It has never been so unaffordable to own a home in Canada.

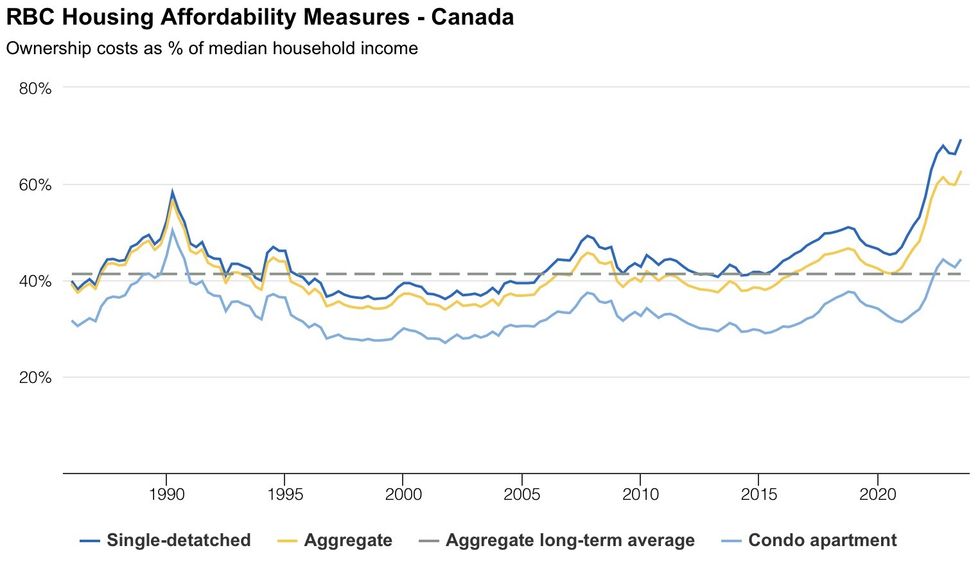

Rising ownership costs, including high mortgage rates and home prices, pushed RBC’s national aggregate housing affordability measure up 2.8% in Q3, to 62.5%.

The increase, which is outlined in a new report from Robert Hogue, Assistant Chief Economist at RBC, follows two consecutive quarters of decline, and has propelled the measure above the previous all-time high of 61.2% that was reached in Q3 2022.

RBC's affordability tool measures ownership costs as a percentage of median household income; when the ratio falls, affordability improves. The long-term average for the aggregate measure is 41.3%. In January 2020, it sat at 42.4%.

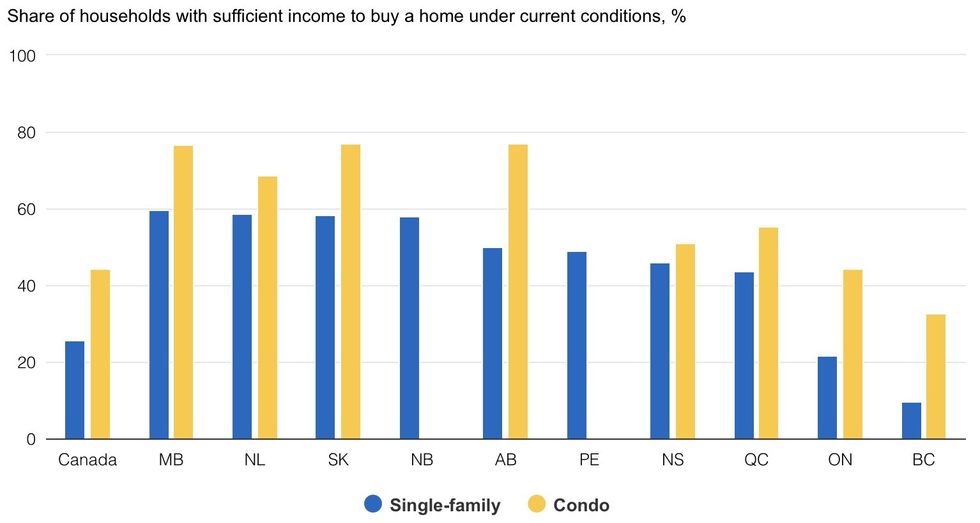

"The significant loss of affordability during the pandemic has shrunk the pool of homebuyers in Canada," Hogue said. "Many households are priced out of the market, especially in BC and Ontario."

In 2019, nearly 60% of all Canadian households could afford to own a condo based on their income. As of 2023, that share has fallen to 44.5%, and just 25.7% have sufficient income to buy a single-family home.

On a provincial basis, more than 75% of households can afford to own a condo in Manitoba, Saskatchewan, and Alberta, as can more than 50% of households in Quebec, Nova Scotia, and Newfoundland and Labrador. The figure falls below 45% in Ontario, and below 33% in British Columbia.

The reality of the affordability crisis plaguing the latter two provinces is distinctly starker when it comes to single-family homes. In Ontario, the share of households that can afford the property type is 21.7%, while the share is 9.8% in BC. In Alberta, New Brunswick, Manitoba, Saskatchewan, and Newfoundland and Labrador, it’s upwards of 50%.

Locally, RBC’s aggregate affordability measure rose in all markets in Q3. Affordability reached its worst-ever level in Toronto (84.1%), Victoria (76.1%), and Halifax (44.2%), and soared to a 15-year high in Edmonton (36.7%) and Saskatoon (35.7%).

Affordability hovered near record-high levels in Montreal (51.9%), Ottawa (48.4%), and Saint John (30.2%). At 47.6%, Calgary may soon overtake Canada’s capital as the fifth least-affordable market in the country, Hogue warned.

In Vancouver, an entire median household income can no longer cover the costs of owning an average home, with RBC’s aggregate affordability measure rising to an "astounding" 102.6%.

Despite the significant deterioration in affordability, there is "modest relief" on the horizon, as Hogue expects the third quarter of 2023 will prove to be the cyclical-worst point for RBC’s affordability measure.

As home prices decline or stabilize in the majority of markets and incomes continue to grow, affordability should improve. A further boost will come once the Bank of Canada starts cutting interest rates, which Hogue believes will be around mid-2024.

But, despite hopeful signs that ownership costs will decline, any improvement in affordability next year will be "modest." RBC’s aggregate affordability measure is forecast to fall to 56.3% by January 2025, well above the long-term average.

"There’s a very long way to go before affordability is meaningfully restored," Hogue said. "Buyers in many of Canada’s large markets will contend with extremely difficult conditions for some time."