On a single job site, Nick Ainis’s construction-management business employs hundreds of sub-contractors. Combined, his army of trades can log upwards of a hundred thousand well-paid hours putting up a mid-sized condo building. But, as developers delay project launches in response to the higher interest rates that have pushed away potential homebuyers, he and his labourers see their prospects in the formerly booming market dwindle. “It’s hard to get new work in this environment, because everybody’s holding off,” says the founder and CEO of Fusioncorp Developments Inc., a construction-management company.

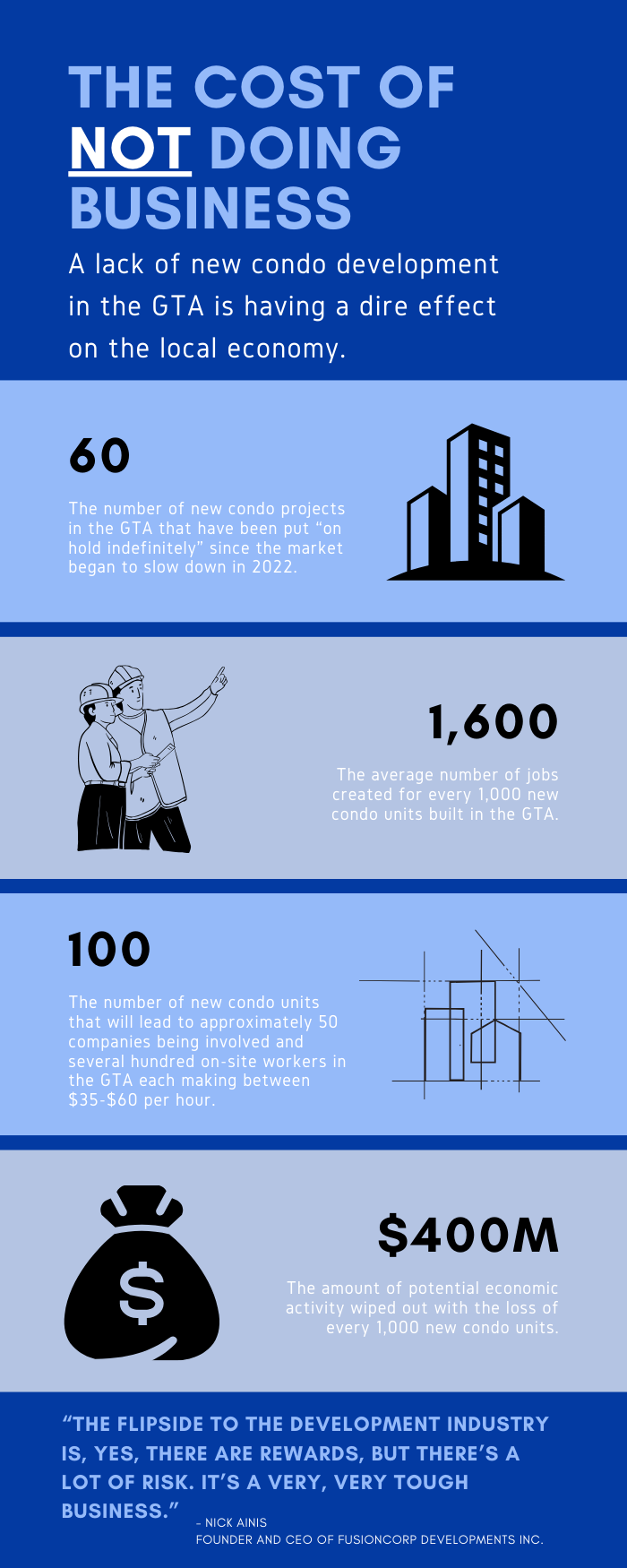

Ainis isn’t being dramatic. Since late 2022, developers have shelved 60 previously planned condo projects across the Greater Toronto and Hamilton Area, a recent report from real estate consultancy Urbanation suggests. Meanwhile, in the first three months of the year, only 958 new pre-construction condos were made available for sale, according to the same report. Now, experts are warning that the sharp drop in homebuilding activity will not only constrain the supply of much-needed housing in the long term, but — because of the size of the construction industry — potentially hammer the local economy and jobs, like those Ainis provides.

