Sorry, housing market hopefuls -- there’s little relief on the horizon in terms of home prices and supply. The Toronto Regional Real Estate Board (TRREB) has released their 2022 Market Outlook and 2021 Year in Review report, along with their January market numbers, revealing that while rapid price growth is expected to calm slightly, affordability will continue to be a top challenge this year.

The board anticipates that a total of 110,000 sales will be completed in 2022 -- a dip from 2021 levels, but still a strong result from a historical perspective. The average selling price is set to rise by roughly 12% to $1,225,000.

While improving labour market conditions and population growth will prop up real estate demand, all eyes are on the Bank of Canada’s impending rate hiking cycle, which could kick off as early as March, to cool conditions in the second half of the year. However, a higher cost of borrowing may have less of an impact than expected, says TRREB, pointing to policies already in place to prevent mortgage payment shock.

“While BoC tightening cycles have historically led to fewer transactions, it is important to remember that home buyers have recently been held to a much higher qualification standard under the OSFI stress test. This could mitigate the impact of higher contract mortgage rates moving forward,” states their report.

Read: “Do Not Include a Stupid Letter”: The Harsh Realities of a Hot Sellers’ Market

However, some prospective buyers may put their plans on hold as a result, says TRREB Chief Market Analyst Jason Mercer. “While home sales will remain strong historically, there are a few key factors that will see transactions slightly off last year’s record pace. First, higher borrowing costs in 2022 will see some households on the margin of affordability temporarily put their purchase on hold."

He also anticipates that there will be altogether fewer buyers, given how many jumped into the market last year, and that lack of supply will continue to constrain deals. “Second, after above-average per capita home sales in 2021, there will be some give-back in 2022, simply because the pool of ready buyers will be smaller. Finally, the perpetual lack of inventory in the GTA will preclude some willing buyers from getting a deal done – simply put: you can’t buy what’s not available for sale,” he adds.

Both Sellers and First-time Buyers are on the Decline

Mercer's take is in line with the findings from TRREB / Ipsos Reid polling, which gauged buyer and seller intentions for the coming year. According to the survey, buyer intentions have indeed dipped this year, but won’t deviate from a historically high norm. “The bottom line is that those who are fully committed to a home purchase will do so in 2022, whereas some of those on the fence may put their decision on hold,” states the research summary.

Additional findings include:

- Detached houses will remain the most in-demand home type, especially in the 905-area markets, while CoT buyers will set their sights on condos and higher-density, low-rise home types.

- There will be fewer first-time buyers in the market, particularly in the 905 area, as prices continue to rise out of reach. However, given the resurgence of the condo sector in the 416, first timers may make up a higher proportion of buyers within the city proper.

- The number of would-be sellers will drop this year across the GTA, given the pull-forward effect of sales volume over the demographic norm in 2021. As well “there still exists a vicious circle where homeowners will decide not to list because they fear they will not be able to find another home that meets their needs.”

- Newcomers to Canada will indeed be a force in the market, as buying intentions are higher amongst immigrant households and so too is the intended purchase price. This is important given that net population growth in the GTA is driven by immigration.

TRREB also released the findings of their joint research with the Toronto Region Board of Trade and Maru Public Opinion. Dubbed “The New Normal”, the results reveal flexible post-COVID hybrid working arrangements will remain in high demand among workers, in turn influencing the capability needs for downtown core office space, and with implications for everything from retail, transit, and economic activity.

“Employers and workers are navigating what the emerging world of work will look like, including evolving corporate cultures and developing hybrid work patterns,” said Craig Ruttan, Policy Director, Energy, Environment and Land Use at the Toronto Region Board of Trade. “While offices will remain vital meeting places for many companies, their purposes and function will evolve to respond to workers’ priorities.”

January Second-Hottest on Record

The latest housing market data continues to perform well above what’s seasonally typical, with the latest numbers revealing January sales were the second-highest on record for the month.

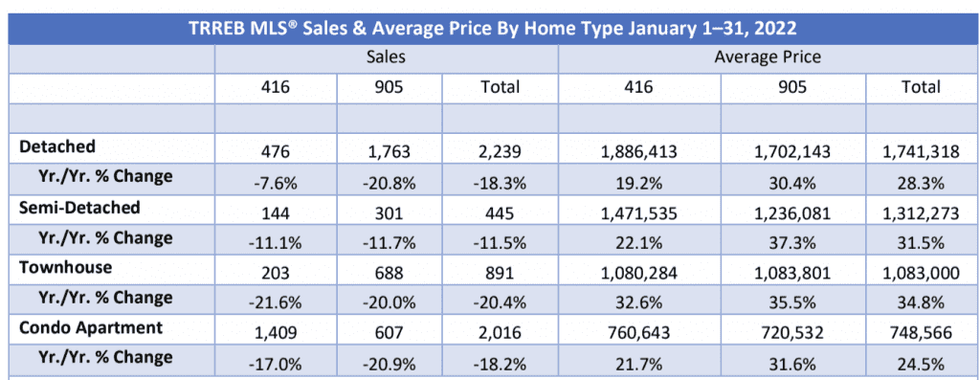

A total of 5,636 sales were reported through the MLS System, according to the Toronto Regional Real Estate Board, a decline of 18.2% from 2021, during which the market grappled with pandemic-induced buyer urgency and abnormally busy conditions.

As has been the long-term developing trend, the year kicked off with extremely scarce supply, as new listings plunged 15.5% year over year, nearly at the same rate as sales. “Because sales and new listings moved in relative lockstep”, that’s depleted overall active inventory to just 4,140 homes available for sale at the end of January -- a 20-year low.

Read: Toronto Real Estate Had its Biggest Year on Record in 2021

Of course, this prolonged extreme supply-and-demand imbalance drove home prices ever higher; the MLS Home Price benchmark rose 33.3%, while the average increased 28.6% to $1,242,793. Overall, the GTA remains ensnared in sizzling sellers’-market conditions, with a sales-to-new-listings ratio of 72.9%.

The 905-area markets experienced the strongest price growth, up 31.6% to an average of $1,355,298, while a total of 3,389 homes traded hands in those communities (-19.9% year over year.) In the City of Toronto proper, homebuyers are now facing an average price tag of $1,073,111 (up 24% year over year), based on 2,247 sales (-15.2% year over year).

Unaffordability continued to grow across all home types, but especially among low-rise housing, with detached, semi-detached and townhouse prices all rising by more than $100,000 in just a month’s time. Condos, meanwhile. remain the only sub-million-dollar option for prospective GTA home buyers.

“It is clear that 2022 is starting off the way 2021 ended in terms of the relationship between demand and supply in the GTA housing market,” says TRREB CEO John DiMichele. “We have provincial and municipal elections this year in Ontario. These are the levels of government whose policies impact real estate development the most. With this in mind, it will be very important for voters to understand exactly what parties and individuals vying for public office propose to do to alleviate the lack of inventory and housing choice in the GTA in the years to come.”