With its record-breaking highs and lows, the Greater Toronto Area (GTA) real estate market has been one crazy roller coaster ride in recent years. Given its existing surplus of inventory and relatively low sales, it’s safe to say that what is typically a busy summer selling season in the notoriously pricey region – one that usually sees dramatic bidding wars and very tight supply – was basically dead on arrival in 2024.

Pent-up demand has yet to lead to a bustling fall market, despite recent interest rate drops. In fact, housing inventory is still high when it comes to all housing types, leading to an oversupplied market and passionate conversations surrounding its current state. As the crisp air begins to roll in, the big question remains: Have we reached the bottom in the GTA’s real estate market downturn? Or, do we have even further to fall?

How We Got Here

Once upon a time, before the term “social distancing” became a familiar one, there was a world where Canada’s interest rates remained blissfully low for a good decade or so. This meant that, despite climbing home prices in many GTA neighbourhoods, home ownership was more attainable for the younger generation.

In late March 2020, the Canadian government slashed its overnight rate to an ultra-low .25% in response to the onset of COVID-19. Of course, the pandemic then saw real estate prices in the GTA – and well beyond – skyrocket to highs that rendered first-time homeownership unattainable for many. Then, not long after the war between Russia and Ukraine became a reality in February 2022, Canada’s interest rates began to climb, along with inflation (not that anyone needs the reminder). So, the Bank of Canada (BoC) aggressively raised its policy rate from 0.25% in March 2022 to 5% by July 2023 – via ten straight raises – in an effort to cool inflation.

Along the way, the region’s red-hot home prices began to cool as well. But falling or stabilizing prices were no match for these sky-high rates on the housing affordability front. The rate remained at 5% for an entire year, until June 2024, when the BoC finally began to lower it – albeit, very conservatively – dropping the overnight lending rate by 25 basis points to 4.75%. Two drops later, it now sits at 4.25%.

Justin Sherwood, SVP of Communications and Stakeholder Relations for the Building and Land Development Association (BILD), says that two key factors lead to current market conditions. “One is the tremendous increase in cost to build new homes, with single-family construction costs increasing 98% in the GTA between January 1, 2019 and 2024, and high-rise increasing by 74%,” he says. “Secondly, the rapid increase in mortgage interest rates are (still) keeping new homebuyers on the sidelines and reducing the scope of what purchasers can afford to carry in terms of monthly payments.”

While Sherwood acknowledges that interest rates will continue to moderate, generating buyer interest in the pre-construction market, he highlights the grim reality that the costs to build new homes remain stubbornly high – and that's cause for serious concern. “While there has been some price moderation since the 2022 peak, prices have remained fairly stable since the start of 2024 and are beyond the reach of new homeowners,” he says. “Without fundamental change to the cost to build, this challenge will persist.”

So, we’re left with an embattled pre-construction market that’s virtually grounded to a halt and no longer economically attractive to investors, who are now more interested in selling rather than buying GTA real estate. Similarly, the GTA’s condo market is all but stalled, with no shortage of options flooding listing sites. In fact, condo inventory in the GTA is up 80% year over year.

“The condo market got too far ahead of itself coming out of COVID,” says Shaun Hildebrand, CEO of Urbanation. “As interest rates dropped and prices started rising quickly, investors jumped in with both feet, often disregarding the fact that the prices they were paying made little economic sense. The market for new condos became dislocated from its fundamentals due to a belief that prices would keep rising quickly and interest rates would stay low. As a result, the market for new condos grew further and further ahead of the resale and rental markets, causing the issues the market is facing today.”

Meanwhile, residential resale home prices may have stabilized from pandemic highs, even dropping slightly as of late, but they’re still incredibly steep compared to other parts of Canada and simply too pricey for many, especially given current interest rates. So, demand just hasn’t been there. Making life easier for first-time homebuyers, however, last month, the Canadian government expanded its eligibility for 30-year mortgage amortization periods and increased the $1 million price cap on insured mortgages to $1.5 million.

