This article was written and submitted by Cameron Levitt, a Toronto-based real estate agent with RE/MAX Hallmark who writes about housing dynamics, market trends, and the Canadian economy.

A recent CMHC report titled "Is Toronto's condo market downturn a repeat of the 1990s?" points to a possible future rebound as new supply has essentially stopped. The argument is straightforward: With no new projects breaking ground today, the eventual shortage could drive another wave of appreciation tomorrow. That thesis is the foundation for many to ask and question whether or not it's time to buy investment condos.

It is a question worth exploring. Toronto has experienced cycles where underbuilding eventually led to renewed price growth, and CMHC is correct to highlight that construction slowdowns can set up future scarcity. For many investors, the current environment feels like a classic 'buy when there's blood in the streets' moment; prices have fallen from peaks, sentiment is negative, and conventional wisdom says to avoid the asset class entirely. But before assuming that contrarian instincts and long-term supply dynamics alone make condos a smart buy in 2025, it is worth looking at the mechanics that investors actually face today. When you do, the investment case breaks down quickly.

The Core Problem: Negative Cash Flow For Investors

Almost every condo in Toronto is cash-flow negative at current interest rates and prices. Consider a typical downtown one-bedroom listed at $619,000. Even with a 4% mortgage rate and 30-year amortization, monthly costs hit $3,349: $2,364 for the mortgage, $699 in maintenance fees, and $286 in property taxes. Against rental income of $2,600, that creates a monthly loss of $749 before taxes, vacancy, and repairs.

In the past, negative cash flow was not disqualifying because price appreciation offset monthly losses. Without a trend of strong appreciation, the negative carry just subsidizes tenants every month with no guarantee of payoff.

Even significant rate cuts would not solve the problem. At 3.25%, investors would still lose $540 monthly. To break even on cash flow would require an interest rate of roughly 1.1% or a purchase price around $423,000, roughly $196,000 below current levels. Major bank economists like CIBC's Benjamin Tal forecast the Bank of Canada policy rate declining to only 2.25% by the end of 2025, nowhere near the levels needed to make condo investment viable.

What The Condo Investment Thesis Really Was

The condo investment thesis evolved over time from rental income to pure speculation. While early condo investors may have focused on steady rent returns, the model gradually shifted to a leveraged momentum trade dressed up as property ownership. Most "investors" were not holding units for steady rent checks, they were speculating on price growth through pre-construction contracts.

Pre-construction operated like commodity futures contracts, where buyers lock in fixed prices for future delivery while betting on asset appreciation. A buyer would put down 20% over several years, lock in a purchase price, and ride the market higher without taking on a mortgage. If values rose, the contract could be flipped before closing for significant profit. It was leverage without carrying costs.

From 2016 through 2021, developers launched tens of thousands of condo units that were quickly sold to small investors chasing momentum, not end users who planned to live in them. Those projects are now delivering into an entirely different market defined by higher interest rates, weaker rents, and falling resale values. The very strategy that drove condo investment is now the source of its vulnerability.

The speculation-driven market also shaped what developers actually built. For years, developers optimized units to satisfy investor demand rather than end-user livability. As prices climbed, units got smaller and layouts became more cramped to hit lower price points that attracted speculators. The result is a glut of small, poorly designed units that offer limited livability for actual residents. Even if the pre-construction market eventually recovers, developers will need to start building units that people actually want to live in, not just speculate on. This means what investors are purchasing now represents leftover inventory from a development era that no longer exists.

When rates are extremely low, investors can justify holding cash-flow negative assets because carrying costs are minimal and momentum-based appreciation covers shortfalls. But when rates rise, fundamentals reassert themselves. Higher capital costs turn manageable losses into crushing monthly drains, while also cutting off the new buyer flow needed to sustain price growth.

Rising Maintenance Fees And Construction Inflation

Maintenance fees are a drag on cash flow, and they are structurally set to rise. A 2023 study of 60 condo corporations across the GTA from Condonexus found average fee increases of 5.1% year over year, while contributions to reserve funds rose by 11.8% on average. Reserve funds, which cover big-ticket items like windows, roofs, and elevators, now represent about a quarter of the typical condo budget.

