Whether out of necessity to create more housing or profit-seeking developers' desires to pack in as many units as possible, Toronto has slowly but surely become home to a host of micro condos: shoebox-sized apartments no bigger than 400 sq. ft.

These units are abundant and usually have a copy-and-pasted similarity, even across buildings. There's often a "kitchen" running flat against one of the walls -- some so small they only have a two-burner cooktop -- a bathroom just big enough to turn around in, and, if you're lucky, a very tight, but separate, bedroom with sliding glass doors. Other layouts opt for a rectangular studio, giving "open concept" a whole new meaning. It's not much, but thousands of GTA residents have learned to make it work.

The sobering reality is that these units, frequently listed around the $500,000 mark, are often the closest within reach for first-time, and particularly young first-time, homeowners. But they're not necessarily the ones who can buy them.

"The majority of these types of units tend to be bought by investors," said Strata agent Nathaniel Hartree-Hallifax. "What percentage of that I can't really say."

One of the reasons -- but not the only one -- for investor-heavy interest in these units is that their smaller size tends to work better for people looking for short-term accommodation, Hartree-Hallifax says, making them attractive rental properties.

"When you're talking about the more micro ones that are 400 sq. ft or under, the people that generally want those are ones are looking to use it as an Airbnb, or a rental for students, or someone who's not going to be there for a very long time," he said.

The Mortgage Problem

The other reason, as so often is the case in Toronto, is that there's a financial barrier. Many mortgage lenders have historically been -- and some still are -- hesitant to give out mortgages for units under a certain square footage. Depending on the financial institution, the cutoff can range anywhere from 600 to 400 sq. ft.

Without an easily available mortgage option, many of these units are bought outright by those with enough liquidity to do so.

"These micro condos that seem like they would target first-time buyers that maybe don't have the budget for a one-plus-den or a larger unit, those people can't buy those condos because they have to buy them in all cash or get a private loan and pay an insane interest rate," said agent Anya Ettinger of Bosley Real Estate.

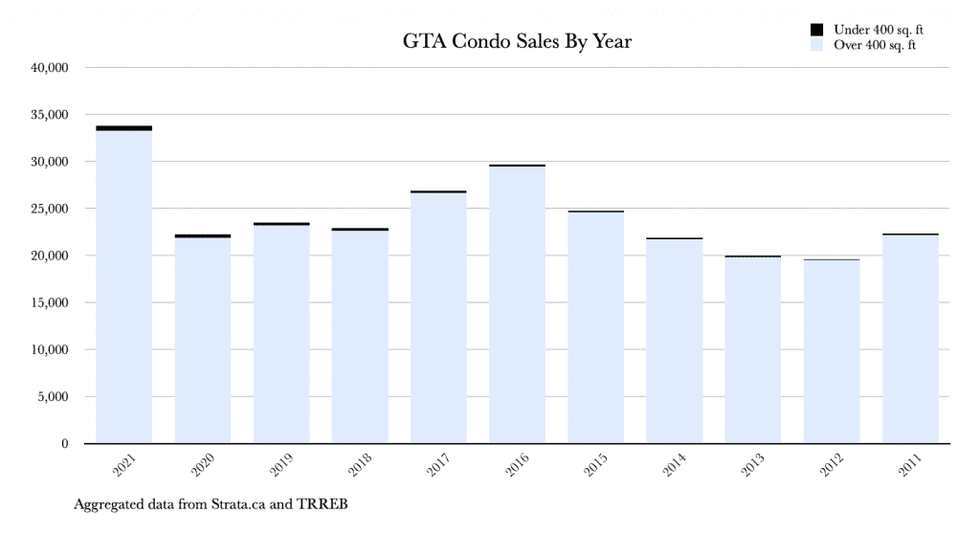

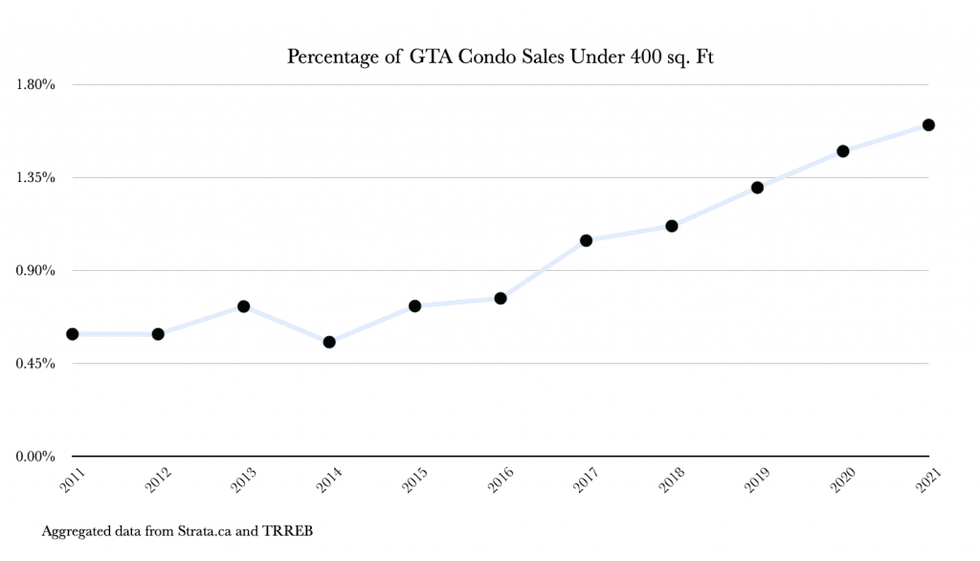

Although micro units make up just a small fraction of the GTA condo market, sales of condo units below 400 sq. ft have been slowly on the rise over the past 10 years, going from making up just under 0.6% of all GTA condo sales in 2011 to 1.6% of sales in 2021.