Pre-Construction And New Builds

Following an all-time low month for new home sales in July, sales in the GTA fell even further in August, posting just 464 transactions. This marked a new historical low, according to BILD. Tellingly, these figures were 46% below those of August 2023 and are a striking 73% lower than the 10-year average. Of the units sold, 235 were condominium units, a figure that marks a 61% year-over-year decrease and puts us 81% below the 10-year average for condo sales. New single-family home sales fared slightly better, with 299 transactions – a year-over-year decline of 14%, but still 56% below the 10-year average.

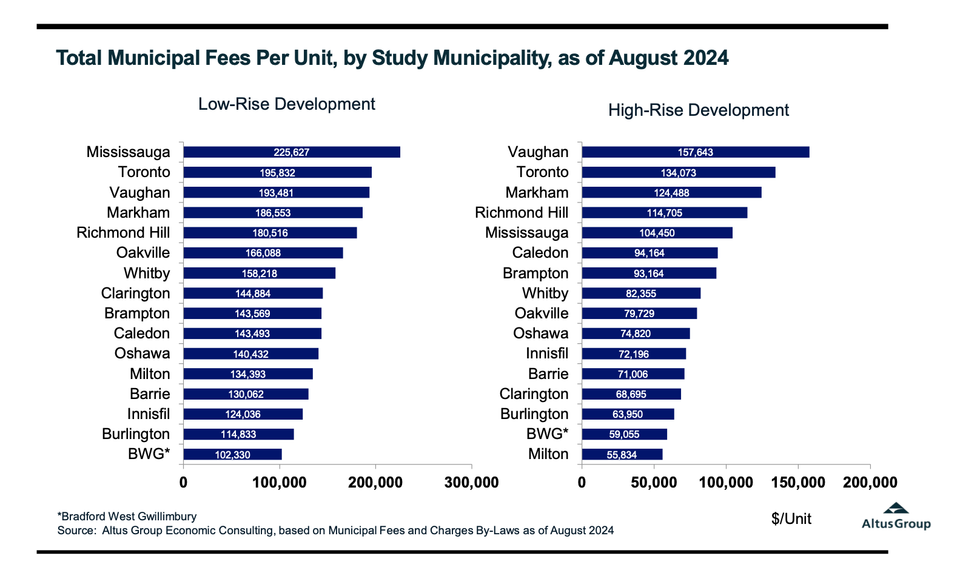

When it comes to building costs, Sherwood points to the problematic impact of government fees and taxes on new homes. “This is especially true of municipal fees and charges which are typically fixed charges by unit,” explains Sherwood. “Municipalities have been raising these costs, many most recently this past summer, while at the same time benchmark prices that the market is able or willing to support, have been declining – in other words, municipal fees and charges as a percentage of the cost of a new home are increasing, squeezing pro-formas and limiting the supply of new homes that will be needed just as buyers return to the market. These municipal costs are not influenced by market conditions and will require leadership from municipalities across the GTA and the provincial and federal governments to reset and adjust taxes on new homeowners.”

On May 1, development charges on Toronto condos increased 20.7% – a move that critics said will only hurt housing affordability. Then, another fee hike quietly (and quickly) went into effect on June 6 as a result of Bill 185. According to BILD's new Municipal Benchmarking Study, since 2022, municipal fees rose by an average of $42,000 per unit on low-rise developments and $32,000 on high-rise units. On average, municipal fees now add $122,387 to the cost of a condominium and $164,920 to the cost of a single-family home in the GTA, according to the report.

