In the midst of all the defeating headlines that keep young would-be homebuyers up at night, there’s a glimmer of hope -- well, depending how you look at it -- on the housing price front in British Columbia (BC).

According to the BC Real Estate Association (BCREA), the province’s real estate sales could drop 25% after the Bank of Canada's anticipated rate tightening -- and prices could finally moderate too. In response to elevated inflation, Canada's central bank has recently hinted that it would raise its overnight policy rate or tighten monetary policy later this year. As a result, mortgage rates have already started to rise.

BCREA’s Market Intelligence report, Too Tight? The Impact of Bank of Canada Tightening on BC Housing Markets, written by the association’s chief economist Brendon Ogmundson, explores both the historical impacts of the Bank of Canada raising its policy rate and a number of scenarios likely to play out in BC’s housing market as a result.

"In simplified terms, monetary policy impacts the housing market by influencing borrowing costs for households and by either speeding up or slowing down economic growth and employment, which are key drivers of short-run housing demand," reads the report. "It can also impact the supply side of housing through its impact on the residential construction investment."

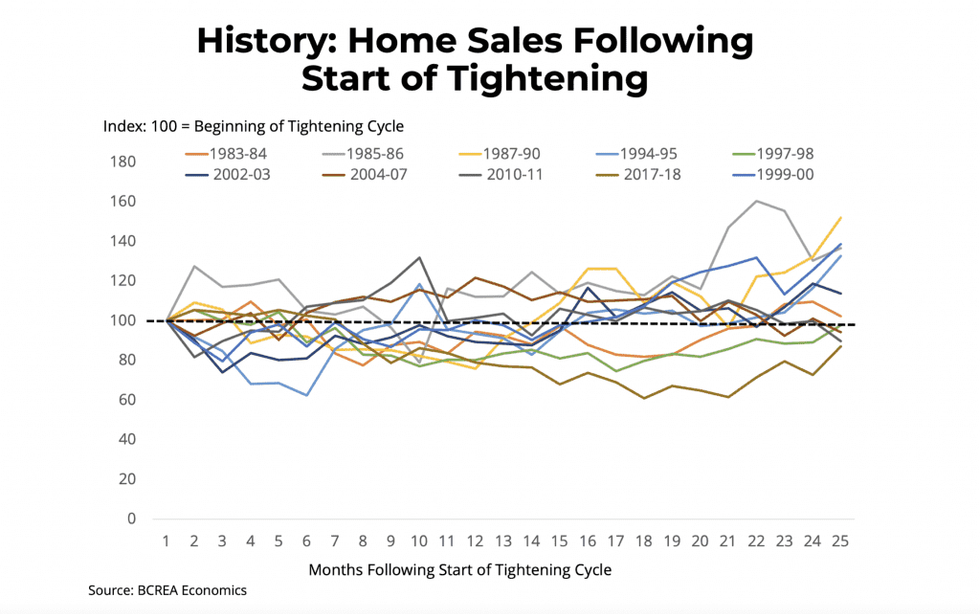

Historically, Bank of Canada rate tightening has led to falling home sales and flattening home prices in the province. Most recent tightening cycles have seen home sales down about 10 to 15% two years following the start of monetary tightening, according to the report.

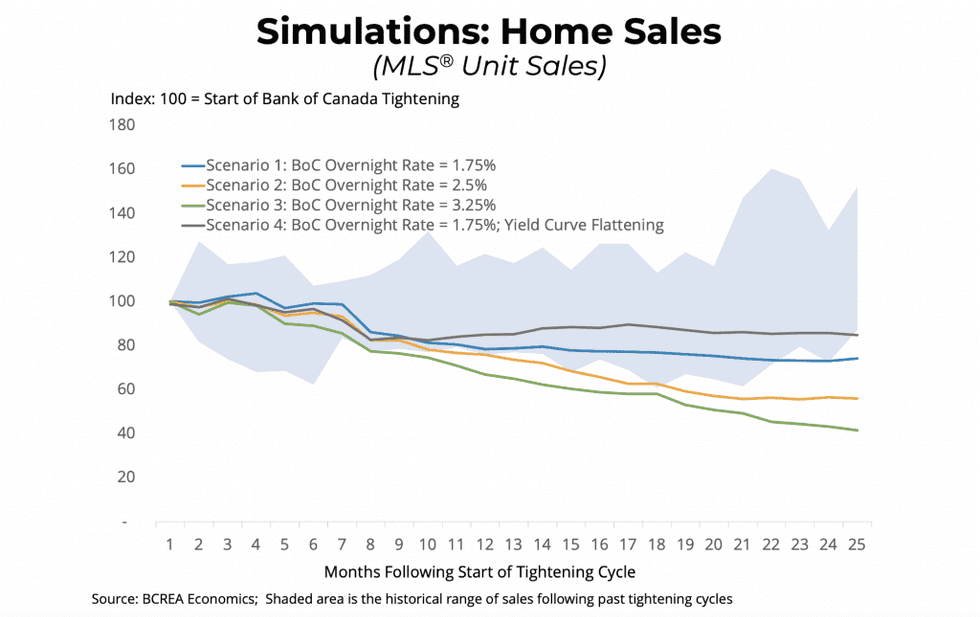

"To better understand how a rising rate environment may impact the market over the next two years, we have used our Canadian macroeconomic model alongside our primary housing model to simulate alternative paths for the Bank of Canada overnight rate and the resulting impact on Canadian mortgage rates and BC housing markets," reads the report.