Toronto-based mortgage broker Paul Meredith says that this increasing popularity, combined with the current red hot market, is leading some lenders to loosen their regulations, particularly for sales in downtown Toronto.

"Because the market is so hot, and especially the condo market is so hot, they're becoming a little bit more relaxed with those policies," Meredith said. "The original issue with the size was that lenders were concerned about the salability of that property. So, in the event that the borrower was to default, how easy would they be able to unload that property? The reason why lenders are becoming more and more relaxed is because the smaller units are becoming more and more commonplace."

But that doesn't mean snagging a mortgage for a micro condo has become easier across the board. In fact, some lenders will flat out not give out mortgages for studio apartments, Meredith says. However, mortgage applicants can always ask for exceptions to a bank's regulations, with square footage being one of them, but the condo's location plays a significant factor in determining success.

"When you have micro condos, they're kind of case-by-case," Meredith said. "A lender will look at the area and whether that type of condo is common for that type of area. So, if they're buying in the middle of downtown Toronto, obviously micro condos are becoming more common... Now if they were purchasing, let's say, a micro condo in Brampton or Hamilton or Niagara Falls, it's not typical for that area, so that would make it much more challenging to obtain the financing on it."

With the rising market already pushing property after property further away from aspiring homebuyers' reach, Ettinger says it's time for lenders to change their approach to financing these units.

"They have to adjust it, otherwise who can buy things other than investors?" she said.

Hartree-Hallifax underscored this, noting that in today's market, the salability of micro condos is not far off from other unit types.

"The rationale is, generally, [lenders] think they're harder to sell and that they're also the most prone to shifts in the market," he said. "The reality is that except for a few extreme situations like COVID, I don't see them sitting on the market that long."

Priced at a Premium

Although micro condos are selling for less than a similar, but perhaps more spacious, one-bedroom condo, those who do manage to buy a micro unit often are paying at a premium compared to regular-sized condos.

"Smaller units tend to have the highest price per sq. ft in the building," Hartree-Hallifax said. "A normal unit, the average is around $1,200 per square foot now. I see a lot of smaller micro units going for like $1,500, $1,600 per sq. ft, so on a price-per-sq.-ft basis, the developer can make more if they can squeeze more units in."

Since the beginning of the year, 110 micro units have sold in the GTA, with an average price per sq. ft of $1,452, according to data aggregated by Strata.ca.

Plans for smaller and smaller units seem to be popping up in pre-construction sales across the city. And although pre-construction prices tend to be a bit higher than what's on the market now, some micro unit prices are rather shocking. At the upcoming 55 Charles Street Condos, the price list advertises a 335-sq.-ft unit on the 50th floor for $942,900. And inside a planned 52-storey tower at 252 Church Street, a 293-sq.-foot studio is priced starting at $542,000.

"It's hard to say, like how small can you get, right?" Ettinger said. "I think that's the biggest thing. I don't think we ever would have imagined one-bedrooms being under 450 sq. feet -- even some new two-beds are under 600 sq. ft. So I mean, if they can fit it, they'll keep going smaller."

Meredith notes, however, that the buyer of a micro condo, even in the heart of downtown Toronto, will have a hard time securing a mortgage if the lender determines that the price the buyer wants to pay doesn't match the unit's value.

"Lenders have to feel confident in the value, so if somebody is purchasing, let's say, with less than 20% down, meaning they have to have the CMHC insurance, then CMHC will be the one that confirms the value," Meredith said. "They'll look at comparable sales in the area to determine if they are purchasing a condo that actually is worth that much money. If the appraisal comes in low, then the buyer would have to make up the difference between the purchase price and the appraised value. So, what happens is their down payment is now based on the appraised value. If they're putting down, let's say, 10%, that 10% is based on the lower appraised value, and then they have to come up with a difference on top of that between the purchase price and the appraised value."

So Where Are First-Time Buyers Actually Buying? And How?

With the deterrent of navigating the tricky landscape that can be getting a mortgage for a smaller unit, combined with a desire for more space, first-time buyers are shifting away from newer buildings.

"All of my clients that have had lower budgets, like really entry-level budgets for a condo, would prefer an older building or a less desirable building with more space than a studio," Ettinger said.

Even still, many first-time buyers, especially young buyers, aren't able to afford to purchase a condo of any age on their own.

READ: 40% of Young Ontario Homeowners Got Financial Help From Their Parents

"I do work with a lot of first time buyers, and especially ones that expect to live there, they're looking for something that's above 500 sq. ft," Hartree Hallifax said. "The reality is that most of them are getting investment from their parents. And the way I've had it explained to me from different parents is essentially, 'We're comfortable, we have our property, it's paid off, it's worth a lot, we have decent jobs, and our kids are going to inherit this money at some point, so we'd rather them build equity and not have to rent, so we don't mind putting in that $100,000 for them to start off.' Obviously, not every family is in a position to do that, but certainly ones that own property in Toronto are."