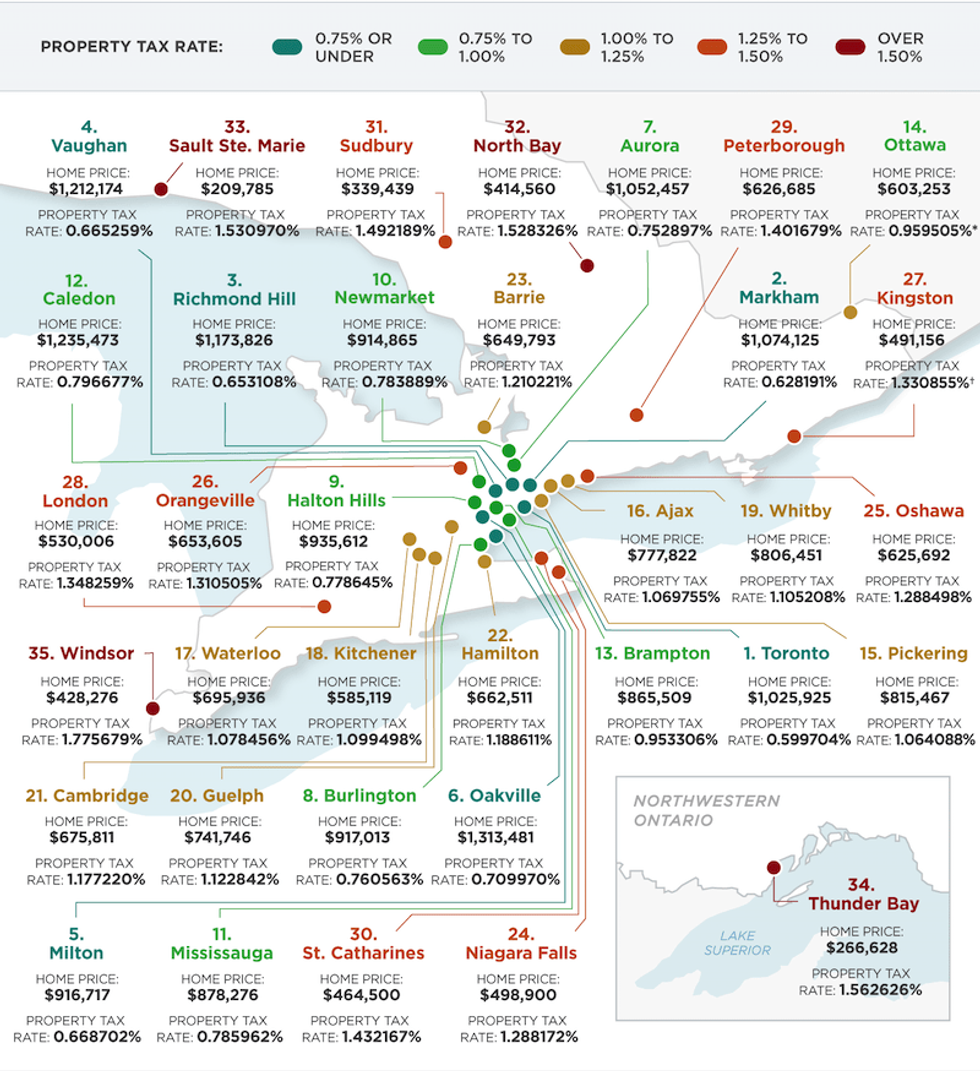

While home prices are, of course, top of mind for any prospective property buyer, property taxes are not to be overlooked. And according to a new report from Zoocasa, Toronto's are currently the lowest in the province.

As it stands, the city's property tax rate is 0.599704%, hovering below Markham's 0.628191%. Meanwhile, the province's highest property tax rates will currently be found in Windsor, with a rate of 1.775679%, and following that city, Thunder Bay's rates are at 1.562626%.

"It’s important to note that this does not mean that every homeowner in Windsor is paying more in property taxes than a homeowner in Toronto," explains the report. "There are a number of factors at play."

Essentially, property tax can be calculated by multiplying a home's most recent value assessment by the residential rate set by the home's local municipality. In Ontario, these calculations are based on a home's value, the Education Tax Rate, and the Residential Tax Rate.

READ: For Downtown Condo Investors, Now is the Time to Watch and Wait

As all that this year has brought to the table rages on, many home buyers in the Toronto area have "elected to trade their urban condos for bigger homes in municipalities across Ontario," according to Zoocasa. And, as property taxes amount to thousands of dollars each year, it's important to understand how they may play into those decisions.

For those looking to relocate, it's also worth noting that property taxes won't stay consistent year-over-year, either.

Municipality depending, the difference paid annually can be thousands of dollars; it all depends on the size of the region, its council’s operating budget, the health of its housing market, and other contributing factors.