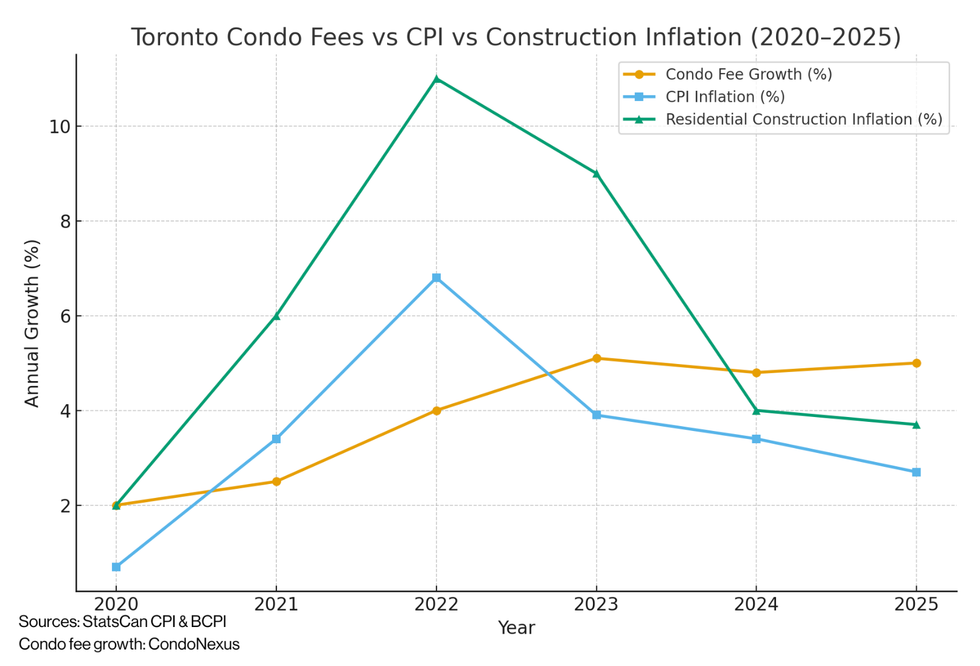

Those costs are driven by construction inflation, not consumer goods inflation, and that distinction is critical. Most of a condo's operating budget goes to maintenance, services, and repairs, while the reserve fund is entirely exposed to construction costs. As the chart below shows, construction costs have consistently outpaced general inflation, creating persistent upward pressure on maintenance fees even as broader price levels have moderated.

Condo corporations face constant pressure to raise fees to keep pace with higher contractor quotes and material costs. The situation may worsen because reserve fund studies are conducted only every three years, meaning many buildings have not yet gauged how recent price increases need to be accounted for in future budgets. Even though construction inflation has moderated from its peak, the massive price increases from 2022-2023 are baked into the cost base, and it will take years of sustained lower growth for other costs to catch up.

Supply And Demand Misalignment In The Investor Market

The CMHC report is right about one thing: new condo launches have slowed to almost a complete stop. But that long-term supply crunch is colliding with a near-term oversupply. The projects launched during the low-rate era are now completing, adding thousands of units to the resale and rental markets. Even with some cancellations, the pipeline remains large enough to act as a drag for years.

