Those thinking about entering Canada's feverish housing market will likely be facing affordability issues for the foreseeable future, as the inventory of homes for sale at the end of December hit an all-time low.

According to the Canadian Real Estate Association (CREA), the number of newly listed properties for sale fell by 3.2% month-over-month on a seasonally adjusted basis in December to 68,252 listings -- resulting in the tightest market conditions ever recorded.

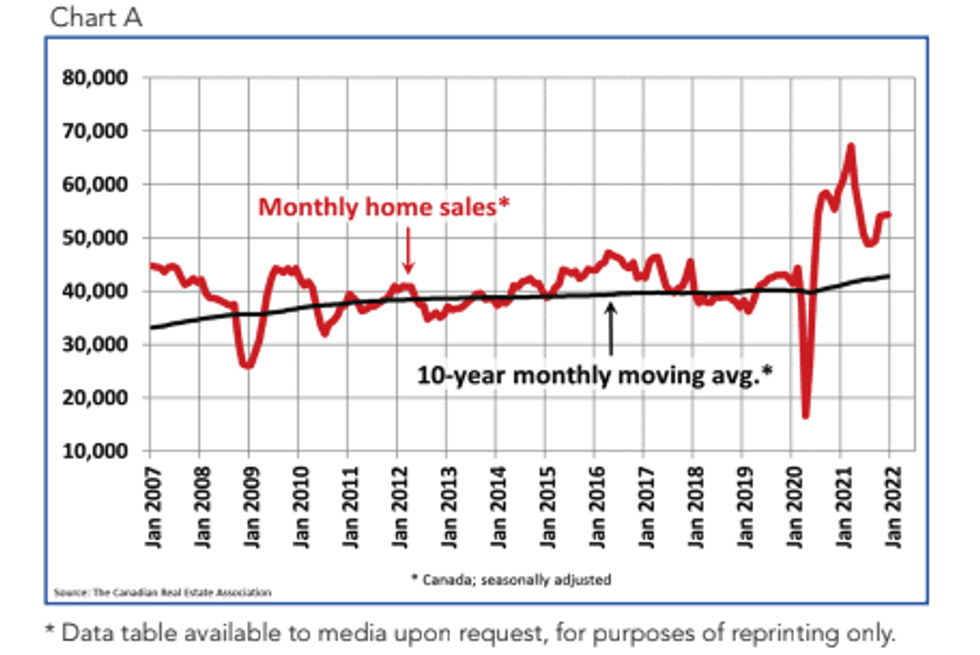

Despite inventory being down, annual home sales still reached a new high in 2021, eclipsing the previous record set in 2020 by about 20%. The association said that about 667,000 residential properties changed hands last year, which was about 30% above the 10-year average.

However, home sales in December were "little changed" from November -- with national home sales inching up just 0.2% month-over-month. The extreme scarcity of properties on the market led CREA senior economist Shaun Cathcart to highlight it as a record low.

READ: Benchmark Home Prices in Toronto Catching Up to Vancouver as Gap Narrows Dramatically

“There are currently fewer properties listed for sale in Canada than at any point on record,” said Cathcart. “So unfortunately, the housing affordability problem facing the country is likely to get worse before it gets better."

CREA said the actual (not seasonally adjusted) number of home sales in December was 9.9% below the record for that month set in 2020. However, that being said, as has been the case throughout the second half of 2021, it was still the second-highest level on record for the month.

With sales little changed and new listings down in December, the sales-to-new listings ratio (SNLR) tightened to 79.7% compared to 77% in November. The association says the long-term average for the national SNLR is 54.9%.

There were just 1.6 months of inventory left on a national basis at the end of December 2021 -- the lowest level ever recorded. The long-term average for this measure is a little more than five months, according to CREA.

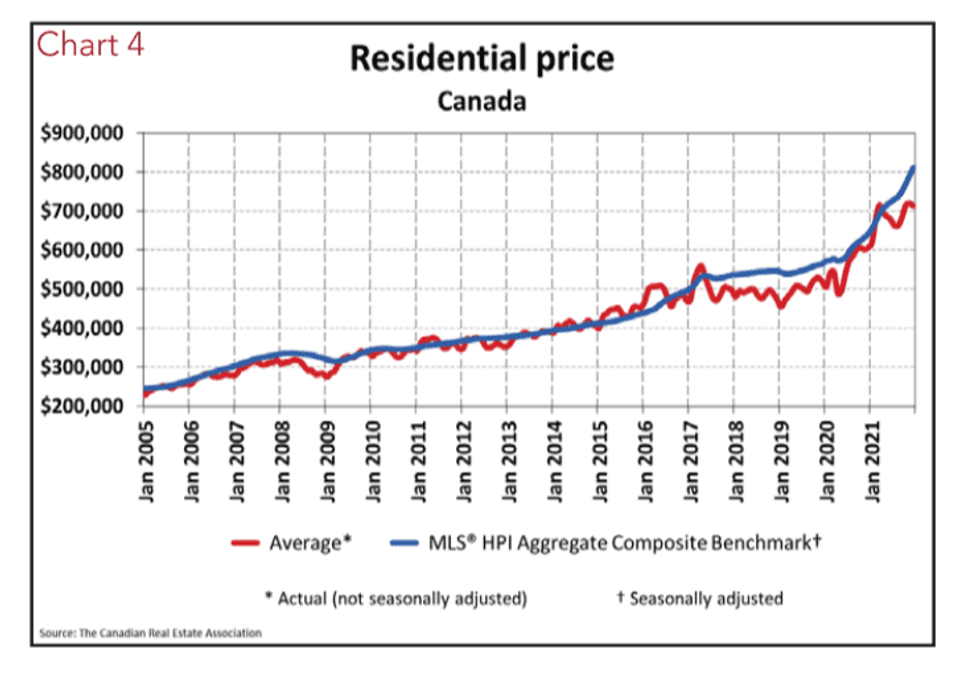

With demand up, prices rose even higher and the association said the average price of a Canadian home that sold on MLS in December went for $713,500 -- up almost 18% from the previous December.

In the Greater Toronto Area (GTA) alone, the average price was above $1.1 million, up about 24% from $932,004 last year. In the Greater Vancouver Area, the average price was more than $1.2 million, up 15% from about $1.1 million the year before.

However, when excluding the Greater Vancouver and GTA -- two of Canada’s most active and expensive housing markets -- from the calculation, it cuts more than $150,000 from the national average price.

READ: The $2 Million Dollar Home? Average Prices in Vancouver Set to Jump in 2022

“With the housing supply issues facing the country having only gotten worse to start 2022, take any decline in sales early in the year with a grain of salt because the demand hasn’t gone away, there just won’t be much to buy until a little later in this spring,” said Cliff Stevenson, Chair of CREA. “But when those listings eventually start to show up, the spring market this year will almost certainly be another headline grabber. "

After a few slow weeks during the early days of the pandemic, Canada's housing market has remained red-hot for the past two years, as frenetic demand from buyers taking advantage of historically low interest rates has drastically outpaced the supply of homes to buy.

The intense demand has heavily contributed to higher housing prices, as buyers now have to pay more to outbid other buyers due to the lack of homes for sale.

That being said, Cathcart says while policymakers are "starting to say the right things," now they must act in order to change the course of the market.

"An aggressive national push to build more homes is what will address the issue, but it will probably have to be a greater amount of building than anything we’ve ever undertaken. A touch over the status quo won’t cut it,” added Cathcart.