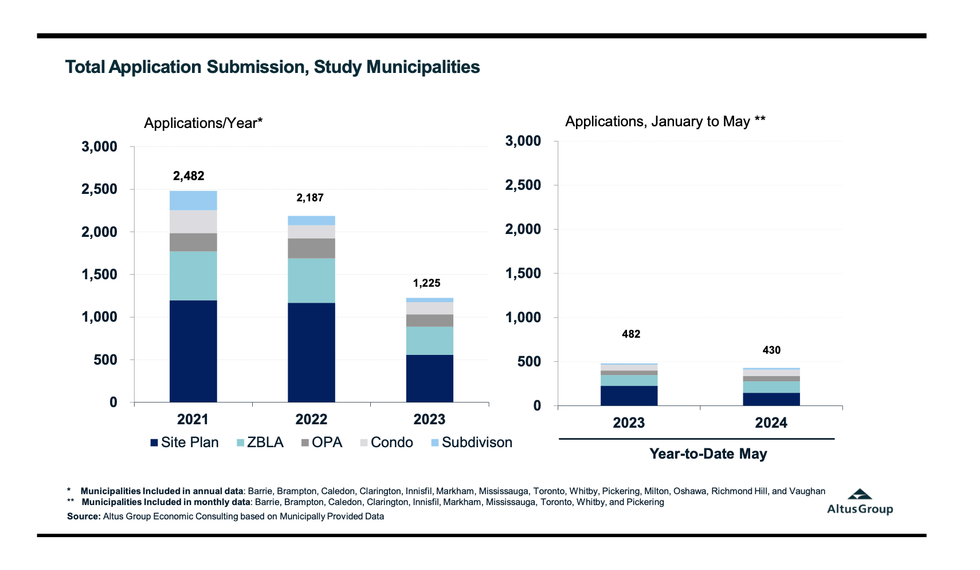

In a climate of high interest rates, high supply costs, and rising development charges, it’s no surprise that a good handful of projects have been cancelled in the GTA. Hildebrand says we'll continue to see projects that were supposed to launch remain on the shelf for the time being, something that's been a theme since the second half of 2022. This 'wait and see' approach will likely last at least until the end of this year, he says.

In July, over 75 condo projects were on hold in the GTHA market, according to Urbanation. “There are a lot of projects that were previously launched that are sitting in pre-construction and hoping for more sales in the fall as rates continue to move lower, and I think you’ll see some projects get pretty aggressive with price cuts and incentives,” says Hildebrand. “If the sales don’t materialize as expected, some projects will get pulled. There are about 50 projects that are less than 40% sold – it’s plausible that a good chunk ultimately won’t proceed.”

This will have negative impacts on the market down the road, he says. ”Certainly, projects no longer being viable and therefore facing cancellation is a concern,” says Hildebrand. “But from a market perspective, I think it’s the tens of thousands of units under construction that were pre-sold at record high prices that will come due for possession in the coming years and won’t likely be worth their contract values. I believe there could be a pretty big shortfall in appraisal values, which could cause quite a bit of supply to hit the market, on top of what we’re already seeing today.”

According to Hildebrand, the longer-term problem with this is the fate of rental supply in a city of elevated rent costs. “If we can no longer rely on condo investors to hold units as rentals, we will be facing a tremendous supply squeeze, particularly once completions begin to trend down in 2027,” he says. “Without a very meaningful pick-up in purpose-built rental construction, the rental supply and affordability situation will get much worse.”

Figures for August reveal that Toronto’s year-to-date housing starts were down 14%. This trend is seen in urban centres across Canada, where new housing starts declined 24% from July to August, according to the Canada Mortgage and Housing Corporation (CMHC).

The 'Bottom' Line

While there is a light on the horizon in anticipation of the impact of interest rate drops, there's no cause for celebration in the GTA's pre-construction market right now. While interest rates will drop, bringing buyers back into the market and potentially taking projects off the shelf, hurdles such as the high cost of building persist. So, the concern is that the slowdown of builds, coupled with the departure of investors from the market, will result in a supply shortage in the not-too-distant future. For this reason, voices like that of BILD are demanding immediate government action. Have we reached the bottom? It depends on how you look at it – but either way, we're a long way from the top.

Revival In The Residential Housing Market?

It was a slow summer for the GTA residential housing market. Although July brought a glimmer of optimism on the home sales front after a similarly slow spring, August saw transactions fall back. Figures from the Toronto Regional Real Estate Board (TRREB) show that there were just 4,975 GTA home sales recorded over the course of August, marking a 5.3% decrease over the 5,251 sales reported in August 2023. The month prior, the same year-over-year metric was up 3.3%.

On the price front, the MLS Home Price Index Composite was down by 4.6% year-over-year in August 2024. The average selling price was down by a lesser 0.8% at $1,074,425, the difference attributed to an increase in detached home sales compared to 2023. On a seasonally adjusted basis, the average selling price edged lower compared to July.