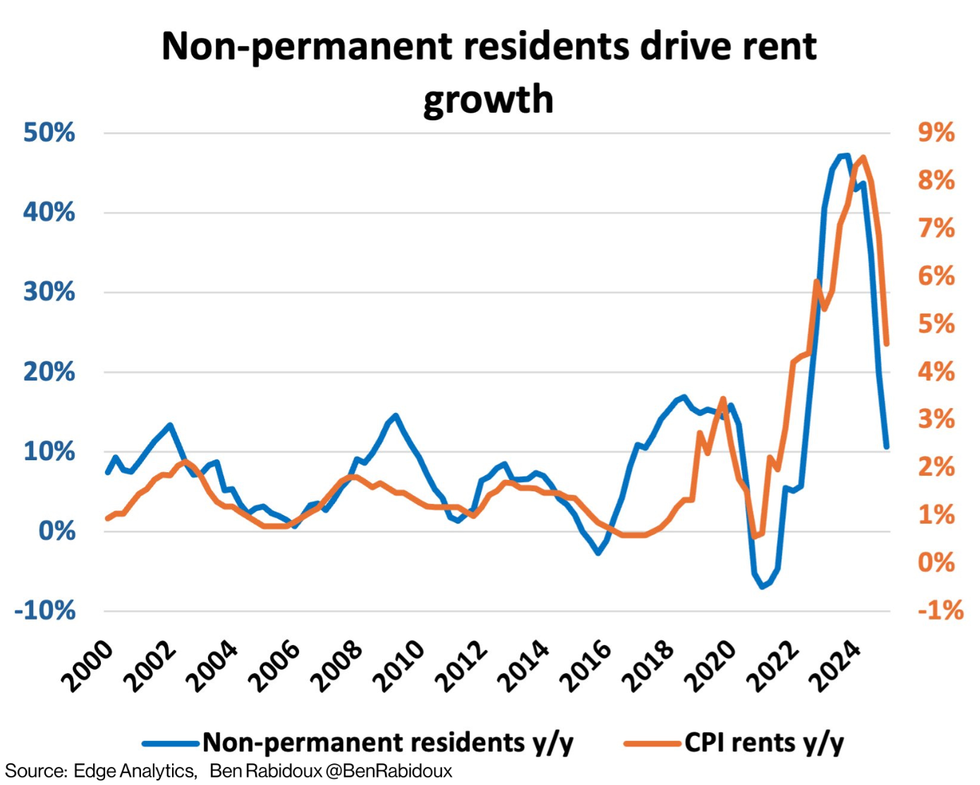

At the same time, rental demand has softened. Housing analyst Ben Rabidoux from Edge Analytics has documented a strong correlation between non-permanent resident growth and Ontario rental prices, as shown in the chart below. Federal policy has cut back temporary resident inflows, particularly student permits, which were a key driver of downtown condo rentals. The dramatic decline in non-permanent resident growth from its 2022-2023 peak coincides directly with the cooling rental market, illustrating how policy changes have removed a critical source of rental demand.

Without that steady churn of new tenants, the upward pressure on rents has stalled. Urbanation reported that average condo rents in the GTA fell by 2.8% year over year in Q1 2025, down to $3.78 per square foot (about $2,612 for a typical 692-square-foot unit). At the same time, active condo rental listings were up 29% year over year, pushing available supply to 1.4 months of inventory, well above the 10-year average of 0.95 months. A rental market under pressure colliding with new supply is not a recipe for investment success.

Institutional Competition In The Rental Market

Another overlooked factor is the growing role of institutional players. Pension funds, REITs, and private equity are building large rental portfolios across Canada. Unlike small investors, they operate with vertically integrated business models, combining construction, financing, and property management under one umbrella.

They also benefit from CMHC-backed financing that offers better loan terms such as lower downpayments, lower rates, and longer repayment periods (40-50 years). These are a huge advantage which are not available to small investors purchasing individual condo units. Institutional players are rapidly capitalizing on these programs: in the first three quarters of 2024, CMHC provided mortgage insurance for over 200,000 apartment units totalling C$48 billion, a 59% increase year over year.

This institutional capital is also targeting the same rental market that small condo investors depend on. In 2024, 40% of condo units in the GTA were rented, up from 29% in 2014, but condo rental units average approximately 50% higher rents than comparable purpose-built rental units. As institutions build more purpose-built rental supply at scale, they can offer tenants better value while still achieving superior returns due to their financing and operational advantages.

That structural advantage means institutions can weather market volatility while achieving superior returns through operational efficiencies. Smaller condo investors are left competing in a game tilted against them.

Conclusion: Answering The Question

So, is it time to 'buy the dip' on investment condos? The CMHC report raises valid concerns about long-term supply constraints, and history does show that construction slowdowns can eventually support price rebounds. But while CMHC focuses on multi-year supply dynamics, the mechanics facing individual investors today tell a different story entirely. Today's investor faces negative cash flow, oversupply, weaker rental demand, institutional competition, and steadily rising costs.

The supply crunch thesis may prove right someday, but in 2025, the risk-reward is firmly against small condo investors. CMHC's long-term optimism about supply and demand doesn't change the fact that buying the dip today is not an investment, it is speculation on future conditions that remain uncertain.