Mid-way through January, 2021 has passed its prime "Happy New Year, the world is fresh again" territory. As resolution-based behaviour begins to fade, so too does the rose-coloured tint some may have held over their ideas about the year ahead.

It's high time, then -- with a realistic frame-of-mind -- to analyze potential housing market trends in Toronto real estate for the next 12 months; President of Realosophy John Pasalis has done just that.

In his Move Smartly Report January 2021, Pasalis delves into the key trends he's watching in relation to the GTA housing market. And those trends vary steeply, presenting both "heat and hangovers," depending on which direction he's looking.

Take the market for single-family houses, for example. This sector of the local real estate scene "is showing alarming bubble-like symptoms," the report says, which are "reminiscent of what we saw in 2016 and 2017 in the GTA."

READ: CMHC Suggests Worst-Case Scenario of Nearly 50% Drop in Housing Prices

The GTA's suburban housing market is ultra-competitive as-is (prices are up over 20% in some regions, including Halton and Durham), but the heat isn't letting up. Instead, it's getting spicier with each passing month. This combination -- a market that's currently hot and appears to only be getting hotter -- is what Pasalis describes as "concerning."

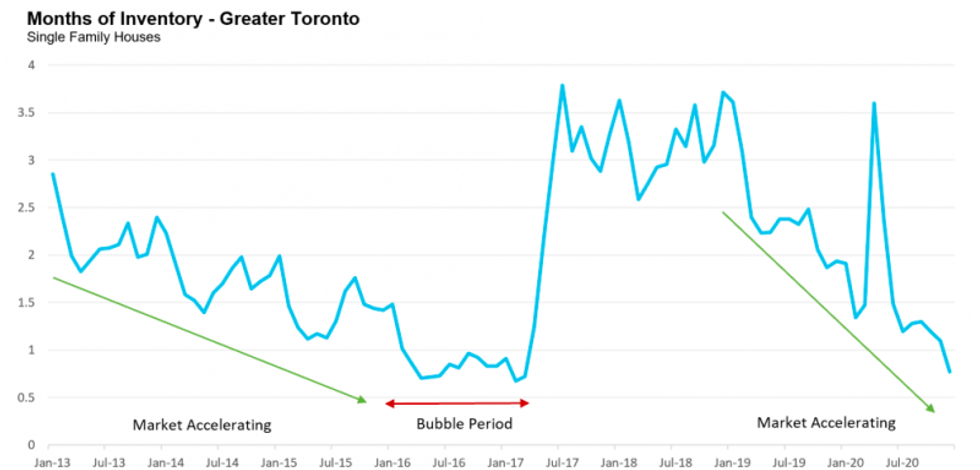

"After GTA home prices fell in 2017, the GTA housing market remained relatively stable for 18 months with roughly 3 months of inventory [MOI]," the report explains. "But since 2019, inventory has plummeted from 3.6 MOI in Jan 2019 to under one month in December 2020."

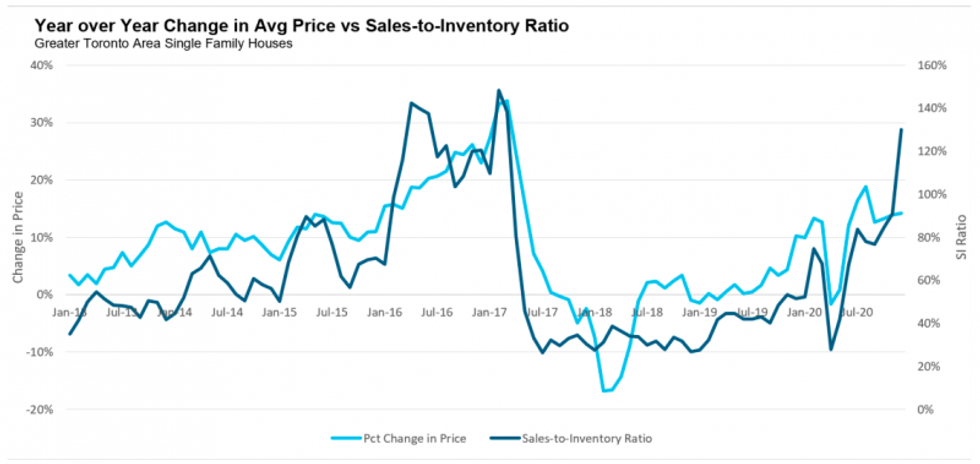

The component of MOI is an important facet to real estate happenings, because their levels are highly correlated with changes in house prices. To illustrate, the report includes a plot of the year-over-year change in average prices set against the inverse of MOI (which makes the relationship positive, rather than negative).

