Toronto city council has voted in favour to increase residential property taxes 4.24% this year.

Council voted 21-3 in favour of the tax hike Wednesday morning, as part of the city's $13.53-billion operating budget.

READ: Budget 2020: What the Average Toronto Property Tax Increase Will Be

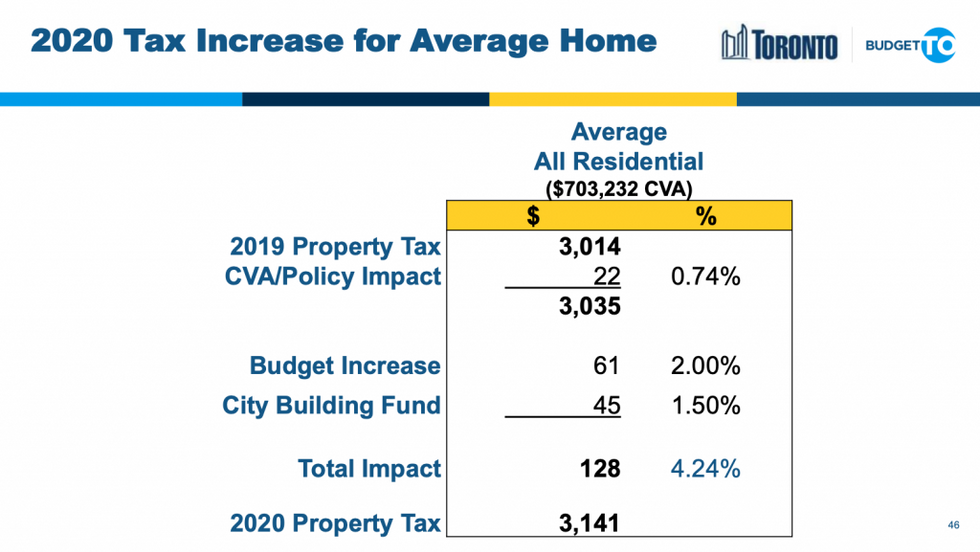

Under the 2020 budget, property taxes are set to increase with the rate of inflation, and when combined with the increase to the City Building Fund, which addresses transit and housing, 2020 property taxes for residents will go up 4.24% to $3,141.

According to the budget, for the average residential home assessed at $703,232, residents will now be paying an additional $128 on their $3,141 property taxes in 2020. This amount includes a $61 increase for city operations, a $22 increase for reassessment and rebalancing, and a $45 increase for the City Building Fund.

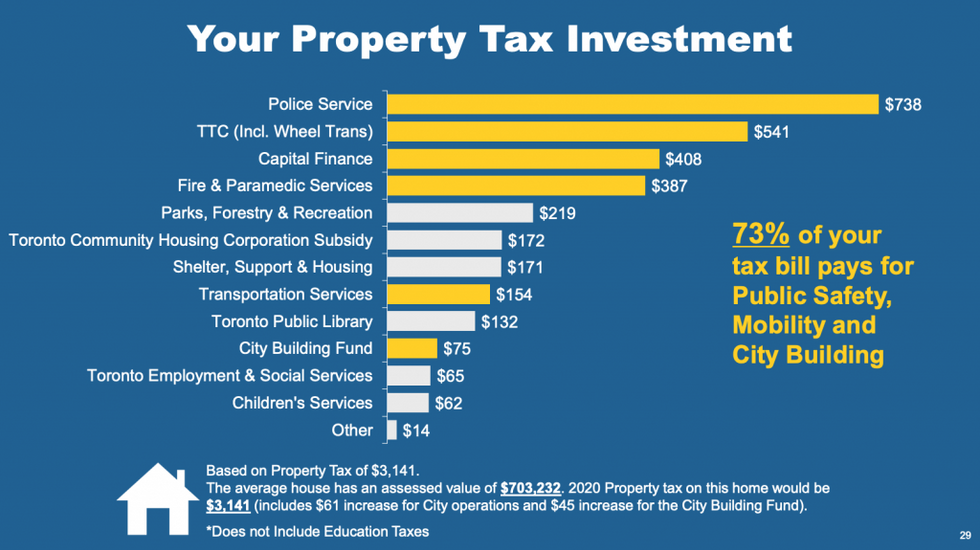

What’s interesting to note is that of the $3,141 taxes, just $62 goes toward children’s services, which explains why childcare is often so hard to come by and the most expensive in the country.

Included in the 2020 operating budget are $67 million in new expenditures, which are said to go toward addressing key city commitments, including poverty reduction ($15.3 million) and addressing climate change ($5.9 million).

Another big focus in the Budget is partnerships, with staff expecting the federal government to continue to support the city’s refugee program, $77 million is already factored into the Budget.

Other partnerships include the provincial upload of subway expansion, which allows the city to redirect funding to transit state-of-good-repair, and the federal government’s co-investment of $1.3 billion for building repair for Toronto Community Housing Corporation.