The scenarios they have simulated include the following:

- The overnight rate returns to its pre-pandemic level of 1.75%

- The overnight rate rises to 2.25%, the mid-point of the Bank of Canada’s estimate range for its neutral rate

- The overnight rate reaches an above neutral level of 3% to combat persistently high inflation

- The overnight rate rises to 1.75%, but the yield curve flattens leading to only a moderate increase in five-year mortgage rates

Each of these scenarios assumes the Bank of Canada begins raising its overnight rate in the middle of 2022, except for Scenario 3 where the Bank is assumed to tighten earlier in the second quarter.

With this year's rising interest rates, Ogmundson forecasts that the number of sales will fall and that home sales will (finally) moderate in the notoriously expensive province.

While Ogmundson says that the impact of rate tightening on housing markets is “generally predictable,” the difference in current times is that the BC market -- like much of the country -- is experiencing exceptionally low levels of supply, with record numbers of active listings. As a result, the impact on prices may not be as significant as it has been in the past, according to Ogmundson.

“In the past, Bank of Canada tightening has usually led to falling home sales and flattening home prices, so it wouldn’t be a surprise to see the same happening in the upcoming round of tightening” says Ogmundson. “Based on previous trends and our model simulations for what might be to come with respect to rates, we have outlined a number of likely scenarios in this report.”

Home sales under Scenario 1 show sales falling from current elevated levels before levelling out to a point that is approximately 25% below their starting point by the end of two years. Under a scenario where the yield curve flattens as bond markets begin expecting the Bank has made a policy error resulting in slower future growth -- like the experience in 2019 -- home sales would level out near their long-run average. "We view these as the two most likely scenarios," reads the report. "If the Bank does raise its policy rate more aggressively in response to an overheating economy, then our models show that home sales would decline more significantly."

How a Bank of Canada tightening cycle impacts the housing market depends on the initial conditions of the market and the economy, highlights the report. "With markets so out of balance, we expect home price growth to slow but to what extent depends on the final rate destination for the Bank of Canada and for Canadian mortgage rates,” adds Ogmundson. “Our model simulations show only a minor impact on home prices in the first two years following the Bank raising its overnight rate.”

BC's red-hot housing market is one filled with bidding wars, multiple offers on new home sites (which is not the norm, even in a hot market), and entire new condo buildings are selling out as pre-sales in days or even hours, says Jamie Squires, vice president of BC's Fifth Ave Real Estate Marketing Ltd.

"So a rise in the rates may see this soften with less multiple offers, but they may not go away completely. With the interest rate increase perhaps it might be three to five competing offers instead of the 10 to 50 as seen most recently in the market on a single listing on MLS," says Squires. "The root issue is supply."

In addition to a glaringly apparent lack of supply, Squires also points to raising construction costs as factors that will prevent notable price drops in the province, despite the looming rate hikes.

"Prices will most likely remain the same and possibly even continue to rise but at a slower and more reasonable pace than the last two years," says Squires. "In my almost 19 years working in the new home sales industry, there is also usually a rise in sales as people hear this news and rush to purchase before the Bank of Canada increases the rates. That said, there may not be enough supply to see this happen this time." Squires says this pushes the most vulnerable buyers down or out of the real estate market and has little affect on the financially well off.

With the root issue to BC's dramatic housing market being supply, Squires says the best solution would be for the federal or provincial government to enforce a policy that pushes the local cities and municipalities to move through the planning stages faster to bring supply to market faster.

"An influx of supply would help slow the rate of sales and flatten or even reduce pricing, as buyers would have a choice of homes to purchase instead of competing over the little inventory we have today in both resale and new product," says Squires.

"Right now, simple approvals that meet the criteria of city and municipal plans are taking a year or more, while ones that require rezoning are taking multiple years. Applications that meet the city’s planning intent for any area should not take this long, and if less time was spent on conforming applications they would have more time to consider, and then approve or deny the non-conforming applications as the case may be. Construction costs of risen dramatically over the last 2 years, so this is the only real solution we can see working to balance the market from an economic perspective."

In the meantime, the silver lining is that a rise in rates will mean home prices may not continue to rapidly climb to record-breaking prices in parts of the province. It's one thing to qualify for a mortgage; it's quite another to afford a home when prices have far outpaced incomes.

In a market where the average home price across all types is now $927,877 across BC (an 18.7% increase from $781,572 recorded the previous year) and $1,230,200 in Vancouver, any relief for the province’s first-time homebuyers by the way of a cooling market is undoubtedly appreciated.

Of course, the housing market situation in BC -- extremely tight inventory, relentless demand, and climbing prices -- isn't unique to the province. We're seeing the same story unfold everywhere from Nova Scotia and New Brunswick, to Ontario and parts of Alberta. In fact, there are currently fewer properties for sale in Canada than any point on record. With the Bank of Canada rates obviously impacting the entire country, the hope is that -- like in BC -- the rate hikes will at least moderate the market in hard-hit cities from coast to coast.

Even if we've kissed the days of buying a single-family home for less than $1M goodby for good in a growing number of places across the country.