If you had to define today’s housing market in one fundamental metric, it would be, undoubtedly, lack of supply. Despite unyielding buyer demand that’s persisted throughout the pandemic, the number of new listings brought to market has remained stubbornly low, remaining well below year-over-year levels, as overall inventory steadily depletes.

According to the Toronto Regional Real Estate Board, new listings plunged by 15.5% year over year in January, with the month ending with just 4,140 homes for sale -- a 20-year low. And it’s a phenomenon extending well beyond the GTA; The Canadian Real Estate Association reported a scant 1.6 months of inventory last month -- tied with December levels for the all-time low -- which has led to some of the toughest market conditions on record.

Read: National Home Prices Hit New Record in January as Supply Remains Historically Scarce

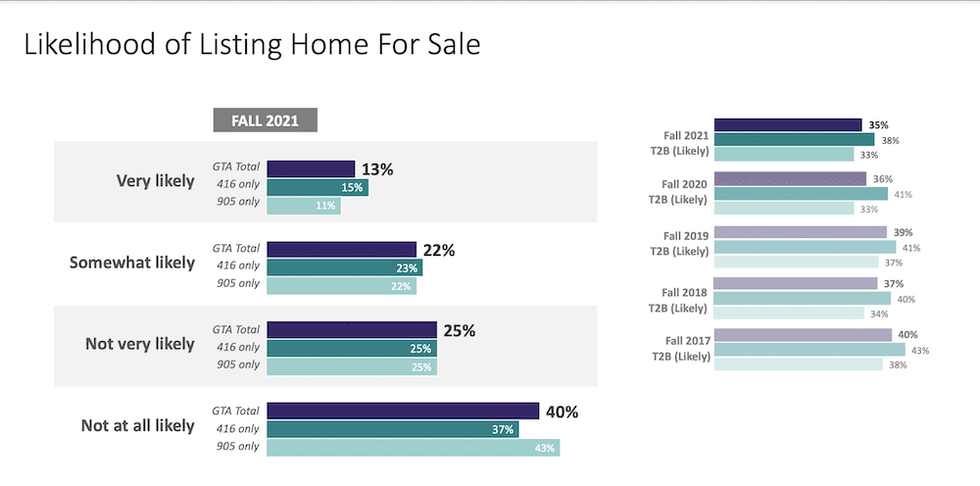

And, there’s no relief expected on the horizon; according to polling conducted by TRREB in partnership with Ipsos, listing intentions will remain depressed throughout 2022. Of existing homeowners surveyed, just 13% indicated they’d be “very likely” to list their home over this year, with an additional 22% saying they’d be “somewhat likely”. In contrast, a combined 65% indicated they’d be “not at all” or “not very likely” to list.

Why Sellers Are Hesitant to Cash Out

But, with homes fetching some of the highest prices in history -- breaking records on a sale-by-sale basis in some neighbourhoods -- you’d think there’d be plenty of motivation for prospective sellers to realize the enormous appreciation they’ve garnered, especially if they’ve owned their property for many years. So, why aren’t they -- and when might they come out of the woodwork?

“Why is nobody selling? You’ve got these record prices, but no one is taking advantage of it. It’s interesting,” says Jim Roberts, agent at Sage Realty.

That record price appreciation, he posits, is much of a curse as it is a blessing; rising prices in surrounding GTA communities have contributed significantly to buyer gridlock, as the question of ‘Where am I going to go?’ becomes more daunting than ever before, while the financial benefits have shrunk.

“With what COVID caused... you now have all these younger buyers saying, ‘I don’t have to live in Toronto anymore.’ So they’ve taken Toronto bidding war mentality, and they’ve taken it all over the province,” he says. “As a result, house prices have skyrocketed, pretty much any direction you drive three hours from Toronto, essentially doubling in the last five years.

“It’s not as simple as saying, ‘I’m going to sell my million-dollar house and go buy something two hours from Toronto for $500,000. That house that was $500,000 three or four years ago may be $800,000 -- $900,000 now. So, you’re looking at moving from your social network, where your family and friends are, and you’re looking at making a lateral move in terms of money in the bank -- and that had been a big motivation.”

Fear of Missing Out

Toronto realtor and chartered accountant Scott Ingram echoes this sentiment, saying many sellers are trepidatious about re-entering a tough market on the buy-side.

“The age-old question of ‘do I buy first, or do I sell,’ is more of a question these days than it was 25-30 years ago. It was normal then that you’d sell your place and then buy a place,” he says. “But now, with things flying off the shelves, it’s become, ‘Oh my god, if I sell my place, then I’m going to have to buy a place, and what if, say I’m closing in two months, what if I can’t find a place in that time frame?’ I think that’s taken some people out. They’re afraid to move.”

He adds that some prospective listers may be suffering from good old “fear of missing out” should they time the market wrong and miss the potential value peak. “People are also afraid of missing out on appreciation. ‘Oh man, my neighbour sold his place in October and got $1.2M, and now my other neighbour sold his for $1.4M. I’m thinking of selling but, gee, what if it keeps going up, am I making a mistake by selling it now?’”