The result is called the Sales-to-Inventory ratio, and it shows how tight supply is resulting in 50% or more homes selling for over asking.

"The last time this happened was in 2016. All early indicators point to a market that will continue to heat up as we move into the first quarter of 2021 market," the report reads. "We are even seeing alarming signs of homeowners flipping houses for 25-30% more than they purchased them six months earlier – in the summer of 2020 without doing any renovations."

Pasalis says this type of "speculative behaviour" hasn't been seen in Toronto since the late 80s, and if these trends continue, it could lead to an increasingly rapid acceleration in house prices fuelled not by market fundamentals, but by extrapolative expectations.

Meanwhile, in a land where backyards and basements are but a reverie, the condo market faces an uncertain future.

Indeed, whether it was due to mortgage rates, vaccine implementation, or just something in the water, December saw Toronto’s condo market activity soar to new heights.

Earlier this month, the theory of investors driving the burst of action is one that Pasalis, alongside Toronto realtor and chartered accountant Scott Ingram and Ron Butler — founder of Butler Mortgage — brought to the table earlier this month. And just this week, Pasalis further described the theory as “interesting,” with consideration of rental vacancies sitting at a 50-year high.

While in general, Pasalis notes the post-lockdown rebound was softer in the realm of condos than it was for houses, those last six weeks of 2020 presented a "significant rebound in interest from condo investors;" these individuals were looking to capitalize on the lowering of prices, crossing their fingers for a rental and resale market rebound in the near future.

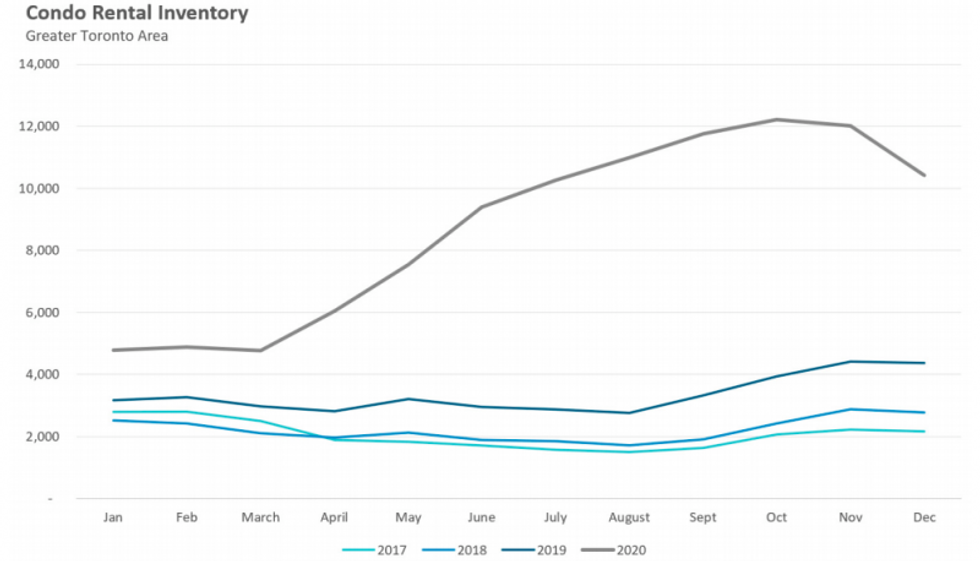

"Where the condo market goes from here will largely depend on what the rental market looks like in the first quarter," the report says. "If the rental market, both inventory levels and rents, remains stable (i.e., avoiding declines) then I expect investor demand to continue into 2021, effectively setting a floor on resale condo prices."

But Pasalis' work notes that if the rental market continues to soften -- as has been the case for several months now -- investors may feel pushed back into the game of "watch and wait." For now, inventory levels have declined slightly, the report says, but prices also continue to lay low.