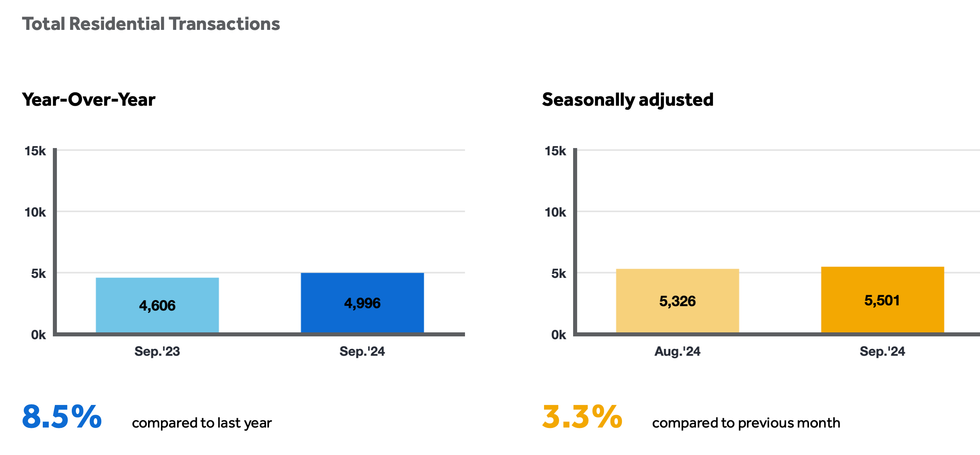

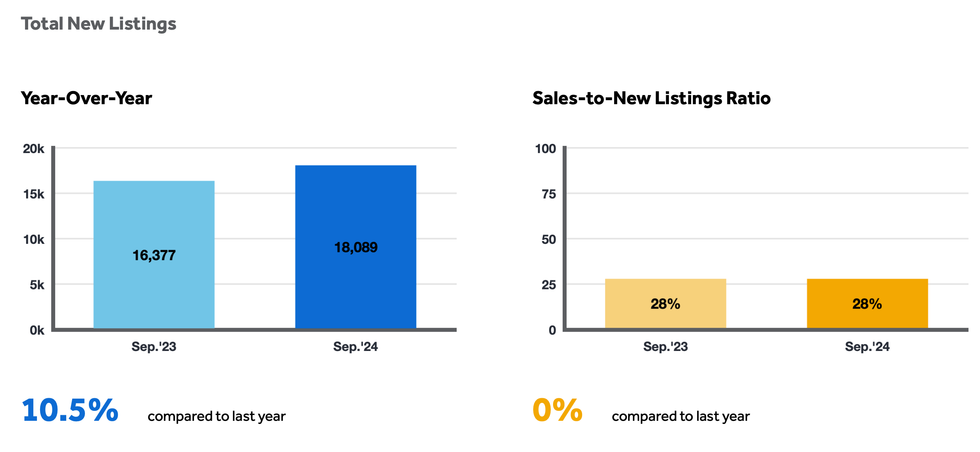

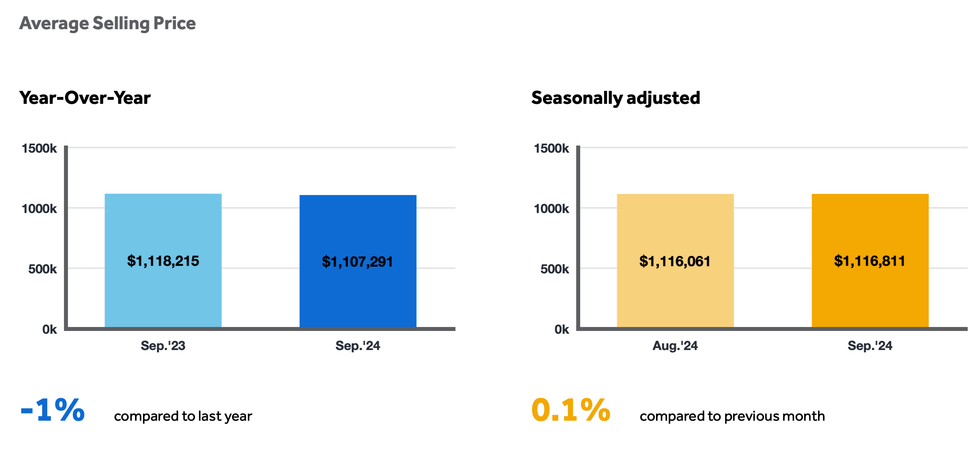

September's stats, released last week, however, show renewed signs of life in the residential housing market -- in some respects, at least. The GTA's home sales hit 4,996 in September, 21 more homes from August still but down from July's 5,391 sales. From an optimistic lens for potential sellers, September's sales did represent an 8.5% increase from September 2023. According to TRREB, September's slight uptick is largely the result of interest rate cuts and mortgage lending reforms. When it comes to home prices, the GTA saw a 4.58% year-over-year decline in its benchmark home price in September, which was reported at $1,068,700.

“We are getting close to a turning point, but we are not quite there yet,” TRREB Chief Market Analyst Jason Mercer told STOREYS last month, pointing to borrowing costs and how they relate to affordability. “If you look at some of the polling that we’ve released through IPSOS, it suggests that would-be homebuyers who are on the sidelines right now but who want to purchase in the near future, need 200 basis points to bridge that affordability gap that exists. We’re getting there; we will have seen more than 100 basis points of cuts by the end of this year. We’re seeing more forecasters, based on inflation, saying that we could actually see a 50-point basis cut instead of a 25-point basis cut that we’ve gotten used to,” he continues.

Mercer says that this will lead to a better affordability picture. “So, as we move into spring of 2025, we should see an uptick in sales,” he says.

Karen Yolevski, COO of Royal LePage Real Estate, says that we’re at an interesting point in the market – one that many would-be buyers have been waiting for. “Prices have been stable; you’ve seen price percentage changes in the low single digits month-over-month or year-over-year, so there hasn’t been a lot of pressure for first-time buyers to leap up off the sidelines – yet,” says Yolevski. She says she’s been watching two camps of buyers over the past two years of subdued activity on the GTA market.

