Nearly half of Canadians regret the amount of debt they’ve taken on.

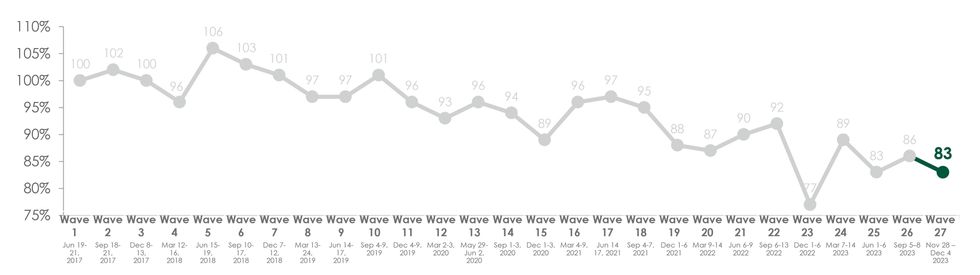

The MNP Consumer Debt Index dropped to 83 points in Q4 2023, a three-point decline from Q3 that marks the index’s second-lowest level since its inception in 2017.

The index sunk under the weight of persistently high inflation and rising interest rates, the impact of which have left Canadians feeling "pessimistic" about their current debt situation.

Created by MNP LTD, Canada’s largest insolvency practice, and conducted quarterly by Ipsos, the index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay bills, endure unexpected expenses, and absorb interest rate fluctuations without approaching insolvency.

A lower score points to increasing financial pressure; the index was at its lowest-ever level of 77 points at the end of 2022.

According to the latest data, 47% of respondents are concerned about their current level of debt, and 47% regret the amount of debt they’ve taken on. The measures have edged up one and two points, respectively, on a quarterly basis. At 63%, the number of Canadians who are concerned about their ability to repay their debts has also risen one point since Q3 2023.

"Spending on credit has served as a relief mechanism for many to keep up with increasing costs, especially for lower-income Canadians. We see from the data that the burden of repaying that debt is exacerbating the growing financial strain for many households, particularly amid higher interest rates," said Grant Bazian, president of MNP LTD.

"Most things cost more and debt repayment costs more. That leaves more Canadians feeling pessimistic about paying off debts, making ends meet, and about their financial futures."

Indeed, 22% of Canadians indicated their debt situation is "much worse" compared to a year ago, a two-point jump from Q3, and 28% said their situation had worsened over the last five years, a three-point increase.

While hope of interest rate cuts is on the horizon, the onslaught of rate hike after rate hike over the last two years has left many Canadians feelign defeated.

Twenty-seven percent of respondents said their ability to deal with a 1% increase in interest rates has worsened; when the question was rephrased to focus on monetary changes brought on by interest rate hikes, 36% said their ability to absorb a $130 increase is "much worse."

"With the cost of living on the rise, households that were already overextended may feel they have to take on more debt just to afford necessities," Bazian said. "The results can be disastrous because they end up trying to fill a hole by digging another one."

In order to pay debt or day-to-day expenses, 18% of respondents said they've had to take money out of their savings, home equity, RSP, or alternative methods over the last year. And with debt mounting, more and more Canadians are struggling to make their monthly payments.

Twenty-six percent of respondents said they'd only made the minimum payment on their credit card, a five-point increase since 2021, and 19% have only made the minimum payment on their line of credit, an eight point increase over 2021. Another 18% have borrowed money they can’t afford to pay back quickly, a seven-point increase over the last two years.

As such, Canadians’ mental health has worsened — 60% said their financial situation causes them anxiety, and 59% said it causes them stress. Nearly half feel a greater sense of isolation, and 40% are embarrassed over their debt level.

"Canadians are facing the added pressure of holiday bills coming due and mortgage renewals approaching as costs continue to increase. Many could be approaching a crisis point both mentally and financially," Bazian said.

"At some point, many realize there is no clear path to repay what they have borrowed, no matter the time horizon or interest rate. This can often be an extremely isolating, stressful, and sometimes embarrassing experience."

While the shame associated with unmanageable debt can often lead people to delay getting help, doing so only makes the problem worse, Bazian noted, and can result in aggressive collections activity or increased susceptibility to debt relief scams.

"Financial comfort and preparedness are key aspects of an individual’s overall well-being," he said. "Those in financial distress should seek help, the same way anyone experiencing a health crisis would seek help."