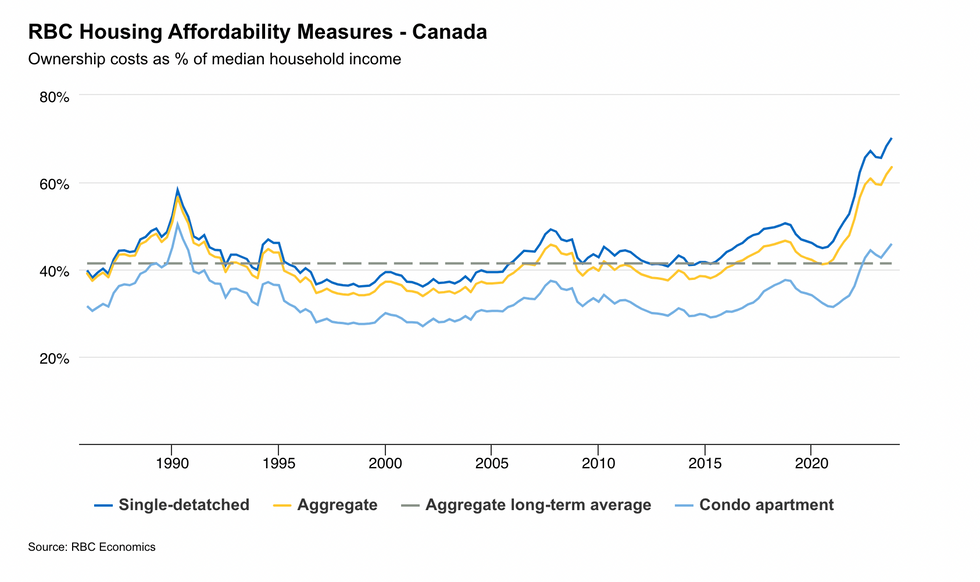

In news that may come as no surprise for Canada’s homebuyers, and would-be homebuyers, it’s officially the most unaffordable time ever to purchase a home, according to RBC Economics (something the big bank has pointed out in the recent past, as well). In a new report, RBC economist Robert Hogue points to perpetually high interest rates (a historic campaign that began back in March 2022), soaring mortgage costs, and a notable deterioration in the country’s priciest markets as setting the stage for a challenging time for buyers.

As Hogue highlights, high interest rates sent home ownership costs to new heights in the last quarter of 2023. A Canadian household earning a median income needed to spend a tough-to-swallow 63.5% of it to cover the costs of owning an average home at market price – a figure that’s up from 61.8% in the third quarter. Brace yourself: this figure is much higher in places like Vancouver and Toronto.

While home prices have dropped from coast to coast after a red-hot run that began not long after the onset of the pandemic, Hogue highlights that our current climate of soaring interest rate costs more than offset these price drops. Despite Canada’s composite home prices easing 0.5% quarter over quarter, the monthly mortgage payment for the composite home (valued at $796,300) increased more than $125 (3.3%) last quarter to $3,990.

While affordability worsened in every market RBC tracks, the country’s most expensive markets – Vancouver, Victoria, and Toronto – experienced the biggest deterioration, something Hogue says is “further exacerbating acute stress” in these regions. They’re not alone in their struggles: the situation is becoming more challenging in Ottawa, Montreal and Halifax, where affordability is at, or near, all-time worst levels.

The figures aren’t for the financially faint of heart. In Vancouver, a household would need a whopping 106.3% of median Canadian household income to cover home ownership costs, a figure that has prompted Hogue to state that the west coast city is "in a full-blown crisis." Toronto, this figure is 84.8% – its worse level ever. Gulp.