“There are those who, even with high interest rates, are well positioned to transact in the market, but have been waiting for the right timing – timing where they can get the lowest interest rate possible and when prices are at the lowest point possible – before they decide to buy,” says Yolevski. ““The second group are those who have a great desire to be in the market, particularly first-time buyers, but with high interest rates, it’s been very difficult for them to qualify for the mortgage that they need. Because prices have been elevated despite drops from peaking in 2022, they simply can’t afford to transact.”

So, the summer season saw a heightened supply of residential inventory, offering buyers no shortage of options come fall – that is, those who are brave enough to emerge from the sidelines. “I’m seeing buyers come out to look,” says realtor Davelle Morrison, who specializes in the Toronto core. In the City of Toronto, September's prices were down slightly compared to last year, with the average price falling to $1,113,671 from $1,119,452. New Toronto listings were up 7,074 from 6,517 in September 2023.

“My open houses for one-bedroom condos are busier than I would expect," Morrison says. "Buyers are still taking their time to make an offer because they know they can. They are checking off the boxes and doing their research and are preparing to negotiate the price down. We really are in a buyers' market."

That’s not to say that confidence is necessarily high among buyers quite yet. “What’s surprising me is how some buyers are trying to back out of deals made long ago,” said Morrison. “I had that case recently, where we weren’t sure if the buyer [would] actually close. It’s caused a lot of stress to my seller client and the lawyers and mortgage brokers involved. We still don’t know if the buyers will close on a transaction that was done back in July. It’s a very different market out there right now.” Different or not, it’s a market that’s showing signs that it’s slowly coming back to life, says Morrison. “The resale housing market has already picked up with multiple offers,” she says. “I would expect that the number of multiple offers will only increase, since the downpayment on properties less than $1,499,999 is now less than 20%.”

The condo market, however, is a different story, she says. “More buyers are starting to come to the market, but it’s not enough to absorb the six months of inventory we have,” says Morrison. “I think the condo market will be flat for a few months before we start to see things turn around.”

