Home sales and housing starts lost some steam last month in the wake of back-to-back interest rate hikes, and one economist says that dips in both those indicators could tempt the Bank of Canada to hold its benchmark policy rate steady come September.

In a note from Wednesday, Desjardins Economist Marc Desormeaux points to the fact that Canadian housing starts slipped by 10% from June to July, while national housing sales fell by 0.7%, marking the first monthly decline in six months.

“The Bank of Canada will likely take some comfort in the sales and starts weakness documented this week, particularly after recent cooling in GDP, employment, trade, and core inflation,” he says. “Combined, these more downcast indicators suggest the painful medicine of higher interest rates is working to cool down economic growth and bring price pressures to heel.”

Accordingly, Desormeaux anticipates that the BoC’s next interest rate announcement, scheduled for September 6, 2023, will see the policy rate held at 5%.

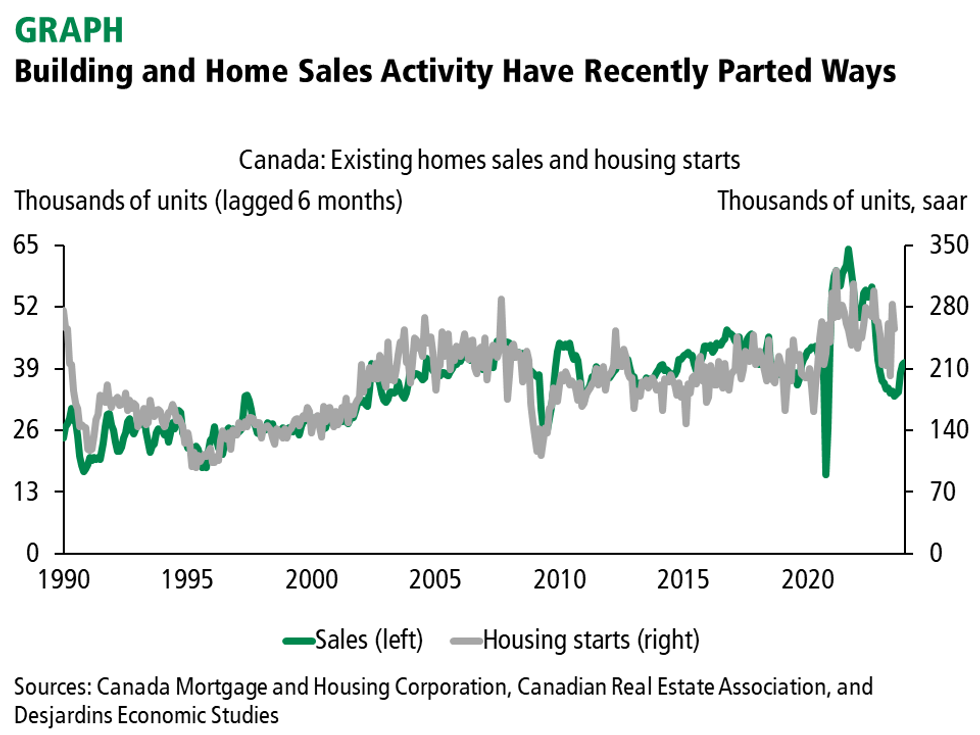

Still, he stresses that “so much is subject to change” between now and September. As well, he points out a peculiar trend with respect to aggregate new construction, which “remains very high relative to historical levels” and deviates from the trajectory of sales.

“To the ongoing question of whether homebuilding would experience the kind of downturn seen in the resale market, July’s answer was: ‘not quite.’ Historically, we’ve observed co-movement in home purchases and new construction, but the data continue to send mixed messages on this front,” writes Desormeaux.

“Going forward, we do expect a more significant slowdown, consistent with construction industry labour shortages, high borrowing and material costs, weak homebuilder sentiment, and expectations of softening economic activity.”

Inflation, Inflation, Inflation

It’s worth noting that this week also brought Statistics Canada’s latest inflation reading, which paints a far more dismal picture of the (prospective) rate realities to come.

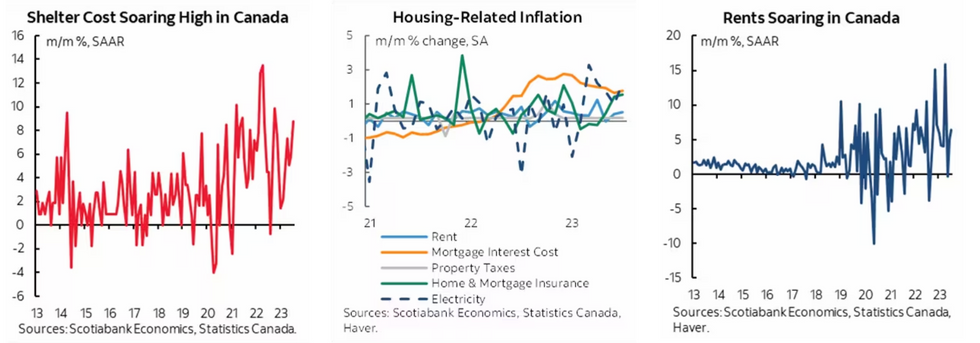

On Tuesday, the government agency reported that the Consumer Price Index ticked up to 3.3% year over year in July — thanks wholeheartedly to mortgage costs, which added close to an entire basis point to overall CPI — up from 2.8% in June.

Scotiabank’s Derek Holt digs into the data and the implications in a separate report from earlier this week, noting that, month over month, last month saw “significant breadth to the jump in services inflation.” Shelter costs, for instance, grew 0.7% (seasonally adjusted) driven by rent, insurance premiums, and electricity.

As immigration continues to surge, rents and house prices are bound to “push higher” and housing inflation stands to only get more “persistent,” says Holt. As well, he adds, price pressures in other service categories — including airfare, recreation, transportation, healthcare, and auto insurance — remain “unacceptably high.”

With overall inflation still looming over the BoC’s 2% target, Holt is of the belief that there will be more rate pain to come.

“When combined with robust wage data and moribund productivity that add second-round drivers to inflation risk plus other reasons to expect inflation risk to remain pointed higher the outcome is such that the BoC needs to continue to raise its policy rate in my opinion,” he says. “I’m of the ongoing view that politics and pressures aside, it needs to crush inflation risk and remain adherent to its principal mandate. It is at high risk to losing the fight.”