“This year’s going to be a particularly weak year for construction given how slow the pre-sale market’s become over the last couple of years,” Shaun Hildebrand, president of Urbanation Inc., tells STOREYS. “That’s a lot of jobs, and it’s a lot of supply that the market isn’t going to be getting in four-to-five years’ time — so these are other by-products of what’s happening in terms of the slowdown in project launches,” he adds.

What Condo Delays Mean For GTA’s Economy And Labour Market

With the rate of homebuilding in Canada slowing — a trend that’s expected to continue — the potential headwinds for the GTA’s economy are significant, experts say.

For example, some 1,600 jobs are created for every 1,000 condo units that are built in the region, notes Justin Sherwood, senior vice president of communications and stakeholder relations at the Building Industry and Land Development Association (BILD), which represents developers around the GTA. “As you see construction activity decrease and projects get pushed down the road, there are very, very real impacts for the GTA as well as for those who are employed by the sector,” he tells STOREYS, adding that 1,000 cancelled units erases $400M in potential economic activity.

For a recently completed GTA mid-rise building encompassing about 100 units, Ainis of Fusioncorp says he contracted out labour to about 50 different companies, providing paychecks for several hundred workers. “Just on the job site itself, there’s tons of companies,” Ainis explains.

Roles included everything from excavators to dig the foundation and form workers to build the bones of the structure, to waterproofing specialists, appliance installers, drywallers, painters, and security to monitor the site — not to mention consultants. “111,000 hours of manpower went into this project,” says Ainis, citing a figure from an internal financial report on the mid-rise condo building. The wages for on-site jobs range from $35 to $60 per hour, depending on factors such as the specific type of labour and whether or not the roles are unionized, he explains. “The minimum is 40 hours a week” when a project is under construction, Ainis adds.

Thanks to an earlier building frenzy, Ainis says his company is working on about 10 projects, the most Fusioncorp had in the pipeline at one time — but many of these are nearing completion. “We feel the impact, because when you’re near the end of the project, your fees are kind of fizzling out,” explains Ainis. There still are some aggressive developers out there who are planning on forging ahead, and Ainis hopes that he can secure some of these contracts. “The flipside to the development industry is, yes, there are rewards, but there’s a lot of risk,” he says. “It’s a very, very tough business.”

What makes matters worse for the economy, suggests Central 1 Chief Economist Bryan Yu, is the fact that other segments aren’t there to pick up the slack this time. Sometimes, during a slowdown in new construction, you might see some companies turn to renos. But higher interest rates have also sidelined the investors and homeowners who might pay for the work, and they’ve curtailed business investment, too. “We haven’t really been seeing too much of that just given the business conditions,” Yu tells STOREYS.

If there is a silver lining to the deathly silence in the new-condo market, it’s that it’s allowing projects that have been delayed by material and labour shortages to get topped off. “We just don’t have enough people to be completing all these sites and starting new ones as well,” Edward Jegg, a research manager at Altus Group, which advises developers, tells STOREYS. “The timeline to completion had been stretched out dramatically,” he notes.

Last year, developers delivered a record of nearly 28,000 units in the GTA, with this year tracking 25% above that level. “[The delay in new developments] is really allowing these projects to finally get completed,” says Jegg.

Lower Interest Rates Will Help Reboot Homebuilding — Eventually

Just as a Bank of Canada cut to the overnight rate won’t magically restore housing affordability in the GTA, housing construction won’t spike at the first sign of more favourable financing terms for developers (or their pre-construction buyers). “It’s going to take time,” says Yu.

Developers must sell units — typically 70% to secure financing, says Urbanation’s Hildebrand— before they can get shovels into the ground. There can be lags of a year or more between launches and construction, and there is currently a record backlog of unsold new condo units. “It’s going to take a while to bring that inventory back down,” says Hildebrand.

So how can there be talk of supply concerns when so many units have flooded the market? Jegg from Altus Group suggests a “big issue” is that land with redevelopment potential isn’t trading like it used to. These properties can take three to six years to prepare for development, so when pent-up demand returns there’s a mid-term risk that the building industry won’t be able to respond. “It’s been a dramatic falloff in these land sales,” says Jegg.

Although a BoC rate cut likely won’t turn the new condo market on its head, it will be an important first step towards a potential return to normal, suggests Hildebrand. “It’s not necessarily that a quarter-point rate decrease is going to change the market, but it’s more like it’s going to help improve sentiment — sentiment in the market is very low right now,” he says. “The market wants to see that these rates are starting to move lower.”