Despite the fact that we’ve seen things perk up in the housing market, generally speaking, the Greater Toronto and Hamilton Area’s new condominium segment remains remarkably sluggish — in large part, because developers have “dramatically pulled back” as they see that buyers aren’t willing (or aren’t in the position) to bite.

Urbanation reported on Monday that only four new condo projects were brought to market in the GTHA in the first quarter of 2024. Those four projects jointly contained 958 individual housing units, and three were in the 905 region.

The Toronto-based research and consultancy firm also said that, jarringly, around 60 new condo projects that were on track to launch since the market began to slow down in 2022 are now “on hold indefinitely.” Those 60 projects would have added some 21,505 new housing units to the region, and were already being marketed to the public when they were put on hold. (This past September, those same figures clocked in at 31 projects and 8,038 units, according to figures previously provided to STOREYS by Urbanation.)

When you consider the state of the buyer pool as of late, those figures do make sense. On the pre-construction side, Urbanation reported that developers that stayed locked in on their pre-construction projects in the first quarter of 2024 were met with tepid results. In fact, just 50% of the pre-construction projects across the region were pre-sold in the quarter, down from a 61% average absorption level a year ago and 85% two years earlier.

Meanwhile, unsold inventory across all stages of development in the GTHA came in at 23,815 units in Q1-2024, marking a 2% quarterly dip, but 30% and 124% increases over the past year and two years, respectively.

“Overall, asking prices for unsold units in the GTHA declined 3% annually to an average of $1,373 per sq. ft,” Urbanation also said. “Additionally, there was widespread use of incentives, among which included reduced or free parking, reduced or no development levies, reduced deposits of less than 15%, rental guarantees, 5% or higher broker commissions, interest on deposits and mortgage assistance programs.”

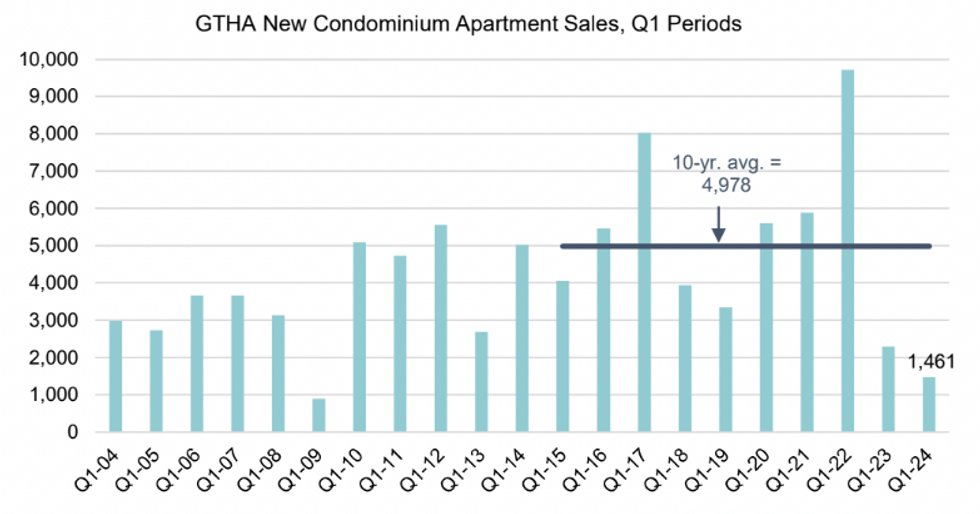

Though developers did their best to entice GTHA buyers last quarters, new condo sales still took a major hit. According to Monday’s data, just 1,461 sales were recorded across the region in the quarter, putting quarterly sales at the lowest level since the Global Financial Crisis in Q1-2009. “Outside of that brief period in early 2009, new condominium sales haven’t been this low since the late-1990s,” Urbanation also noted.

In addition, sales recorded over the first quarter came in 71% below the latest 10-year average for Q1 periods (4,978 sales), and were also down a whopping 85% from the Q1 high reached in 2022 (9,723 sales).

As for new construction: there was a steep drop-off in the quarter. “In Q1-2024, 2,361 new condominiums began construction in the GTHA, down 52% annually,” the firm said.

“After two years of pre-construction sales trending down sharply, construction activity is being hit hard,” said Urbanation President Shaun Hildebrand. “While anticipated reductions in interest rates in the second half of the year should lead to some improvement in market conditions for new condominiums, activity will likely remain subdued as the industry works it way through current inventory and digests the numerous government policies on housing recently released.”

Looking ahead a little: a total of 17,076 units across 56 projects have released marketing materials for an upcoming launch in the next couple quarters, according to Urbanation, with 70% of those slated for the 905 region.

- Over 30 GTHA Condo Projects Delayed As Developers Await “Better Market” For Launch ›

- GTA Sees Record-Setting Absence Of High-Rise Condo Launches In 2024 ›

- Over 22,000 New Condo Units Are Going Unsold In The GTA — A “Record High” ›

- High-Density Land Sales Plunge To A 10-Year Low In GTA ›

- Why Development Land Is The Most Common Asset To Fall Into Distress ›

- A Record Number of New Condo Units Are Going Unsold In GTHA ›

- More Than 75 Condo Projects On Hold In GTHA Amid “Dislocated” Market ›

- 33 Condo Projects Changed To Rental, Cancelled, In Receivership Since 2022 ›