With the Burnaby Lake Village project being placed under creditor protection last week at the request of the lender, what had been a private conflict playing out behind closed doors between Peterson Group and Create Properties has now been pushed into the public eye for all to see.

Burnaby Lake Village was set for the 19-acre property at 6800 Lougheed Highway in Burnaby, directly adjacent to Sperling-Burnaby Lake Station, where the developers were planning over 4,000 new homes across 14 mixed-use buildings between the heights of 12 and 25 storeys. The site is also directly adjacent to 7000 Lougheed Highway, where Create Properties is undertaking a completely separate master-planned project called Burnaby Lake Heights on its own.

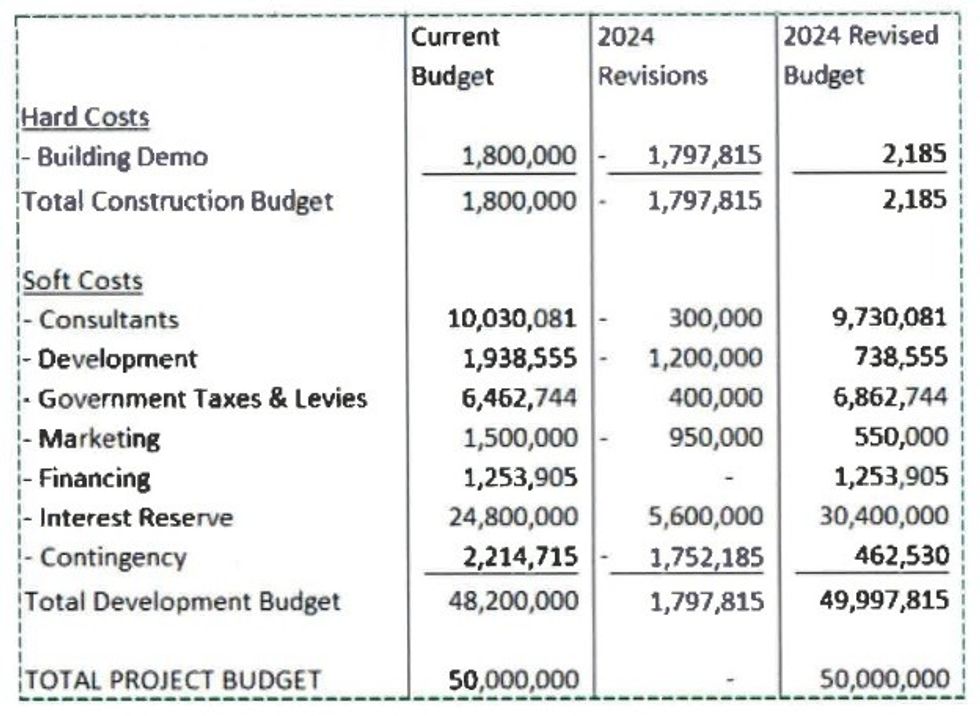

Although the City of Burnaby has granted final adoption to the master plan rezoning application, third reading (conditional approval) to Phase 1A, and second reading to Phase 1B, that progress primarily exists on paper and work on the site has yet to commence in any substantial way. According to the court-appointed Monitor, portions of the property have been leased to London Drugs as a warehouse and the facility has also been rented out for movie productions.

As first reported by STOREYS last week, the project — legally owned under 1112849 BC Ltd. and beneficially owned by Sperling Limited Partnership — was placed under creditor protection at the request of a lending syndicate comprised of RBC, TD, BMO, and Scotiabank after the conflict between the partners resulted in them defaulting on a $210,000,000 loan. As of November 21, the outstanding amount owed was $207,601,972.89, plus interest.

Seeking creditor protection under the federal Companies' Creditors Arrangement Act (CCAA) is something typically initiated by the insolvent entity themselves. In this particular case, however, the conflict between the partners became insurmountable and the banks were forced to step in.

The following is an account — based on conversations with some of the parties involved, industry sources, and court documents — of how the partnership broke down, the attempts at arbitration, and the future of the project.

The Agreements

Sperling Limited Partnership was formed in September 2018, just ahead of the partnership acquiring 6800 Lougheed Highway on October 17, 2018 for $209,000,000. Units in the partnership had a subscription price of $1.00 per unit. Peterson's share amounted to $35,292,000 while Create Properties' share amounted to $33,908,000, giving them, respectively, a 51% and 49% stake in the partnership and project.

The partners agreed that Peterson would take the lead on carrying out the project, while Create retained protections that allowed them to participate in decision-making. Matters involving borrowing money, budgets, and approvals, among other things, required consent from both parties.

