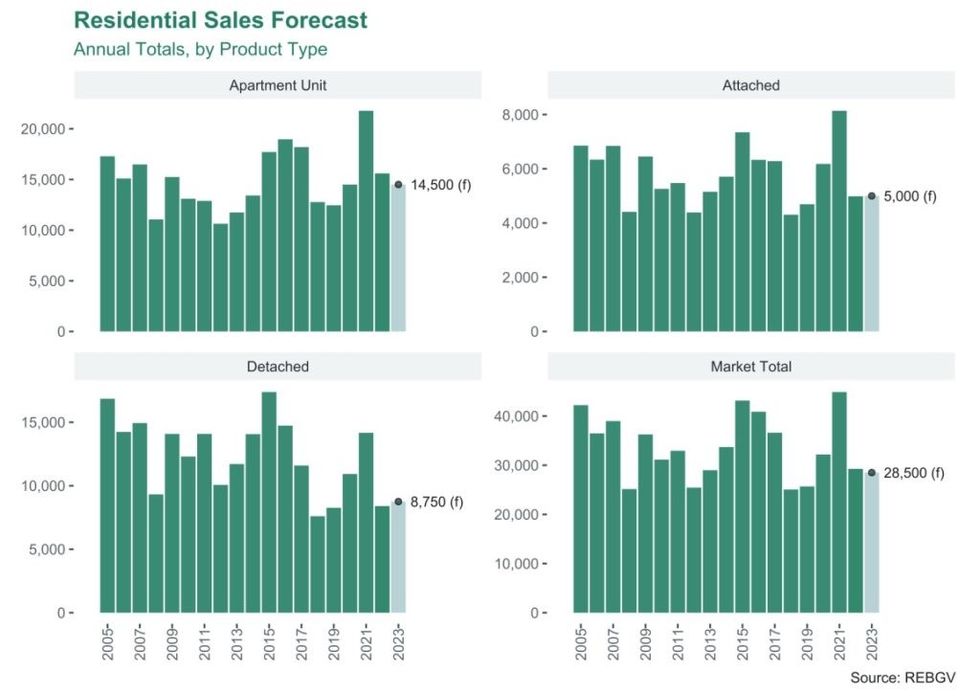

Pending a recession, REBGV is projecting 28,500 home sales in 2023 -- a 2.6% decrease compared to 2022. It's also much lower than the 2020 and 2021 pandemic years, but is an increase compared to the pre-pandemic years of 2018 and 2019.

The minor dip, however, does not hold true across property types, with single-detached home sales expected to increase by 4.3% (8,392 to 8,750) and townhouse sales by 0.3% (4,985 to 5,000). The overall 2.6% decrease is the result of a projected 7% decrease in apartment sales, falling from 15,592 to 14,500.

"Inflation remains stubbornly high, despite the Bank of Canada's historically monumental efforts to bring inflation back to their preferred target range of between 1 and 3%," REBGV said. "Largely because of this, mortgage rates are expected to remain higher than market participants had been used to in recent times."

REBGV also notes that historical data shows home sales in Metro Vancouver tend to slow down as mortgage rates rise rapidly, and can take close to two years to fully recover. Late in January, the Bank of Canada raised its policy interest rate to 4.5%, but noted that they expect to "hold the policy rate at its current level" while assessing the impact of its eight consecutive interest rate increases.

Although many believe that the Bank of Canada has indeed reached the end of its interest rate hike cycle, high interest rates will remain prohibitive for some would-be buyers. The minor dip in market activity that REBGV is projecting takes that into account.

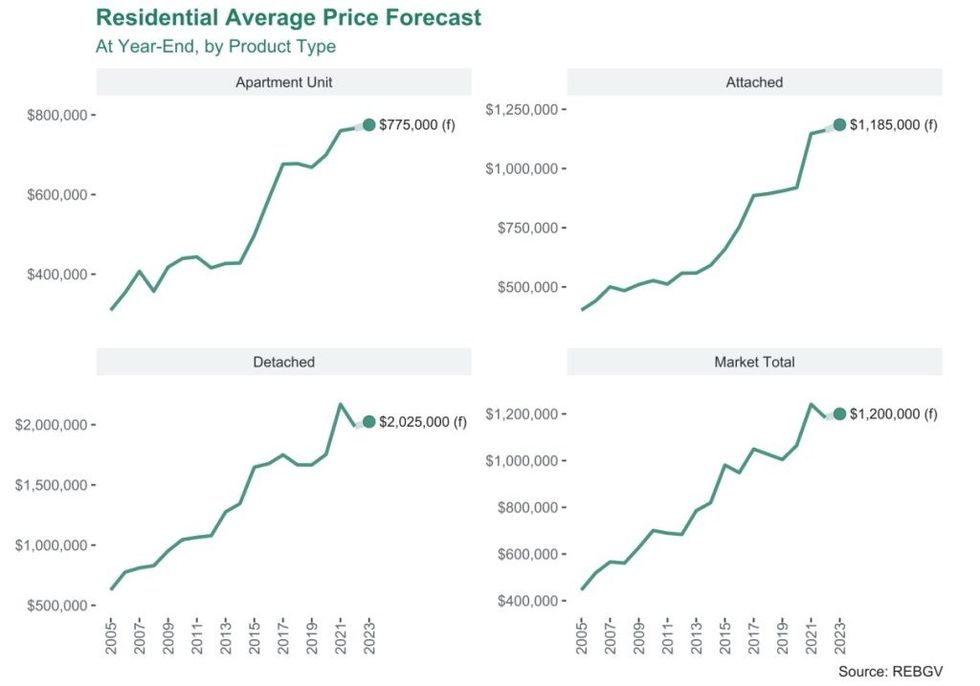

Home prices, however, have historically been less affected by increased mortgage rates, REBGV says, which is why they are projecting the composite residential average price to hit $1,2000,000 -- a 1.4% increase from where the average price ended in 2022, at $1,182,935.

In this case, that projection is expected to hold across all property types, with average home prices for single-detached homes expected to increase by 2%, townhouses by 2.1%, and apartments by 1.1%.

"Nearly all other historical tightening cycles in Canada yielded more modest declines in prices in the region," REBGV said, while noting the exception of the 1980s recession, which resulted in more drastic price corrections. "Interestingly, a few tightening cycles were even associated with price escalation; a somewhat counter-intuitive result that is nonetheless a verifiable fact of the historical record."

READ: Past Is Prologue: How Recessions Have Impacted The BC Real Estate Market

Home prices have declined by an estimated 10% since the beginning of this current tightening cycle, REBGV says, but have shown signs of slowing down. On top of that is the steady and strong demand in Metro Vancouver, as the region continues to see significant population growth from immigration.

"Despite the well-publicized challenges of housing affordability in this region, the amount of people who continue choosing to reside here represent an important source of demand pressure that continues to push up against a supply of homes that remains scarce," REBGV concludes. "As the real estate market continues to adjust to the higher mortgage rate environment, it is likely that more buyers and sellers will step back into the market."