The Bank of Canada has grown more concerned about the ability of households to manage their debt in a higher interest rate environment.

In its Financial System Review for 2023, the Bank of Canada (BoC) warned that "early signs of financial stress" are starting to appear, as declining home prices and elevated interest rates have reduced the financial flexibility of many homeowners.

Throughout the pandemic, an increasing number of first-time buyers stretched their budget in order to break into the housing market, taking on large mortgages with lengthy amortization periods. According to the BoC, the share of new mortgages with an amortization period longer than 25 years rose from 41% to 46% over the course of 2022; in 2019, it was 34%.

Higher interest rates have also led debt service ratios (DSRs) for recent homebuyers to increase significantly over the past year -- the share of new mortgages with a DSR of more than 25% jumped from 12% to 29% in 2022.

While a longer amortization period reduces the size of monthly mortgage payments, it increases the period of household vulnerability as equity is built more slowly. A higher DSR reduces borrowers' flexibility when expenses unexpectedly increase or they experience a loss in income.

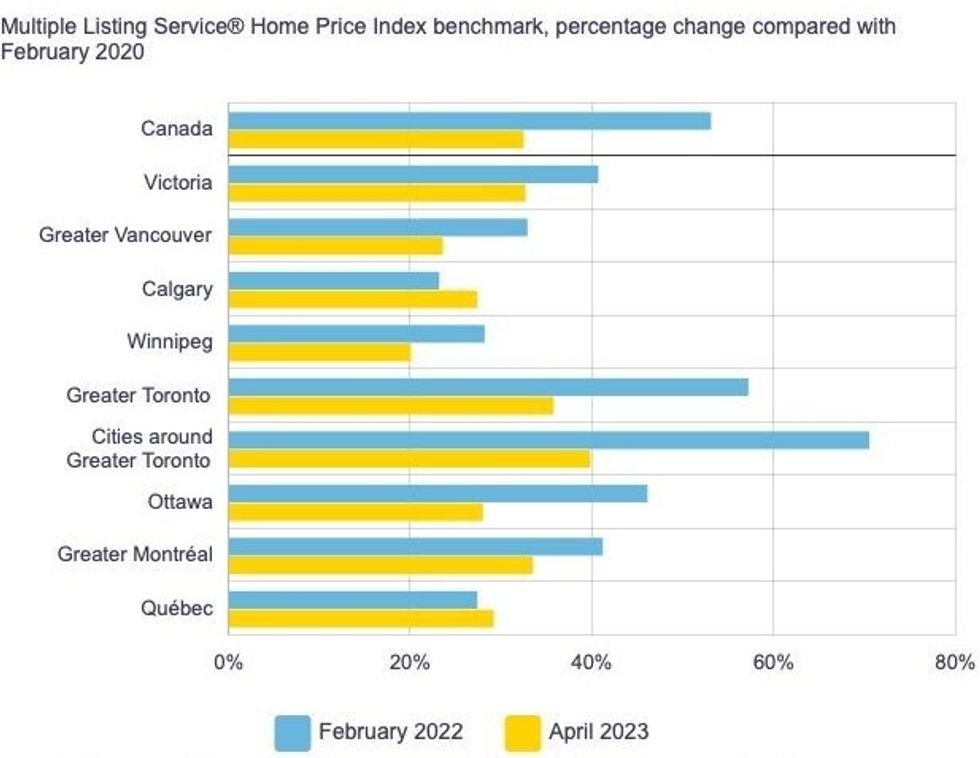

Since peaking in early 2022, home prices have declined "sharply" in most major Canadian cities. Nationally, the MLS Home Price Index (HPI) has fallen 13.9% from March 2022 ($841,300) to April 2023 ($723,900). For households that purchased near the peak, the price decline could lead to limited or negative equity in their home.

"A severe recession with significant unemployment and further reductions in house prices could cause substantial financial stress for some households," the BoC said. "Lower home equity could limit refinancing options on mortgages, leading to an increase in defaults."

The share of indebted households that are behind on any credit payments for at least 60 days has been increasing since mid-2022. Homebuyers have become more reliant on credit card debt over the past year, with the proportion of those carrying over an outstanding balance now exceeding the pre-pandemic peak.

