As the threats of rising interest rates and inflation continue to loom over Canada, so too does the possibility of a recession. The real estate market is often considered a good indicator of the business cycle, so to get a feel for what may be coming, it may be wise to look at past recessions and how they've affected BC real estate.

Since 1980, Canada has seen four recessions: the 1980-1982 recession triggered by a drop in oil production after the Iranian Revolution; the 1990-1992 recession triggered in part by restrictive monetary policy following the Saddam Hussein-led Iraqi invasion of Kuwait; the 2008-2009 recession triggered by the US housing bubble burst; and the 2020 recession triggered by the COVID-19 pandemic.

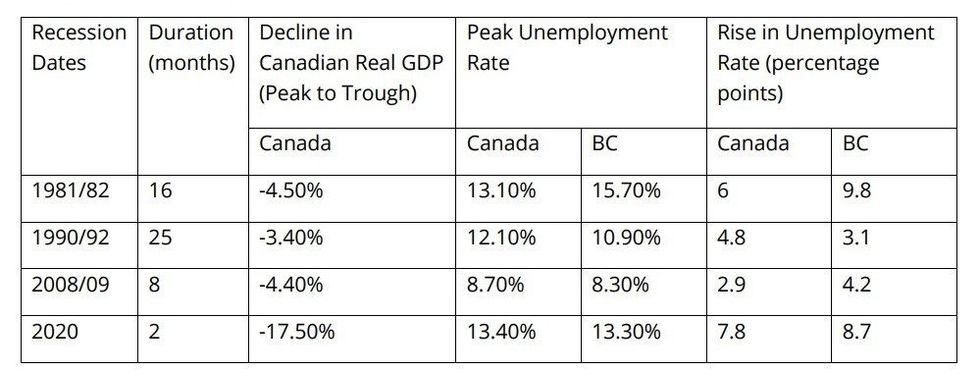

Although the most recent recession was somewhat brief, recessions have, on average, lasted between eight and 25 months, and have generally seen an approximate 4% contraction in Gross Domestic Product and a 4.5% increase in unemployment, according to the BC Real Estate Association (BCREA).

Specific to BC, sales activity in the real estate sector usually begins to fall in the months leading up to recessions. With the 1990 recession, sales began to tail off about four months before the official onset of the recession, while the 2008 recession saw sales peak 15 months prior, according to the BCREA.

The 2020 recession was more of an outlier, however, as sales fell little leading up the onset of the recession, and then not only recovered quickly, but reached levels even higher than were seen pre-pandemic within a year.

Historically, home sales decline by about 50-70% compared to pre-recession peaks, and then remain at that level for approximately one year before slowly recovering. And that is exactly where the real estate market in BC is at right now.

In a year-end report published earlier this month, BCREA statistics showed that home sales fell in December by 49.4% compared to 2021. That was, of course, a record year for the BC real estate market, but 2022's numbers were below historical averages, too, the BCREA says.

In terms of price, the BCREA says prices generally follow a similar pattern to unit sales in the lead-up to a recession. With both the 1990 and 2008 recession, home prices in BC plateaued for a year or two before continuing their ascent. With the 2020 recession, prices hit a bottom in May 2020, but then skyrocketed to 24% above pre-pandemic levels by March 2021, and 46% above pre-pandemic levels by Q1 2022.

Since then, however, average prices have declined around the province, as interest rates have been raised. According to year-end statistics published by the Real Estate Board of Greater Vancouver, home prices fell by about 3.3% compared to 2021. For the Fraser Valley, the decline was about 19%.

What's Past Is Prologue?

If the past is a good indicator of the future, and current trends with unit sales and home prices are lining up to historic trends, the BCREA is expecting the onset of a possible recession to coincide with the start of the housing market recovering.

"If the Canadian economy finds itself in recession this year, it may come at a time when the BC housing market is already at a low point," says the BCREA.

"BCREA's modelling suggests that if interest rates remain on their current rate path, housing market activity will remain well below its average historical level in 2023," they added. "Likewise, our model suggests that prices will trend downward in the coming months, although prices have historically traced various paths following rate tightening."

READ: New Year, Same Rate Pain: Canadians in for Long Road of Affordability Challenges

The BCREA points out that BC's economy has favourable demographics, as a large cohort of millennials are aging into their household-forming years, which means the demand for housing in the province will remain strong. They also recognize that, historically, home sales make strong recoveries in the year immediately following the onset of a recession. Home sales increased by 31% in 1982, 46% in 1991, 24% in 2009, and 33% in 2021.

"Importantly," the BCREA notes, "any recovery is predicated on a continued decline in bond yields and fixed mortgage rates through 2023 in anticipation of the Bank of Canada easing monetary policy."

The Bank of Canada's next interest rate announcement is scheduled for Wednesday, January 25, with experts expecting another increase of 25 to 50 bps. Time will tell how 2023 plays out. Or, perhaps, time has already told us.