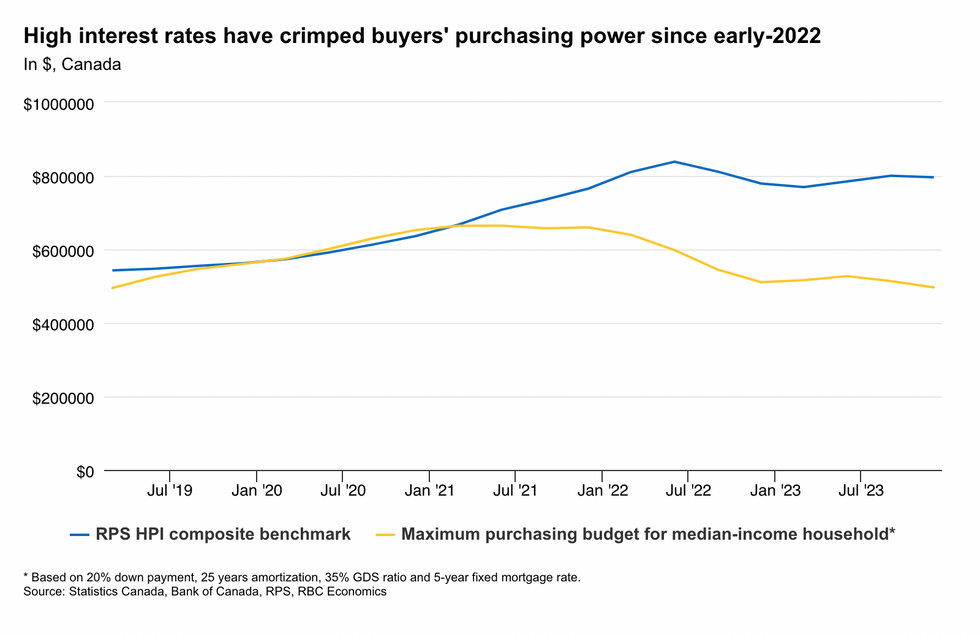

Hogue highlights how – despite a rate hike pause last summer – interest rates have “crimped” the budgets of Canada’s buyers.

“We estimate they’ve shrunk the maximum budget for a household with a median income ($85,400 at the end of 2023) by 22% since the first quarter of 2022 to just under $500,000 (assuming a 20% down payment and 25-year amortization period),” writes Hogue. “Home prices, meanwhile, have fallen just 1.8% over the same interval. It’s no wonder homebuyer demand has cooled so much. The ability of many Canadians to get into the housing market has greatly diminished.”

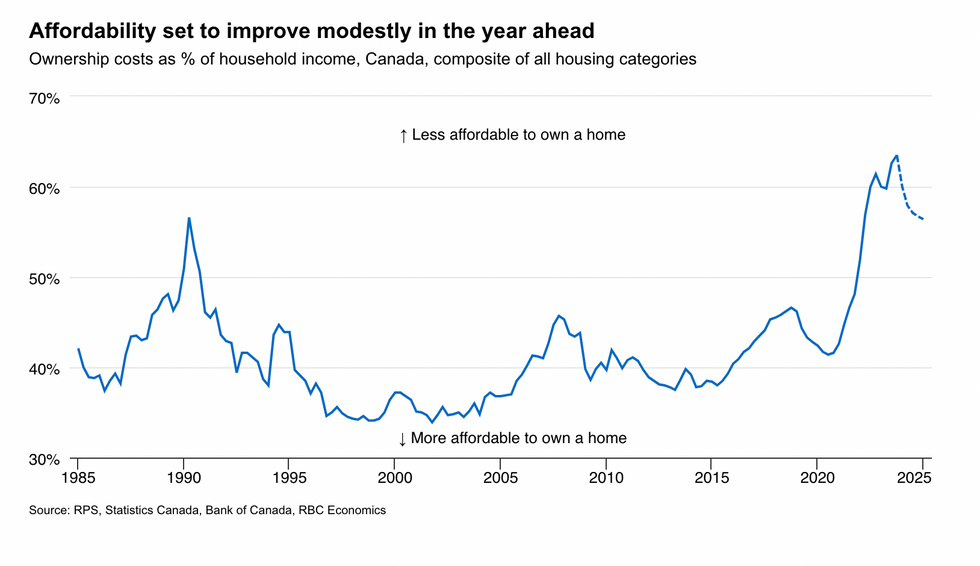

The good news? There’s some relief in sight. The rate drops countless Canadians are waiting for could come with the summer sun, according to Hogue. “We see the growing likelihood of rate cuts starting mid-year as a turning point for housing affordability in Canada,” writes Hogue. “We expect lower borrowing costs will restore some of the massive losses during the pandemic.”

You may want to hold off on the champagne celebrations, however. “Any improvement over the coming year is poised to be modest and leave budget-constrained buyers wanting,” writes Hogue. “The scope for improvement in the year ahead — while sufficient to rekindle some buyers’ enthusiasm — will be small relative to dramatic loss of affordability that occurred during the pandemic.”

In simple terms, under RBC’s base case scenario, the share of an average household income needed to cover ownership costs would only fall to mid-2022 levels by 2025 – something that would “scarcely lower the bar for most potential buyers.”

The bottom line is that meaningfully restoring affordability will likely take years in many of the country’s priciest markets. “In this context, we expect the housing market’s recovery to be slow at first, before gaining momentum as interest rate cuts accumulate,” writes Hogue. The rollback of earlier hikes will help restore some buying power and narrow the gap with market prices — provided the latter don’t rise too rapidly."

In the meantime, no shortage of sidelined house hunters will inevitably wait for rate cuts before looking for a new home.