Micky Lehava, who sells real estate throughout the GTA for Harvey Kalles, points to a notable difference in outlook between buyers and sellers. “Buyers are approaching with cautious optimism as inventory levels have increased to around four months, compared to the past four years when it was closer to two months, making it easier for them to find properties and giving them more negotiating power,” he says. “This balance has created more opportunities for buyers, especially first-time buyers, to enter the market, particularly in the condo sector where inventory is high and prices are stabilizing.”

Sellers, on the other hand, are adjusting to more realistic expectations after years of a strong sellers' market, says Lehava. “It’s now more important than ever for sellers to price their homes strategically and consider selling before buying to ensure they have a clear idea of their financial position,” he says. “An experienced agent can help sellers maximize their home’s value and navigate the current market, which, while balanced, may require more targeted strategies.”

The 'Bottom' Line

There are early signs that activity is starting to pick up in the residential market, which could indicate we're moving toward a more balanced market and the bottom is behind us. This is expected to continue in the wake of further interest rate drops, the next one now just weeks away. However, the sellers of the region's single-family homes will enjoy this before their condo-listing counterparts will. The condo market will likely take more time to correct itself.

Selling Suburbia

Naturally, market differences persist between the city core and suburbia, predominantly because of the higher concentration of single-family homes in suburbia, versus a densely populated sea of condominiums.

“If you think of the downtown core, up Yonge Street corridor, and certain areas like Mississauga City Centre, you see a lot of condo apartments; that’s one difference between the GTA suburban areas and the surrounding Greater Golden Horseshoe and we have seen a lot of supply in the condo market,” says Mercer. “We expect to see some of those listings getting absorbed as we see more first-time buyers move from the sidelines, but we really need to see some more relief on the rate front. We’re expecting this as we move through the fall and even more so in the spring of 2025.”

Realtor Zain Jafrey specializes in the Durham Region, which saw home prices climb during the pandemic, and says that its real estate market and other areas surrounding the downtown core have experienced significant fluctuations. Sales in Durham were up to 672 transactions in September from 653 in September 2023. The average selling price, however, dropped slightly, with an average price of $894,499, compared to $907,359 in September 2023. Furthermore, September saw 1964 new listings, a figure up from 1,727 September 2023.

“With recent interest rate announcements, I believe momentum is once again building in the suburban markets,” says Jafrey. “Earlier this year, the market was notably slower, marked by uncertainty and a lack of optimism about what the year might bring. In recent months, however, the Bank of Canada’s focus on potentially reducing interest rates has begun to instill renewed confidence in the market. As a result, buyers are returning, eager to explore what opportunities their purchasing power can offer. Sellers are also taking notice of this renewed stability and are considering their options, whether it's looking to upsize, downsize, or exit the market completely.”

Like many areas of the GTA Jafrey says the biggest cause for concern in the market is the ongoing uncertainty around interest rates and their impact on affordability.

“As for whether we've reached the bottom, it's difficult to say definitively,” says Jaffrey. “While there are signs of stabilization, particularly in suburban areas where buyer interest is picking up, market conditions are still highly sensitive to external factors like government policy and housing supply. The market appears to be finding its footing again, and with recent policy changes — such as the introduction of 30-year amortization for first-time homebuyers and increasing the CMHC mortgage cap to $1.5 million — it will be interesting to see how these developments impact the real estate landscape after December. These shifts could have significant implications for affordability and buyer activity moving forward.”

Meanwhile, Harvey Kalles' Lehava says that we could see variation in the markets in Toronto’s surrounding areas. “Take into consideration that places like Hamilton and Oshawa that went through a big boom during COVID – places where people thought they could buy more for less – are likely going to see fewer gains long term, and bigger losses short term in their respective markets,” he says. “Location, location, location!."

Notably, average home prices increased in Peel Region (from $1,049,968 in September 2023 to $1,058,346 in 2024) and in Halton Region (from $1,245,146 in September 2023 to $1,255,112). Meanwhile, York Region saw home prices decline from last September, with an average price of $1,263,790 in 2024, compared to $1,330,636 in 2023). When it comes to sales, they were up in all three of these regions compared to 2023: 907 (2024) from 808 (2023) in Peel, 875 (2024) from 795 (2023) in York, and 537 (2024) from 477 (2023).