Another important consideration, Jim Roberts adds, is that the cost of selling in today’s market -- especially in Toronto, where transactions are hit with a double land transfer tax -- is just exorbitantly expensive.

“Moving is very expensive, and if you’re one of my clients -- I work with a lot of people in the east end of Toronto, downtown -- your average three-bed semi-detached house is probably worth something around $1.5 million dollars right now. And to upgrade to something with four bedrooms, maybe even detached, you’re looking up around the $2M mark, maybe even beyond that. So, if you buy for $2M, your land transfer tax is going to be about $75,000, and to sell your house with your average agent who may be charging 5%, that may be another $75,000 on your $1.5M house. So I think a lot of people are saying, ‘I don’t really want to just wipe out $150,000 of equity that I have.”

Instead, he says, existing homeowners are often choosing to stay put and renovating, investing equity that would otherwise be lost to fees into upgrading their home and amping up its value. If you go to Home Depot and take a look at the price of lumber, look at kitchen cabinets, in stock or anything to be upgrading your house, the cost of those things have practically doubled. There’s just so many people choosing to take that money that they’re going to lose in terms of the equity just from moving, they’re just going to renovate their house.”

If You Build It, They Will Sell

Of course, demand pressures are only one half of the equation; as the housing crisis has deepened, calls have grown more urgent for levels of government to materially ramp up housing creation.

The federal government has made new housing construction a key promise, implementing the National Housing Strategy, a 10-year, $72B plan to boost the supply of affordable housing. Most recently, the province-appointed Ontario Housing Affordability Task Force unveiled a 55-part proposal with the goal of building 1.5M homes over the next decade, including drastically reducing existing zoning rules, cutting development project red tape, and expediting the appeal process on contested building projects. While it remains to be seen whether any of these measures will actually be put into practice, the proposal highlights some of the existing challenges preventing new housing from coming online.

READ: Today’s Housing Market Looks a Lot Like 2017’s… That Should Worry Everyone

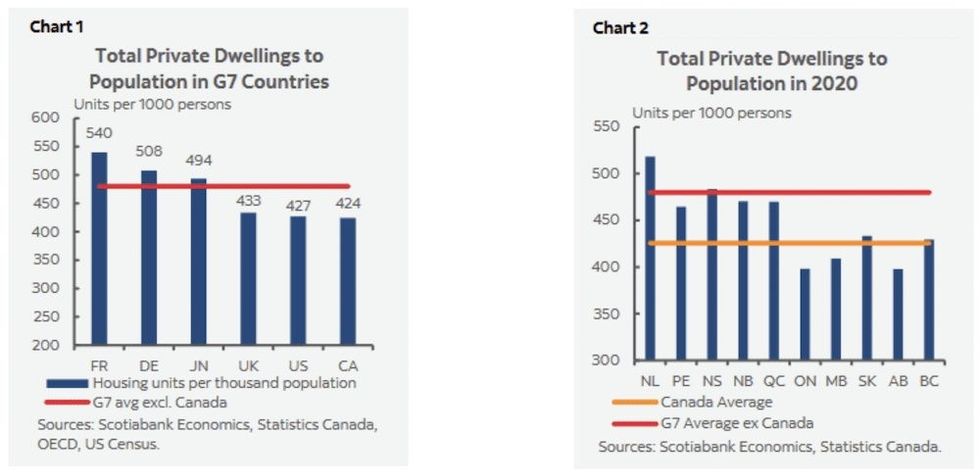

Jason Mercer, TRREB’s Senior Market Analyst, told STOREYS in a media Q&A that lack of supply is a significant contributor to the “vicious circle we’ve found ourselves in over the last decade” in terms of seller hesitancy. He points to a recent study conducted by Scotiabank Global Economics that reveals how Canada lags on the global stage in terms of housing supply creation.

This is impacting seniors, he says, who would typically downsize and add their family home to the listings pool.

“If you own a three-or-four bedroom detached home, and don’t really need that space, you might like to move into something different, but you want to stay within a specific geography,” he says. “Well, if that’s not available to you, you can’t buy what’s not available, and so you’re not necessarily going to list your home if you’re in that scenario, especially if you can still live in that home -- you can go down the stairs and everything else -- which I think is a scenario a substantial cohort of the population find themselves in.”

He adds that as long as builders fail to focus on “missing middle” home types -- dwellings that fill the gap between high-rise units and spacious single-family homes -- sellers will remain hesitant without suitable options.

“We’ve been a real laggard in Canada and certainly in Ontario and the GTA in terms of bringing homes online, especially bringing them online at the same pace as we’re seeing the population grow, so in the aggregate, we need to see more supply coming online, we also need to see a greater diversity of supply, so that ‘missing middle’ of home types” the plexes and stacks and what have you, that kind of bridge that gap between traditional low rise housing and condominiums,” he says. “We can then move from a vicious circle to a more virtuous circle where people are saying, ‘I’m seeing these different projects coming online in my neighbourhood, and they’re appealing to me, so I will now list my home because I feel certain that I’ll be able to find a home that meets my needs from an affordabl[ability] perspective.”