Rent-to-Own Agreement

Understand how rent-to-own agreements work in Canada, their benefits and risks, and how they help renters transition into homeownership.

May 22, 2025

What is a Rent-to-Own Agreement?

A Rent-to-Own Agreement is a contract that allows a tenant to rent a property with the option—or obligation—to purchase it after a set period.

Why Do Rent-to-Own Agreements Matter in Real Estate

In Canadian real estate, rent-to-own agreements are often used by buyers who may not currently qualify for a mortgage but plan to do so in the future. These agreements typically include:

A lease term (usually 1–3 years)

- A portion of monthly rent set aside as a future down payment

- A locked-in purchase price or formula for future value

- An option or requirement to purchase at the end of the lease

Benefits for buyers include:

- Time to improve credit or save for a down payment

- Price certainty in a rising market

Risks and considerations include:

- Loss of credits if the purchase doesn’t proceed

- Responsibility for maintenance and insurance

- Higher monthly payments compared to standard rentals

Rent-to-own agreements must be carefully reviewed by legal and financial professionals to ensure fairness and clarity for both parties.

Example of a Rent-to-Own Agreement in Action

A family enters a rent-to-own agreement for a $600,000 home, paying $2,500 monthly, with $500 credited each month toward a future down payment.

Key Takeaways

- Combines renting with future buying option.

- Monthly rent may include credit toward purchase.

- Purchase terms are agreed upfront.

- Suitable for buyers building credit.

- Requires legal review to avoid pitfalls.

Related Terms

- Lease Option

- Home Purchase Agreement

- Down Payment

- Credit Score

- Alternative Financing

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

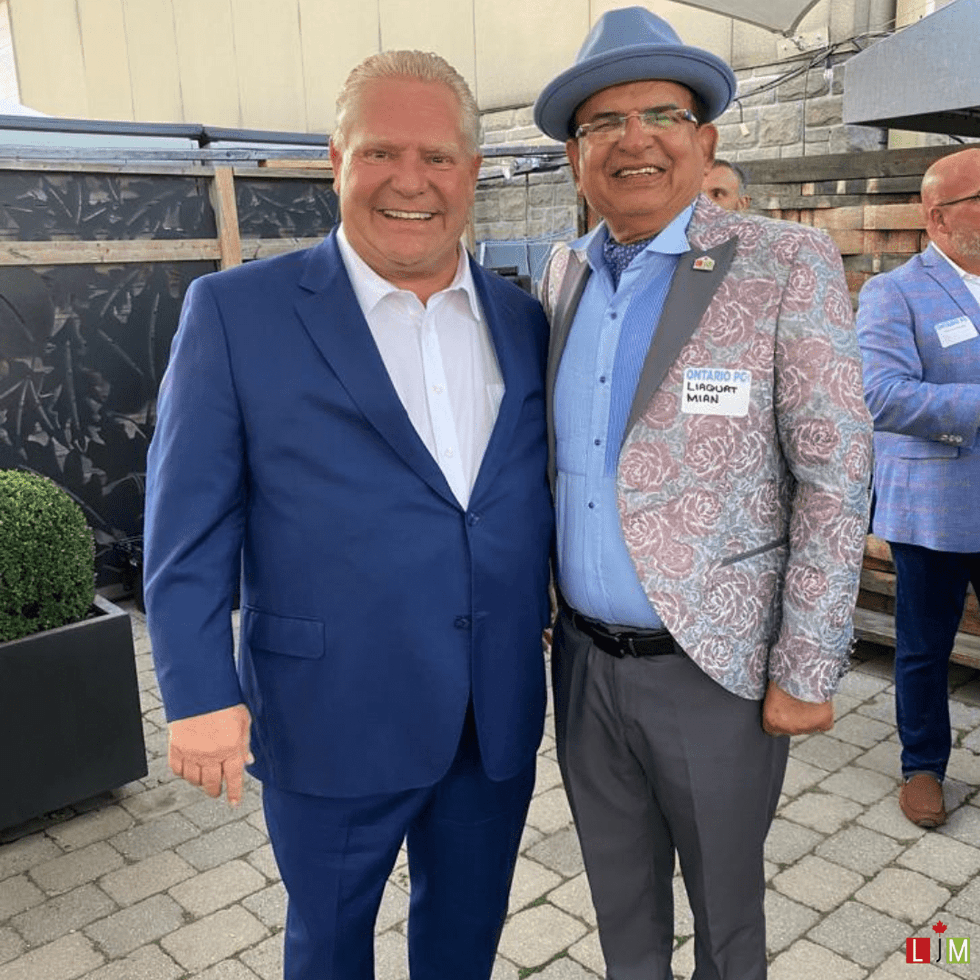

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

401-415 King Street West. (JLL)

401-415 King Street West. (JLL)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)