The 'Bottom' Line

Thanks to its higher concentration of single-family homes, the regions surrounding the downtown core could see more overall bustle and activity once rates continue to drop further. As with its downtown counterparts, however, a true market rebound won't happen any time soon. But it looks like we're on the road to revival.

What's Next?

As for what’s in store, all eyes are on the BoC and its anticipated rate announcement on October 23, which is expected to see the rate drop by a further 25 to 50 basis points. However, rate cuts aren’t necessarily a magic solution to the GTA’s relentless housing crisis.

“Further rate cuts will help, but consider the starting point – new condo sales in the first half of the year were at a 27-year low, so I don’t think we’re getting back to normal anytime soon,” says Hildebrand. “The current total level of condo supply in the GTA, factoring in unsold units in development, assignment listings, and resale listings on MLS, is approaching 40,000 units — that’s a number the market has never seen and will take some time to absorb, especially given that completions are projected to remain at record highs for the next couple years. But I think as developers continue to pull-back on new launches, some projects are pulled from the market, and demand begins to improve, in about a year, it’s possible that market conditions could begin to balance out.”

As always, supply remains top of mind for many. “Our biggest concern is that the current status of the market, characterized by this holding pattern, is masking the greater problem that we aren’t going to have enough supply, and enough affordable supply, to meet the demand when it returns,” says Yolevski. “We’ve seen homebuilders pull back on new projects and housing starts are down. That pause in construction doesn’t impact the market today – both resale and preconstruction – but if you look forward four or five years, when projects that would have started now would be completed, we’re going to see very few projects available, and a low supply of new units come online at that time.”

Despite the current abundance of inventory and room for negotiation for buyers, Mercer similarly says we can’t lose sight of the longer-term issue of supply. “We continue to see very strong population growth, and right now we’re not seeing strong price growth in the market, but as we absorb some of the standing inventory over the next couple of years as housing becomes more affordable on the back of lower rates, then market conditions will tighten,” says Mercer. “If we don’t have a diversity of supply in the pipeline to meet different housing needs, then we will get back to tighter market conditions and to price growth well above inflation. So, this isn’t the time to take our foot off the gas when it comes to policy measures designed to bring more supply on the market. And that comment is really directed to all three levels of government.”

Speaking of policy measures, Yolevski says that those who can afford to buy (that aforementioned first set of would-be buyers) will benefit from both lower rates and last month's mortgage announcements.

“In light of the length of time it takes to bring new supply to the market, the struggles we have at all levels of government, and the economic factors that limit the ability to get new projects off the ground, these announcements are positive because they will reduce the barriers to entry,” says Yolevski. “This is particularly true for end users. If you look at the increase on the cap on prices for insured mortgages, you can’t get one if you’re an investor, you have to be an end-user. So, it will directly help those who will be living in homes.”

While the increase in amortization times isn’t without its critics, who say the move won’t help affordability, it’s undoubtedly a welcome one for countless first-time buyers across Canada.

“First-time buyers are an important part of the market; that’s where you see your growth, through new entrants,” says Mercer. “There are many people out there paying very high rents, both in the condo apartment rental sector and also the primary rental sector, so, as interest rates start to trend lower, they’re going to be looking closer at making that move to the home ownership sector, and that will be particularly pointed at the condo apartment segment. On top of that, if they are able to take advantage of longer amortization periods, that has a similar effect to an interest rate cut, so that will make their payments more affordable. Any move like that that affects your payment in a positive manner will help drive first-time buyers to make the leap from the rental market to home ownership.”

In the meantime, the good news for buyers is that options abound – for now. “Those buyers waiting on timing understand that more buyers means more competition and upward pressure on prices,” says Yolevski. “So, there is a lot of incentive for the buyer who has been waiting it out to start transacting as we move through the rest of 2024 and into 2025. Today, there are lots of options for buyers – condos, resales, and new construction.”