Sperling GP Ltd. was the General Partner and was controlled by a group of five directors: Peterson Chairman Benjamin Yeung, Peterson President & CEO Raymond Choy, Peterson CFO Paul McIntyre, Create Founder Lin Licao, and Create VP of Development Bruce Ma (who left the company a few months ago.)

As part of the partnership agreement, a dispute resolution mechanism was also established.

"[The dispute resolution processes] require the concerned party to issue a written notice to the party detailing the dispute, and the parties will then meet to attempt to resolve the dispute," according to an affidavit by Lin Licao dated October 18, 2024. "If no resolution is reached, the parties will submit the dispute to mediation, and if the parties cannot agree on a mediator within fourteen days or the mediation process is unsuccessful for certain reasons the dispute is referred to arbitration."

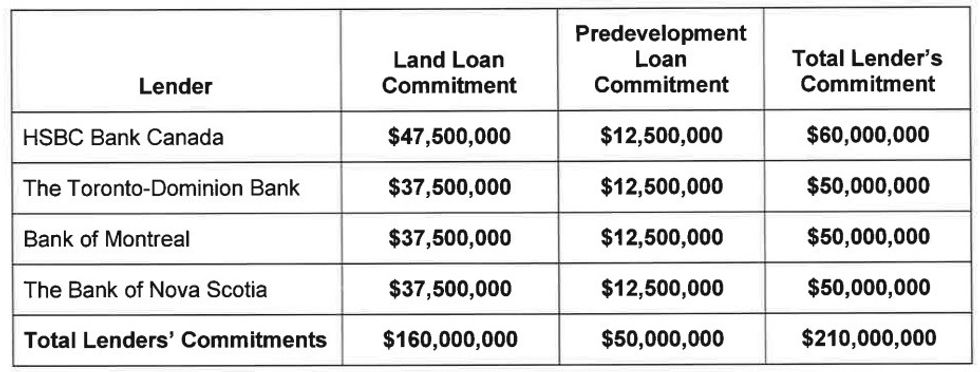

The partnership subsequently secured financing in February 2022 through HSBC, which has since been absorbed by RBC, who then reached an agreement with TD Bank, BMO, and Scotiabank to form a lending syndicate. The loan to the developers was for $210,000,000, consisting of a $160,000,000 land loan plus a $50,000,000 pre-development loan facility, and had a maturity date of September 1, 2024, after being extended for six months in March.

Peterson was serving as the sole guarantor of the loan, through Peterson Property Holdings Inc., Spruceland Mall Limited Partnership, and Peterson Investment (Spruceland) Ltd.

Conflicts Emerge

The first signs of trouble occurred a year ago.

"Starting in the fall of 2023, Peterson began discussions with Create around refinancing the Loan Facilities," said Peterson CFO Paul McIntrye in an affidavit dated December 4. "Create refused to approve materials to be sent to the lenders to discuss refinancing, and failed to confirm that it would fund its share of interest after March 1, 2024, based on the lenders' reluctance to continue to allow interest to be paid out of the pre-development facility."

According to Create's Licao, Peterson issued a Notice of Dispute on December 29, 2023 and expressed concern regarding "Create's refusal to agree on a budget for 6 months commencing March 1, 2024, to correspond with the extension of the Loan from RBC; and Create's refusal to agree to a budget and build-out concept for the moveable sales centre."

The dispute could not be resolved by a mediator and Create then commenced arbitration in June, alleging "that Peterson has caused the General Partner to breach the General Partner's duties in relation to the Partnership Agreement, and that the Partnership has suffered loss of profits and additional carrying costs due to the mismanagement of the Project by Peterson and its affiliates."

Licao says Create was seeking "a declaration that Peterson owed, and has breached, fiduciary duties and duties of fairness and good faith to Create and the Partnership, a declaration that the General Partner has also breached its duties to Create, and an order that the Partnership be dissolved and a receiver be appointed for the purposes of carrying out the dissolution of the Partnership."

On July 3 of this year, Peterson and Sperling GP Ltd. commenced arbitration against Create alleging that "Create breached its duty to the Partnership and to Peterson to act honestly and to exercise its discretionary powers in good faith in a manner consistent with the Partnership Agreement, including by refusing to approve proposed budgets and the development and construction of a presentation centre." In his affidavit, McIntyre added that he informed Create on June 27 that the Partnership required a cash call to fund interest payments for July and August, but that Create did not respond.

As relief, Peterson sought a declaration that Create had breached its obligations, an award of damages for that breach, and "an order that the limited partners of the Partnership cause the Property and related Project assets to be sold on terms ordered by the arbitrators."