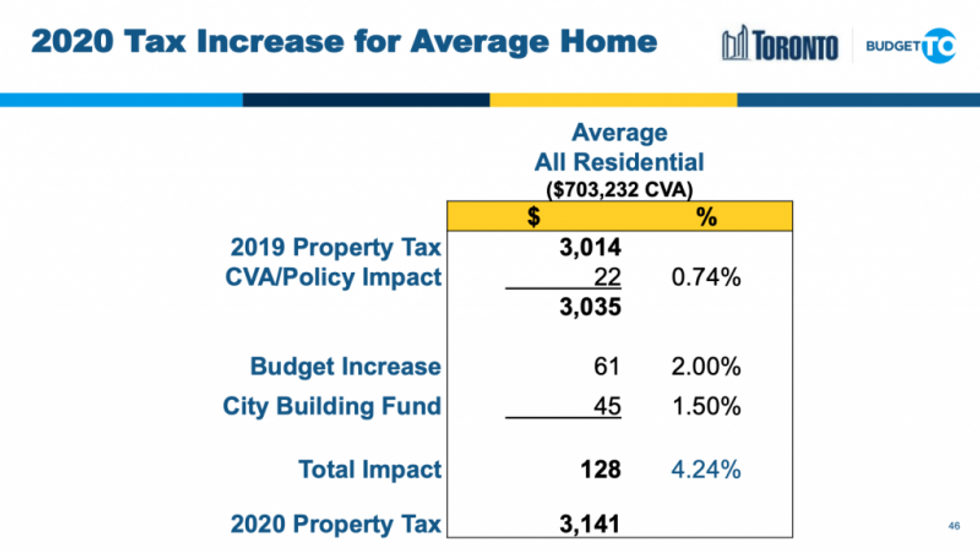

For example, Toronto's early year announcement about a more-than-4% increase in property tax rates was influenced by budget allocation, wherein $13.53 billion would go to the operating budget, while $43.46 billion would be designated to the 10-year capital tax and rate supported budget.

This meant a 4.24% increase, bringing the average home's property tax amount to $3,141.

For Zoocasa's most recent report, 2020 property tax rates for 35 Ontario municipalities were compiled, and calculations were completed for what each region's homeowners would pay in taxes at three sample assessment values: $250,000, $500,000 and $1,000,000.

"Our findings show, perhaps unsurprisingly, that for homes with the same assessed value, there is a significant variance in the annual property tax amount paid by homeowners, depending on where they live. For example, in Windsor – which features the highest property tax rate among the municipalities included on our list at 1.775679% – a homeowner would pay $8,878 per year in property taxes on a home assessed at $500,000," reads the report.

"By comparison, in the City of Toronto – which has the lowest tax rate at 0.599704% among the municipalities included on our list – a homeowner would pay a comparatively lower $2,999 for a property assessed at $500,000."

According to Zoocasa, cities where local real estate is of particularly high value, and where there are larger populations, generally have more capabilities to keep their tax rate low. This is because the amount collected from individual homeowners is -- based on real estate prices -- higher, in general, and there are more tax payers contributing payments overall.

"For example, as real estate prices and property assessment values increased in Toronto, the largest city in Ontario, so do property tax revenues, giving council the ability to keep the rate low," reads the report.

In Markham and Richmond Hill, where property tax rates are 0.628191% and 0.653108% respectively, average home prices are relatively high -- $1,074,125 and $1,173,826 -- which means overall lower tax rates are permissible.

On the other hand, in Windsor, where the property tax rate was the highest amongst the municipalities listed in the report (1.775679%), the average home price was $428,276 in October. This shows that cities with the highest tax rates often have the lowest-priced real estate. Another example arises in Thunder Bay, where the property tax rate is 1.562626%, while the average home price was just $226,628 in September 2020.

An additional factor that impacts property tax rates, Zoocasa explains, is the city’s commercial-to-residential tax ratio. Generally, in most municipalities, businesses pay at least twice what homeowners pay in tax, while the Canadian average sits at 2.5. A higher commercial property tax rate generally translates to a lower residential rate, and the reverse is also true.

Compared to last year's findings, municipal rankings stayed relatively similar in this new report. All the municipalities who, in 2019, had property tax rates of under 0.75% remained the same, although the order fluctuated slightly. Toronto remained the lowest, then too, at 0.614770%.

Cities With the Lowest Property Tax Rates in Ontario, 2020

- Toronto: 0.599704%

- Markham: 0.628191%

- Richmond Hill: 0.653108%

- Vaughan: 0.665259%

- Milton: 0.668702%

Cities With the Highest Property Tax Rates in Ontario, 2020

- Windsor: 1.775679%

- Thunder Bay: 1.562626%

- Sault Ste. Marie: 1.530970%

- North Bay: 1.528326%

- Sudbury: 1.492189%

The report does emphasize that a lower or higher property tax rate and amount shouldn’t be the only guideposts towards the decision to purchase a home.

"Buyers should consider the big picture of their lifestyle and financial needs when determining what properties, budget or cities fit them best; property taxes are just one financial consideration to be aware of."

And, just because property tax values are particularly low today, doesn't mean they'll remain that way. In March, the city's property tax was the sixth-lowest in the Greater Toronto and Hamilton Area (GTHA) but -- even then -- experts warned that meant plenty of room for major hikes.