Municipal Tax

Understand how municipal taxes work in Canadian real estate, what they fund, how they’re calculated, and why they matter for homeowners.

May 22, 2025

What is Municipal Tax?

Municipal tax is a property tax levied by local governments in Canada to fund essential services such as public schools, emergency services, infrastructure, and community programs.

Why Municipal Tax Matters in Real Estate

In Canadian real estate, municipal tax is calculated based on the assessed value of a property and the municipality’s annual tax rate, also known as the mill rate. Homeowners receive a property tax bill, typically on an annual or semi-annual basis.Municipal taxes pay for:

- Local road maintenance and snow removal

- Fire, police, and paramedic services

- Waste collection and recycling

- Public libraries and recreational facilities

- Local school boards (in some provinces)

Buyers should factor municipal taxes into affordability calculations and request recent tax statements during due diligence. Tax rates vary significantly by region and property class.

Understanding municipal taxes ensures homeowners remain compliant and aware of the ongoing financial obligations of property ownership.

Example of Municipal Tax in Action

A homeowner in Halifax receives a municipal tax bill of $3,800, based on their property's assessed value and the city's mill rate for residential properties.

Key Takeaways

- Collected by local governments.

- Funds community services and infrastructure.

- Based on assessed property value.

- Varies by location and property type.

- Must be paid to maintain good standing.

Related Terms

- Property Tax

- Assessed Value

- Mill Rate

- Tax Arrears

- Lien

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

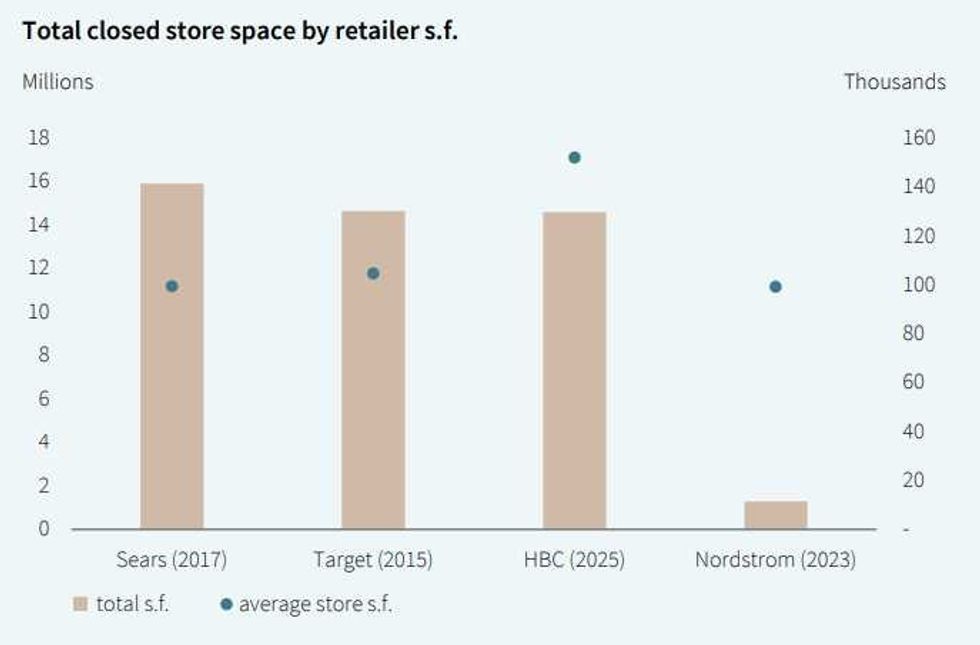

Hudson’s Bay vacated about as much space as Target did in 2015. (JLL)

Hudson’s Bay vacated about as much space as Target did in 2015. (JLL)

Jon Sailer

Jon Sailer