Borrowing costs are set to rise as early as March as the Bank of Canada plans to increase its trend-setting interest rate in response to soaring inflation and a cheap-debt-fueled run up in home prices. But just how impactful will higher mortgage rates actually be when it comes to cooling the nation’s scorching real estate market?

According to new commentary from Canada’s banking regulator head, home prices could drop as much as 20% once rate hikes are underway, based on the precedent set between 2015 - 2017. That was the Bank’s last significant hiking cycle, as additional market-cooling policies, such as foreign buyers’ taxes, were implemented during that time frame to stem speculative activity.

“Looking ahead, it feels like we’re at the latter stages of that phase [of speculative activity], and my expectation is that, as rates go up, assuming they do, some of that fever is going to abate a little, and you’ll see a slowdown in prices,” states Peter Routledge, Superintendent of the Office of the Superintendent of Financial Institutions (OSFI) to David Herle on the Herle Burly podcast. “In some markets, where you had a really rapid increase in prices, you could see a fall of 10, 20%, even. That’ll be a return back to -- I don’t want to say norm -- but a return back to sanity after a sudden buildup in prices, and, by the way, we went through that in Vancouver in 2015 and 2016, and then in Toronto in 2016, 2017, and you’re talking trough-to-peak declines of 10 - 20%, so we can absorb that volatility.

His thoughts follow a recent Market Intelligence report from the British Columbia Real Estate Association, which posits home sales could plunge 25% once the BoC kicks off its tougher monetary policy mandate.

“Prices Tend to Be Pretty Sticky”

However, other industry experts don’t necessarily think that the immediate price reaction will be so steep.

“The fact is, house prices usually don’t plummet overnight like they do in the equities market. The housing market is pretty sluggish and pretty slow to change, especially on the way down. On the way up, it can explode, but when the market’s cooling, prices tend to be pretty sticky. And that’s why I think it’s less likely that you’re going to see a 20% decline this year,” says John Pasalis, President of Realosophy Real Estate.

“We’re probably more likely to see a plateauing, perhaps some softening, if things cool in the second half of this year, a slight decline, but I don’t know if it’s going to be in the magnitude of 20%.”

Sales Historically Bounce Back After Rate Hikes

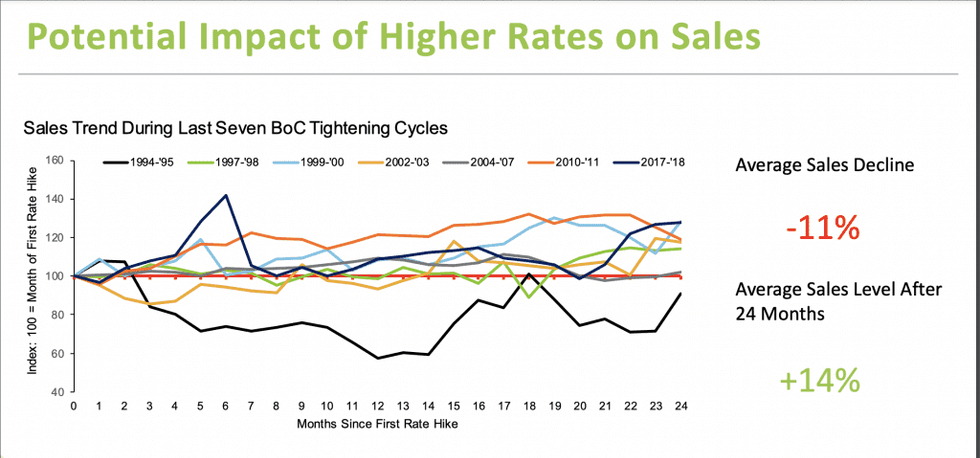

Jason Mercer, Senior Market Analyst at the Toronto Regional Real Estate Board, says that while, historically, rate hikes do slow the market in the short term, buyers have been resilient enough to absorb the higher cost of debt, and tend to move forward with their purchasing intentions.

“The impact of higher rates on sales, that’s been pretty steady over time,” he stated in the board’s live Market Outlook and January News Release call. “Essentially what we’ve seen, since the early 1990s, when the Bank of Canada explicitly adopted an inflation targeting policy at that 2% mark, is that 24 months after the start of a rate tightening cycle, you do generally see a dip in sales -- and that makes sense, as people move to the sidelines as they reassess the type of home they’re going to purchase, where they’re going purchase, etc.”

“But it’s generally temporary as people come to terms with that rate increase and that hit to affordability. Over that two-year span, you start to see people move back into the market. So on average, you see an initial sales decline of about 11%, when you start to see that rate tightening cycle on the part of the Bank of Canada. But when you look to the end of that 24-month period, sales have actually increased from that beginning point, by about 14%. So people take a step back, they reassess their situation, and they move back into the market, they don’t just give up on the purchase of a home entirely.”

20% is Just a Drop in the Bucket

Another, more sobering, point is: how much of a price break would a 20% drop be, really? The latest data from TRREB shows average home prices in the GTA increased 28.6% since last January alone, now sitting at $1,242,793. A 20% cut would lower that to $994,235, taking buyers back about 12 months in time in terms of affordability, and leaving the priciest end of the market -- detached houses -- still well out of reach for many.

Read: Average GTA Home Prices Forecast to Rise Another 12% This Year

Says Pasalis, “If we think about low-rise prices, which are at $1.6 million right now -- that would get prices back down to $1.3 million on average. They were pretty steady for most of 2021, so it brings us back to the beginning of the year, effectively. Is that affordable? Well, it’s still unbelievably expensive -- but it’s more affordable than $1.6 million, right?”

He adds that today’s market factors are unique from the precedent in that active listings are at their lowest levels, ever with just 4,140 homes for sale in the GTA in January -- a 44% drop year over year.

“I think the other thing to keep in mind is even if we see a sluggish market, or a downturn, it will be obviously important and interesting to see how low prices go. In 2017, prices fell about 20% in four to five months, and the fact is, one of the things that might put a floor on how low prices could go is we are still out of balance, we still have, at the end of the day, a lot of demand, we’re not building enough. And those fundamentals don’t disappear in a softening market, it’s just that they basically put a floor on how low prices will go, because we still have a lot of demand.”

“If prices fall, a lot of times, in periods like this, it’s just because buyers are fed up. That’s kind of what happened in 2017 in the suburbs; people said, ‘This is insane,’ and prices fell by 20%, and then they plateaued for like two years. I think we can’t predict the future, but it is possible we might see similar trends.”