Joint Venture

Understand joint ventures in Canadian real estate — what they are, how they work, and why they’re used in development.

July 29, 2025

What is a Joint Venture?

A joint venture in real estate is a partnership between two or more parties to develop, own, or operate a property or project, sharing risks, costs, and returns.

Why Joint Ventures Matter in Real Estate

In Canadian real estate, joint ventures allow entities to pool resources, access larger projects, and leverage complementary expertise.

Key features:

- Defined by contract

- Shared decision-making and profits

- Flexible structure (corporate, partnership, trust)

Joint ventures are common in large-scale development, commercial investment, and redevelopment projects.

Example of a Joint Venture in Action

The developer and pension fund formed a joint venture to build a mixed-use community on 50 acres of urban land.

Key Takeaways

- Partnership for real estate projects

- Shares risks, costs, and profits

- Used for large or complex deals

- Defined by detailed agreement

- Leverages strengths of partners

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

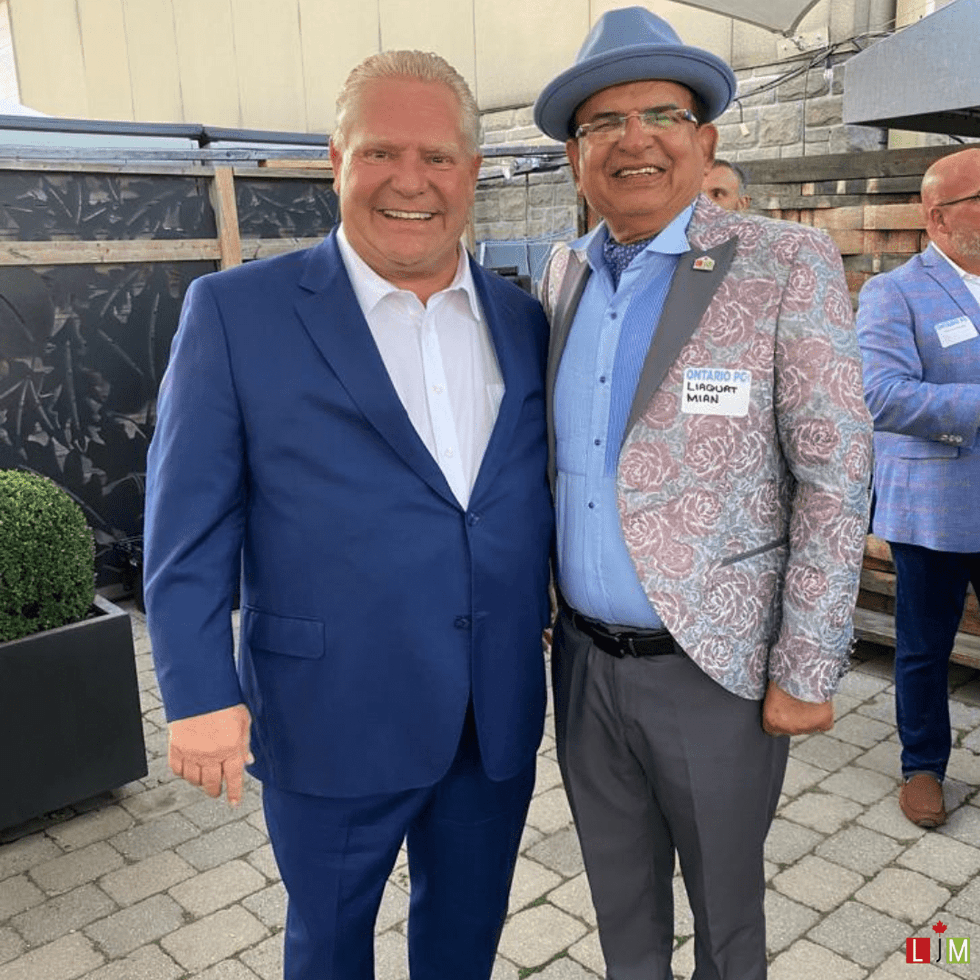

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)