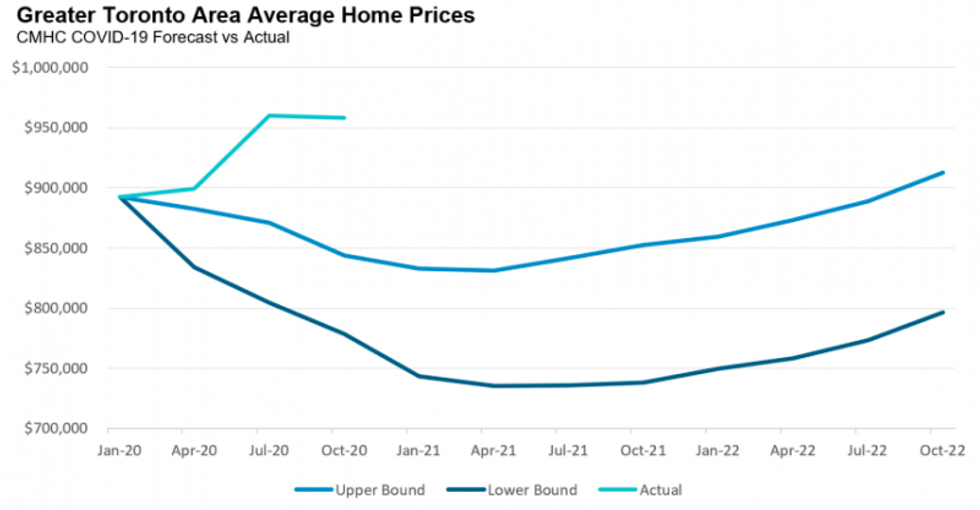

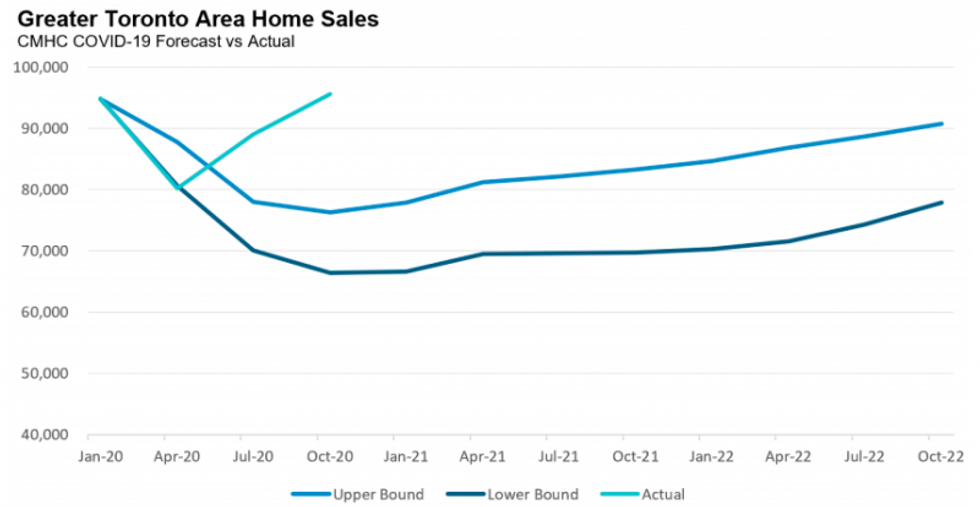

And, balancing a series of future-oriented predictions, the report also speaks to the present, through analysis of "the most pessimistic forecast for Toronto’s housing market" the Canada Mortgage and Housing Corporation (CMHC) released shortly after COVID-19's onset.

The forecast called for a sustained decline in both house sales and prices, the upper (optimistic scenario) and lower (worse than expected scenario) of which are presented in the charts below, alongside actual sale and price levels:

(CMHC sales are based on seasonally adjusted annual rates, while actual sales are based on actual sales over the last twelve months.)

Of course, the pandemic is not over, and there are surely still many impacts left unseen for the local real estate market. But even so, the report asks: why did CMHC get their forecast so wrong?

Pasalis says he suspects CMHC viewed the COVID-related economic slowdown as similar to a traditional, deep recession, which was probably not well-suited to the actual form the pandemic's economic impacts would take. The report cites a Bank of Canada Analytical Note, which argues: "The economic impact of COVID-19 is often compared with past recessions, but this pandemic arguably has more in common with natural disasters."

In essence, this means the difference between an abrupt stop in economic activity due to a shock to the system that's unrelated to economics, at its core, compared to an underlying fragility in a financial system resulting in a long-standing downturn in financial wellness.

But what the report says may be the biggest issue with the CMHC forecast was "not that it was wrong (economists often expect to be), but that it was delivered with overconfidence that a decline in house prices was a foregone conclusion." Further, Pasalis expresses concern that when messaging such as this turns out to be faulty, Canadians may perceive the housing market to have a super-strength, of sorts.

"Eight months later, we hear the message that many consumers are taking away from this, which is that if home prices didn’t crash 'with our economy in slow motion, oil being given away, millions of Canadians on income support and a greater % of mortgages not being paid than we’ve seen since the Great Depression,' then nothing can make house prices crash," reads the report.

"But when authorities make such strong stands for and against positions, only to be wrong, consumer behaviour is at risk — such bold posturing may fuel the exuberance we are seeing in the housing market today."