From foreign buyers’ taxes, to mortgage rate hikes, to stress tests, all tiers of government have spent considerable resources in attempts to tame the housing market -- but nothing has quite stuck.

Canadian real estate has proven resilient in the face of any price-cooling measures; appreciation has continued its rapid ascent into 2022, with the national benchmark shooting up 28% in January alone.

And, while Canada’s largest urban centres have long been financially prohibitive, that affordability is significantly eroding in the “secondary” markets is an especially troubling trend. According to the Canadian Real Estate Association, last months’ data reveals 30-40% year-over-year benchmark price increases in a slew of (once) more affordable markets across the country, including the Fraser Valley, Bancroft and Area, and London St. Thomas, just to name a few.

Read: Toronto's Home Prices Are Now Officially Higher Than Vancouver's

However, while this home value appreciation -- and accompanying buyer activity -- has arguably been supercharged by the pandemic, it’s not the first time the market has experienced such massive price jumps.

In the now infamous March of 2017, the Greater Toronto Area housing market recorded a record-shattering (at the time) year-over-year average price increase of 33.1%, to $916,567. Red flags were raised. Policymakers fretted. And by April, the former Liberal provincial government had implemented the Ontario Fair Housing Plan, a pack of 16 measures designed to cool real estate demand including a foreign buyers’ tax for the Greater Golden Horseshoe, stronger rent controls, and threats to curb speculative investor activity.

Tweaks to Come From the Federal Level

Given the frothy state of today’s market, whether or not various levels of government are poised to pull the levers once again is a top question for everyone from homebuyers to economists.

According to Robert Hogue, Senior Economist at RBC Economics, we will, at the very least, see some changes come down from the federal level at Budget time as the Trudeau government makes good on several of their housing-related election promises. He notes Federal Minister of Housing and Diversity and Inclusion Ahmed Hussen has “a very full plate” regarding an anti-flipping tax on residential properties as well as a ban on “blind” offer bidding.

“It looks like they’re pushing through a number of those items,” Hogue tells STOREYS, adding that at this stage, it’s unclear what form they’ll take, “especially when you think of when they curb ‘excessive profits on investment properties’ -- well, what is that?”

He adds that, given the extent of some of the proposed measures, it will likely take some time for the government to put them into place, postponing any immediate shock for buyers. “I think it’s unlikely for some of those measures that will require setup in terms of involving the CRA, etc., for taxing capital gains on properties for example… acknowledging that there’s still a lot of uncertainty, and I’m sure in the context of a minority government, there’s lots going on behind the scenes in Ottawa, as far as what’s palatable in gaining support as far as a budget package.”

While the timing for this year’s budget is unconfirmed, it traditionally occurs in May, meaning a shift could come just in time for the spring market peak.

How Similar is Today’s Housing Market to 2017?

Scott Ingram, Toronto realtor and chartered accountant, says for those watching today’s housing market fundamentals, there’s a sense of waiting for the other shoe to drop.

“People are waiting for something to happen, for somebody to slap them in the face and say, ‘Wake up, what do you think you’re doing?’” he says. “Funny enough, I thought that the beginning of 2020 was starting to look like 2017, but then the pandemic happened. The last couple of times when things have been getting heated, something stepped in. So people are wondering, ‘What’s it going to be this time?’ Because we can’t keep up this pace forever.”

Read: Could Rate Hikes Lead to a 20% Drop in Home Prices?

He adds that when previous measures have come down the pipe, the market’s response has been more emotional, rather than based on fact.

“When you look at what was in the Ontario Fair Housing Plan, the reaction was more than the substance of what was in there,” he says. “Oh, there’s a foreign buyers tax -- ok, if 5% of things are being purchased by foreigners, then that shouldn’t have been a big deal to 95% of people.”

The impact of the FHP was indeed immediate. Sales fell between April and May 2017 by 12.33%, along with a 6.18% softening in prices. What was especially notable, though, was the immediate flood of new listings, up 51% from March to May, and 49% year over year. As a result, market conditions did a 180; the sales-to-new-listings ratio decreased to 39.5% from the previous 70.83%, marking a plunge straight from a sellers’ to a buyers’ market.

By July -- the pit of the 2017 market in terms of seasonal sales volume -- transactions were down 50.97% from March. Prices had fallen 18.59% to $746,218, and supply was rapidly ramping up, with active month-end listings soaring by 138.4%. It wasn’t for a full year -- June 2018 -- that sales began to see year-over-year increases again, up 8,082 (a scant 1.35%), and an additional two years before prices caught back up, hitting $960,869 in June 2020 -- when the pandemic’s influence was becoming apparent.

And it can’t be denied that today’s market fundamentals are starting to look awfully familiar -- in some cases, even more dire than before. In the GTA, for instance, January prices are well above the $916,567 that set off alarm bells in March 2017, by a full 35.5% at $1,242,793. Sales are 53.3% below those March levels, but the key here is they’re constrained by supply; active listings sit 47.3% lower, with just 4,140 homes for sale at the end of January. New listings came in at 52.2% lower. And perhaps most telling is the sales-to-new-listings ratio: at 70.6%, the level of market competition is almost identical to that of five years ago.

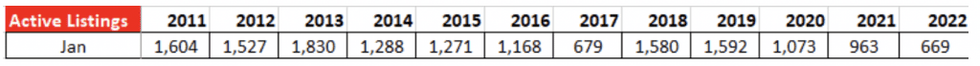

Ingram says listings levels are the canary in the coal mine, pointing to the trend for active January inventory going back to 2011. He notes that both 2022 and 2017 were standout years in terms of their record lows of supply, at 669 and 679 homes for sale, respectively.

“[2017] was the previous low by a lot, but you can see that in the last three years [before 2017], it’s been flat,” he says. Over the last few years, it’s been getting smaller and smaller because of people aging in place, doing things to gain appreciation, etc. -- and now it’s just a logjam. And I think that was the thing in 2017, too.”

How Effective Would New Housing Policies Even Be?

While it remains to be seen whether a policy shift today would spark a similar market slowdown, one variable remains constant: nervous sellers.

Jim Roberts, Real Estate Agent at Sage Realty, says nothing makes prospective sellers more anxious than the possibility they’ve missed the appreciation peak post-policy change, which could prompt a similar influx of listings this year.

“I think everybody saw, five years ago, the federal government tried to slow the market down. I think there was a six- to nine-month period where there was a lot of uncertainty, a lot of buyers backed out because they were unsure, a lot of listings came onto the market because a lot of sellers were unsure if they’d see the same yearly appreciation gains that they’d seen up until that point,” he says. “And once everything shook out, the underlying fundamentals of the market became good again, with a growing population, improving economy.”

As well, he adds, as long as today’s buyers can continue to fund their home purchases, any policy-induced blip is bound to be temporary.

“Canadian banks, the lending institutions, are really conservative relative to their American counterparts, it’s actively hard to get a mortgage in Canada; you have to have proof of income, you have to have a substantial down payment, there’s a limit on how much debt you can be servicing on a monthly basis, so as long as people can keep hitting those thresholds, it’s a tough situation, because they’ve tried everything, and it hasn’t worked.”