Trust Account

Learn how trust accounts work in Canadian real estate, who manages them, and how they protect buyers and sellers during transactions.

May 22, 2025

What is a Trust Account?

A trust account is a special type of bank account used by real estate professionals, lawyers, or developers to hold client funds separately from their own operating funds.

Why Do Trust Accounts Matter in Real Estate

In Canadian real estate, trust accounts are a critical component of financial and legal protection. When a buyer submits a deposit during a property transaction, that money is held in a trust account until closing.

Trust accounts are used for:

- Buyer deposits or down payments

- Rent collection by property managers

- Construction draws or developer funds

Real estate brokerages and law firms are regulated and audited to ensure trust accounts are properly maintained. Misuse or commingling of funds can result in disciplinary action, fines, or loss of license.

Trust accounts provide transparency and security, ensuring that funds are available and accounted for during the transaction. Buyers and sellers should always confirm that deposits are being held in a verified trust account.

Understanding trust accounts builds confidence in the real estate process and protects clients from financial risk.

Example of a Trust Account

A buyer’s $50,000 deposit is held in the listing brokerage’s trust account and only released upon successful closing of the home sale.

Key Takeaways

- Holds client funds securely during transactions.

- Used for deposits, rents, and development funds.

- Maintained by lawyers or brokerages.

- Separates client money from business funds.

- Ensures trust, compliance, and accountability.

Related Terms

- Deposit

- Real Estate Lawyer

- Brokerage Account

- Closing Process

- Financial Regulation

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

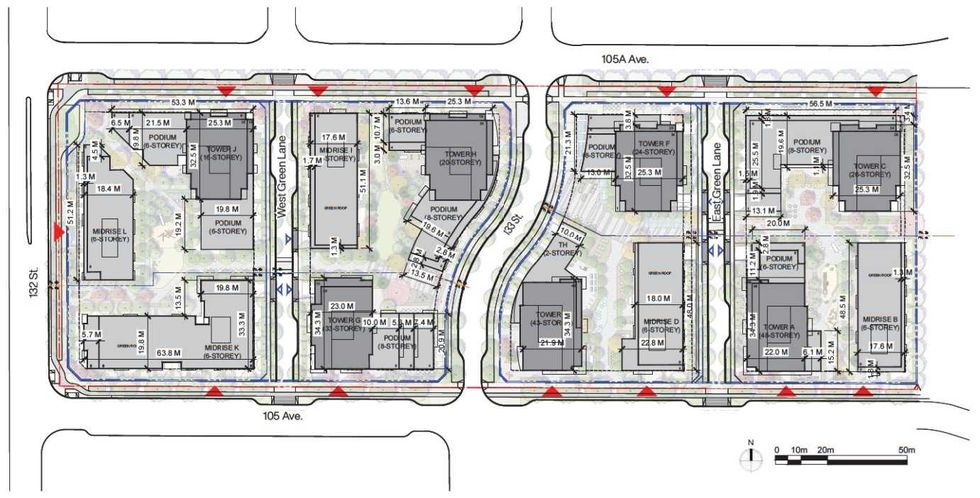

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group)

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group) An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) A rendering of the project at full build out. (Arcadis, Onni Group)

A rendering of the project at full build out. (Arcadis, Onni Group)