In his affidavit, Licao says that at this time, Peterson also "acknowledged that they cannot work together on the Project and that the Partnership should be dissolved," while McIntyre says in his affidavit that "Peterson advised RBC that while Peterson desired a consensual and orderly sale to occur during the term of a Loan extension, there was no agreement between Peterson and Create on a request for a loan extension."

The arbitrations initiated by both parties have still not played out, with both stuck in a fight over the appointment of the three-person arbitration tribunal. That fight remained ongoing as of mid-November, according to McIntyre's affidavit.

Escalation

The conflict escalated further after the partnership defaulted on the loan on September 1. RBC, acting on behalf of the lender syndicate, issued the developers a Notice of Default and demanded payment on Setpember 3.

On September 5, Create says Peterson called a meeting of the aforementioned five directors of Sperling GP Ltd. for September 16 to approve a proposed plan to issue additional units in the partnership in order to raise up to $208,346,300 — the amount owed to RBC as of September 3 — by November 13.

Peterson "considered this to be the last opportunity to avoid a foreclosure," said McIntyre, while Create considered this an attempt to push them out of the project.

"The ongoing [initial] disputes between the parties have continued to escalate, and, in my view, the relationship breakdown has now culminated in Peterson taking steps to dilute Create's partnership stake by a proposed issuance of partnership units," said Licao in his affidavit, adding that Create's stake would be diluted from 49% down to 12.22% and that they would also lose certain rights under the partnership agreement once their stake becomes less than 25%.

Peterson says they provided proper advance notice of the meeting, which Create disputes, but no representatives from Create attended the meeting on September 16. The meeting was adjourned to September 23, but Create's directors again did not show up said McIntyre, who added that they were then able to approve the plan to issue new units via a section of the shareholder's agreement that allowed for quorum to be formed at adjourned meetings even if directors are absent.

Create Properties subsequently issued another Notice of Dispute, with their primary concern being "the significant undervaluation of the Partnership units and the unreasonable timing of the issuance of the Proposed Additional Units." According to Licao, he believed the unit price should have been closer to $3.87 based on appraisals of the property he received in May 2023 and January 2024, which had an average of $488,000,000. Peterson says these appraisals were "dated and unreliable" and "employed valuations that did not apply any discount rate to their conclusions to arrive at a present value rather than a future value."

Licao says that Peterson and the General Partner did not make other attempts to pay off the debt to RBC, such as securing financing from another lender, and then refused to attend a meeting to resolve the Notice of Dispute issued by Create over the new units, which Licao believes represented a breach of the partnership agreement. McIntyre said that securing financing was unlikely because the registration of a new charge on the property would have required the consent of RBC and lenders generally will not consent to new charges being registered where there is a default on an existing debt.

On October 1, Create issued a demand for Peterson not to proceed with the issuance of the new units. At a shareholder meeting on October 7, Create says Peterson determined the $1.00 unit price based on current economic conditions, did not provide further details, and refused to confirm or deny whether they had communicated with potential partners or how many new units they intended to purchase. In his affidavit, Licao also said that "Create is not in a financial position to subscribe for additional units" and attributed that difficulty to "financial harms caused by Peterson to date."

On October 18, Create then amended their initial arbitration notice from June to include their concerns regarding the new units. Create then applied for an injunction to restrict Peterson from commencing with the issuance of new units, but the injunction application was adjourned, according to Peterson, after RBC indicated that it was going to commence insolvency proceedings.

Burnaby Lake Village Restructuring

RBC's application seeking a court-appointed Monitor over Sperling Limited Partnership was granted on November 28.

Peterson disclosed that the project had entered creditor protection in a press release that day, adding that Peterson had the ability and intention to repay the debt owed to RBC, but that Create refused to provide consent for Sperling Limited Partnership to do so or to seek a loan extension. In a statement provided to STOREYS, Create said this was "false" and that they were taken by surprise by Peterson's press release.

Additionally, Peterson says Create has indicated that it believes the City's new proposed height-based development framework could allow the project to become more profitable. McIntyre says this is not a certainty. He also said that Create has argued that there is no urgency to market the property, which Peterson also disputes, citing its position as the sole guarantor of the loan and the Interim Lender during the CCAA proceedings.

The court-appointed Monitor has outlined a timeline for a proposed sales process and says it intends to seek approval for the sales process before the end of this month. Peterson has indicated that it intends to submit a stalking horse bid — a default bid in the case no better bids are found — but details of the bid have yet to be disclosed. What has been disclosed now, however, is that the conflict between Peterson and Create Properties runs deep and currently has no end in sight.