Coming as zero surprise, Canada’s relentless housing crisis is front and centre of the just-released Federal Budget 2024. In addition to a seemingly endless slew of announcements made in April, Prime Minister Trudeau and his government introduced housing-related promises that targeted everything from ramping up the construction of new homes and new initiatives to help first-time homeowners, to increased protections for renters and measures to target homelessness – and a lot more.

As a result, there were no real surprises on the housing crisis front with Budget 2024. One thing was, however, notably clear: Canada’s wealthiest will essentially pick up some of Canada’s housing tab. The Budget 2024 zeroed in on Canada’s wealthiest residents, asking them to pay their fair share. In total, the budget includes a cool $8.5B in new spending for housing.

“Budget 2024 proposes new measures that will make the tax system more fair and generate $21.9B in revenue over five years to invest in building more homes, faster, creating good-paying jobs, and incentivizing economic growth that delivers fairness for every generation,” reads the Budget.

In an attempt to justify the move, it highlights an analysis by the Parliamentary Budget Officer that shows that in 2019 the top 1% held 24.9% of Canada’s household wealth. “At a time when middle class Canadians are struggling to get ahead, when their hard work isn’t paying off, the government is improving the fairness of the tax system,” reads the Budget. “We are asking the wealthiest Canadians to contribute a bit more, so that we can make investments to ensure a fair chance for every generation.”

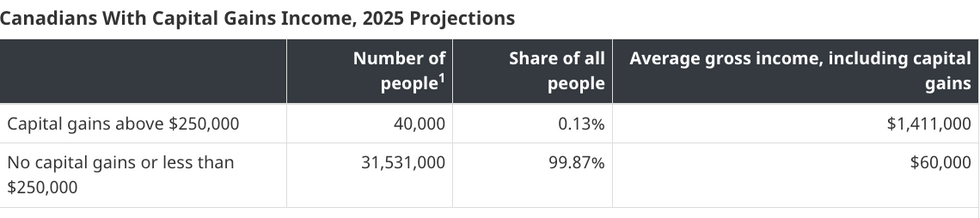

In an effort to make Canada's tax system “more fair,” the government is proposing an increase in taxes on capital gains. In total, capital gains tax revenue from individuals and corporations is expected to generate $19 billion in new revenue. The government intends to increase the inclusion rate on capital gains realized annually above $250,000 by individuals and on all capital gains realized by corporations and trusts from one-half to two-thirds, by amending the Income Tax Act (effective June 25, 2024). The inclusion rate for capital gains realized annually up to $250,000 by individuals will continue to be one-half (50%).

According to the budget, just 0.13% of Canadians with an average income of $1.4M are expected to pay more personal income tax on their capital gains in any given year. As a result of this, for 99.87% of Canadians, personal income taxes on capital gains will not increase. Still, we don’t imagine the less-than-one-percent of Canadians it will affect to be all too thrilled.

In case you’ve missed it, here’s a recap of what else Trudeau’s government has promised when it comes to housing this April (sit down; it’s a lot).

New $6B Infrastructure Fund

On April 2, Trudeau’s big item of news was a $6B Canada Housing Infrastructure Fund, which he said would "accelerate the construction and upgrading of critical housing infrastructure" — water, wastewater, stormwater, and solid waste infrastructure. The $6B will include $1B that will be available for municipalities with urgent infrastructure needs that will directly result in more housing. The remaining $5B will then be made available to provinces and territories to support long-term priorities. But there are strings attached; provinces only qualify for the fund if the “commit to key actions that increase housing supply.”

Most notably – and controversially – these include requiring municipalities to completely embrace fourplexes. It also includes implementing a three-year freeze on increasing development charges; adopting forthcoming changes to the National Building Code to support accessible, affordable, and climate-friendly housing options’ require as-of-right construction for the government's upcoming Housing Design Catalogue; and implementing measures from the Home Buyers' Bill of Rights and Renters' Bill of Rights.

Measures to Speed Up The Construction Of New Homes

On April 3, Trudeau announced measures that are designed to speed up the construction of new homes across the country. Stating his agenda for a “team Canada” approach, Trudeau called on every order of government to come together to build more homes for Canadians at affordable prices, especially on land ready for development. The prime minister announced that his government would be delivering a $15 billion top-up to the Apartment Construction Loan Program to build a minimum of 30,000 new apartments. “With this top-up, the program’s financing is on track to build over 131,000 new apartments within the next decade,” reads a press release.

Trudeau also announced new reforms to the Apartment Construction Loan Program – an initiative that boosts the construction of new rental homes by providing low-cost financing to homebuilders – to increase access to the program and make it easier for builders to build. These reforms include: extending loan terms; extending access to financing to include housing for students and seniors; introducing a portfolio approach to eligibility requirements so builders can move forward on multiple sites at once; providing additional flexibility on affordability, energy efficiency, and accessibility requirements; and launching a new frequent builder stream to fast-track the application process for proven home builders.

On the same occasion, Trudeau also announced the launch of Canada Builds, partnering with provinces and territories to build more rental housing across the country. “The federal government is leveraging its $55 billion Apartment Construction Loan Program by making it available to support partnerships with provinces and territories that launch their own ambitious housing plans, similar to the recently announced BC Builds initiative,” reads a release.