Households that took on a mortgage between 2020 and 2022 are carrying about 17% more credit card debt on average than those that purchased property between 2017 and 2019, which the BoC said points to a "greater reliance on credit cards among recent homebuyers to finance debt."

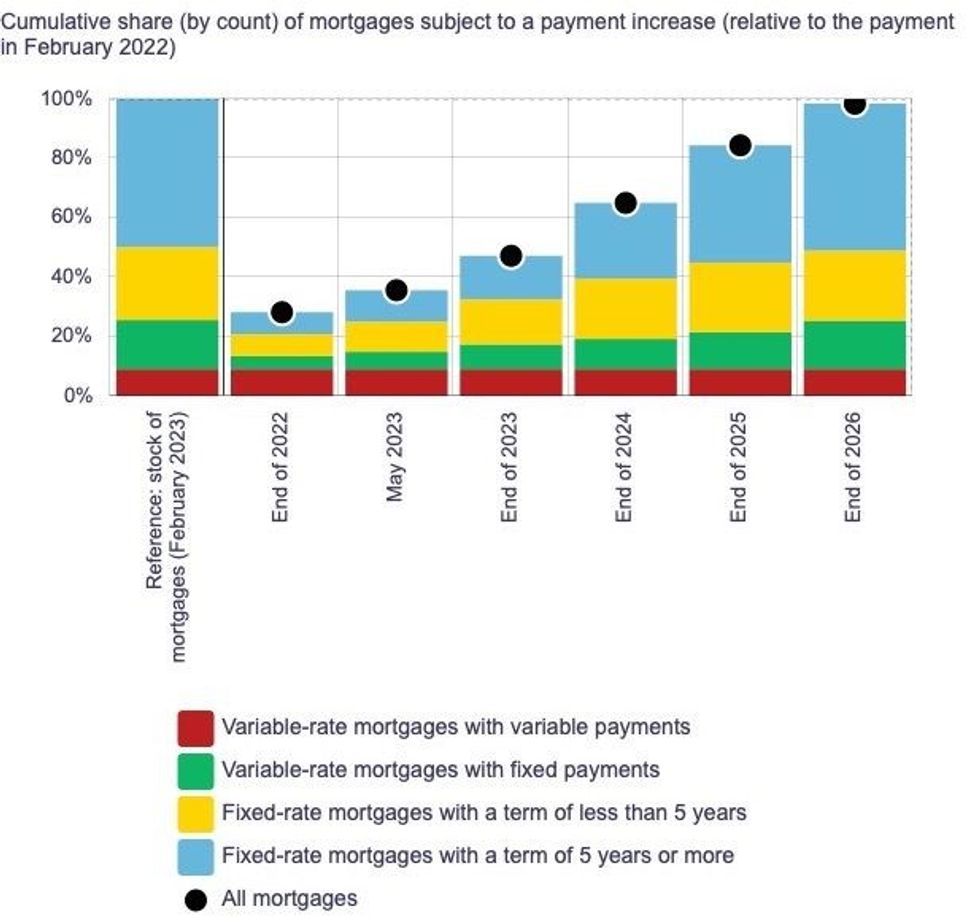

Arrears on credit cards have risen near pre-pandemic levels, but mortgage arrears remain near historic lows. To date, about one-third of mortgage holders have had their payments increase compared with February 2022, but this share will rise to nearly all mortgages by the end of 2026. If mortgages rates evolve as expected, the BoC predicts the median payment increase over the 2023-2026 period will be about 20%.

Although the mortgage stress test will have prepared many households for higher payments, some will see a more significant impact when their rates rise. The combination of higher DSRs, lower home equity, and longer amortization periods will reduce household flexibility in the event of added financial stress.

"More households are expected to face financial pressure in the coming years as their mortgages are renewed. The decline in house prices has also reduced homeowner equity, and some signs of financial stress — particularly among recent homebuyers — are beginning to appear," the BoC said.

"A large negative shock, such as a severe global recession with significant unemployment that further depresses house prices, could increase loan defaults among households. If defaults on uninsured mortgages with negative equity were to occur on a large scale, they could result in sizeable credit losses for Canadian lenders."