As more and more Canadians become renters, interest and investment in multi-family rental properties are expected to remain high, despite an uncertain financial environment.

In a new 2023 Canadian Economic Outlook from real estate and property management firm Morguard, the Ontario-based company says that after a decline in spring 2020, demand for purpose-built, multi-family rental properties strengthened during the second half of 2021, extending to the midway point of 2022.

"Investment transaction volume totalled $7.1B for the first half of 2022, as reported by CBRE," Morguard points out. "The total was in line with the record annual high of $14.1B in 2021."

Multiple offers on investment properties were commonplace during that time, the report says, with confident investment in major markets amidst the supply of large portfolios falling short of demand.

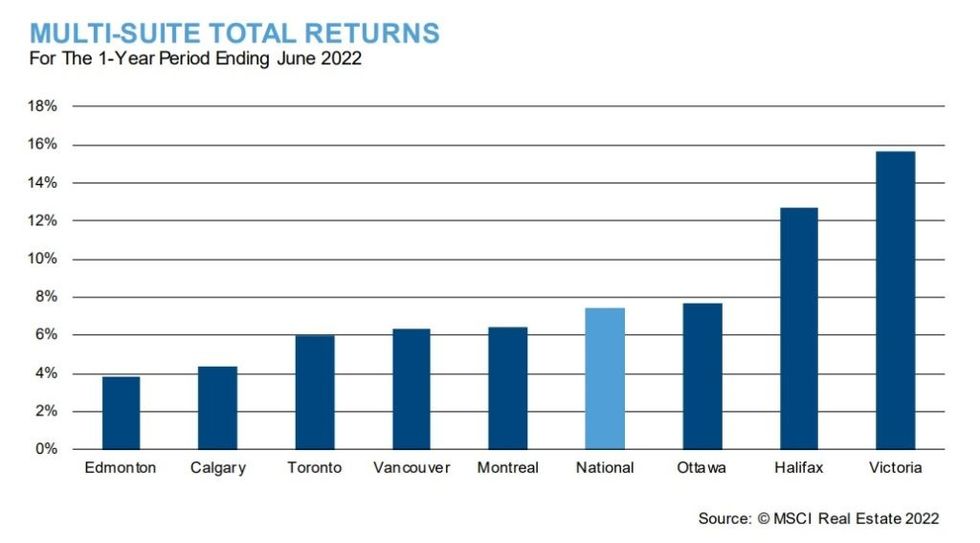

The returns on those investments also remained healthy, with a national average return of 7.4% for the fiscal year ending June 30, 2022 -- an increase of 2.2% compared to the previous year.

Returns on multi-family investments in Victoria were the highest in the nation at nearly 16%, followed by Halifax at nearly 13% -- the only two markets in Canada that saw average returns over 10%.

Meanwhile, in the larger markets such as Toronto and Vancouver, average returns were at about 6%. Calgary and Edmonton saw the smallest returns on multi-family investments in the nation, with both hovering around 4%.

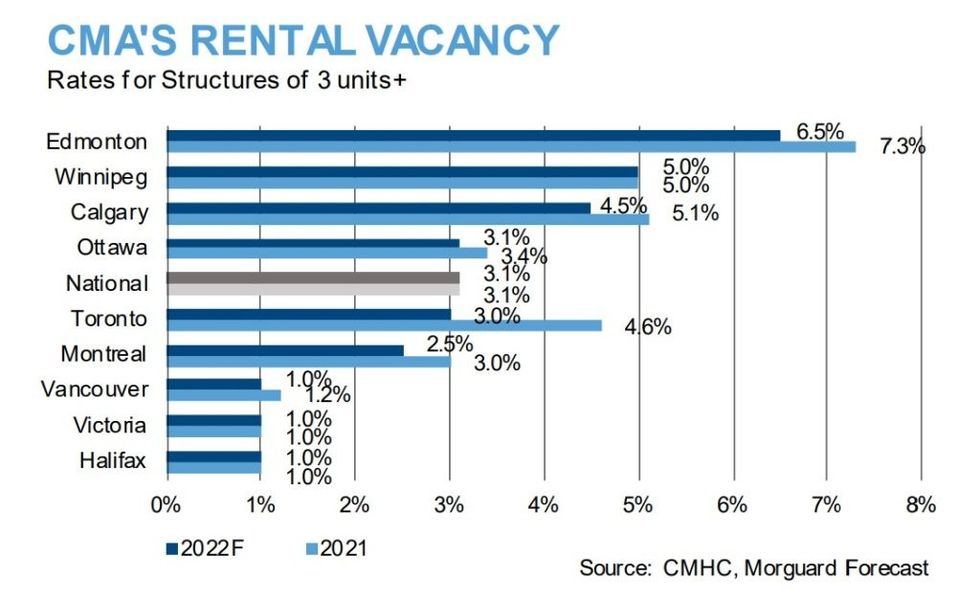

The strength of returns was found to be closely correlated to vacancy rates in their respective markets, particularly at the two ends of the spectrum: Calgary and Edmonton had some of the highest vacancy rates while Halifax and Victoria had some of the lowest.

By transaction volume, in the 18 months leading up to June 2022, Montreal accounted for 30% of total national sales, the most of any market in the country. Second was Toronto at 27%, followed by Vancouver at 16%.

In that same timespan, multi-family properties accounted for 22% of all real estate transactions, second only to industrial real estate sales, which accounted for 30%.

Notable transactions include CAPREIT's $281M purchase of six properties from JOIA's portfolio in Montreal, Q Residential's $165M purchase of the 423-unit Golfview Towers in Toronto, and Centurion Apartment REIT's $81.7M purchase of a 233-unit development in Surrey, British Columbia. Those three transactions were the largest transactions by price and amount of units in their respective markets.

The Rental Market

The increased investment in multi-family properties came as the national average rent price increased significantly. According to Rentals.ca data, the average listed rent in December across all types of rental unit was up 12.4% compared to a year ago, to $2,024.

And there is no evidence that the increases will be slowing down.

"Several factors contributed to the recent rental demand strengthening," Morguard says. "Canada's economic recovery boosted employment levels and rental demand. At the same time, young workers in the 15 to 24 age cohort were able to secure employment and rental accommodation."

Morguard also pointed to increased international migration as adding to the demand for rentals. Many are concerned about whether the nation's housing supply can keep up with Canada's immigration targets, and those concerns will likely remain in place for the foreseeable future.

Vancouver-based Toby Chu, Chairman and CEO of CIBT Education Group — the parent company of GEC Living, which specializes in student rental buildings across Metro Vancouver — previously told STOREYS: "International and domestic students arriving in Vancouver to study, they rent. Migrants moving to Vancouver for work, they rent. New immigrants arriving in Canada, they rent before they buy. Interest rate causes stress test issues for new home buyers, thus they rent. Homeowners downsize from owning to renting, they rent. I think the rental crisis will transform a bad dream into a nightmare."