$600M Towards Housing Prefabrication, Homebuilding Innovation Mortgages

On April 5, Prime Minister Justin Trudeau announced a new series of actions the Government of Canada will be taking geared towards prefabrication and modular housing solutions. The first item is a $50M Homebuilding Technology and Innovation Fund, which will go towards scaling up and promoting innovative housing solutions such as prefabricated and modular housing. In a press release, the Government of Canada said that the fund will also seek to "leverage an additional $150M from the private sector and other orders of government" and that it will be led by Next Generation Manufacturing Canada.

Another $50M will be delivered through the regional development agencies and go towards "modernizing building practices through modular housing, mass timber construction, robotics, 3D printing, and automation." Thirdly, Trudeau announced that his government will be reviving and updating its post-war Housing Design Catalogue with up to 50 new designs, including blueprints for rowhouses, duplexes, fourplexes, and other building forms.

Lastly, through the existing Apartment Construction Loan Program, another $500M will be made available specifically for "new rental housing projects using innovative construction techniques," such as prefabrication and modular manufacturing.

30-Year Mortgages For (Some First-Time Buyers)

Last week, Finance Minister Chrystia Freeland announced that the Canadian government would allow 30-year amortization periods on insured mortgages for first-time homebuyers purchasing newly-built homes.Organizations like the Canadian Home Builders’ Association (CHBA), naturally, support the move. After the announcement, it didn’t take long for the CHBA to issue a press release, stating its support for the new changes. The move, however, wasn't without its critics. Multi-Billion Dollar Plan to “Solve” Canada’s Housing Crisis.

Toronto-based mortgage broker and real estate commentator Ron Butler is one such critic. “This is very insignificant because it’s highly restrictive,” Butler told STOREYS. “It’s only for new construction and only for first-time homebuyers.”

The changes will take effect on August 1.

Multi-Billion Dollar Plan To “Solve” Canada’s Housing Crisis

On Friday, the Liberals' most ambitious announcement involved seemingly countless promises. The plan lays out a bold (and very ambitious) strategy to unlock 3.87 million new homes by 2031. The 28-page Solving the housing crisis: Canada’s Housing Plan promises to direct major dollars to help battle the country’s housing crisis and deliver more homes. This means $1.5 billion for a new co-op development program and allocating $1 billion to an existing program, which provides loans to those building and repairing affordable housing.

The Liberal government turned its focus to the impossible-to-ignore reality that housing encampments are growing in cities like Toronto, promising to eliminate these illegal communities throughout the country. The golden solution comes in the form of a $250-million fund, a figure that would be matched by provinces and allocated to impactful community action plans designed to get people out of tents and into housing. This includes creating more supportive and transitional housing and providing relief on the rental front. Furthermore, the government announced that it would top up the Reaching Homes federal homelessness initiative with another $1 billion over four years.

For renters, Trudeau announced the launch of a $1.5 billion Tenant Protection Fund to offer funding to legal services and tenants’ rights advocacy organizations to better protect tenants against unfairly rising rent payments, renovictions, or bad landlords. The government said they’re providing more affordable and rental housing. This means $1 billion for the Affordable Housing Fund to build affordable homes, launching a permanent Rapid Housing Stream, and the launch of a $1.5 billion Canada Rental Protection Fund to protect and expand affordable housing.

The plan also introduced the idea of leveraging rental payment history to improve credit scores, helping potential homebuyers qualify for a mortgage and better rates. On the homeowner front, Trudeau announced his government would be increasing the Home Buyers’ Plan withdrawal limit by $25,000 and extending the grace period to repay by an additional three years.

Furthermore, Trudeau announced new measures included in Canada’s Housing Plan to attract, train, and hire the skilled-trade workers Canada needs to build more homes. This means $90 million for the Apprenticeship Service; $10 million for the Skilled Trades Awareness and Readiness program; and $50 million in the Foreign Credential Recognition Program.

In the same announcement, Trudeau said that his government would increase the capital cost allowance rate for apartments from 4% to 10%, something that will increase the amount that builders can write off come tax time. On that front, the government also wants to restrict corporate investors from scooping up existing single-family homes. He announced $15 billion in additional loans for the Apartment Construction Loan Program to build a minimum of 30,000 new rental apartments in big cities, small towns, and rural communities. With this additional financing, the program is on track to build over 131,000 new apartments by 2031-32.

Student housing (or lack thereof) has also become an incredibly pressing issue. The government announced it will extend the existing GST exemption on rentals to student residences built by public post-secondary academic facilities. Unlocking public land for development was also front and centre. Trudeau announced that a Public Lands for Homes Plan will lead a national effort to build affordable housing on federal, provincial, territorial, and municipal lands across the country.

The prime minister said his government would be delivering a $15 billion top-up to the Apartment Construction Loan Program to build a minimum of 30,000 new apartment and new reforms to the Apartment Construction Loan Program – an initiative that boosts the construction of new rental homes by providing low-cost financing to homebuilders. These reforms include: extending loan terms; extending access to financing to include housing for students and seniors; introducing a portfolio approach to eligibility requirements so builders can move forward on multiple sites at once; providing additional flexibility on affordability, energy efficiency, and accessibility requirements; and launching a new frequent builder stream to fast-track the application process for proven home builders. Also announced was the launch of Canada Builds, partnering with provinces and territories to build more rental housing across the country.