As mortgage costs soared and gasoline prices rose, Canada’s annual rate of inflation edged up in July.

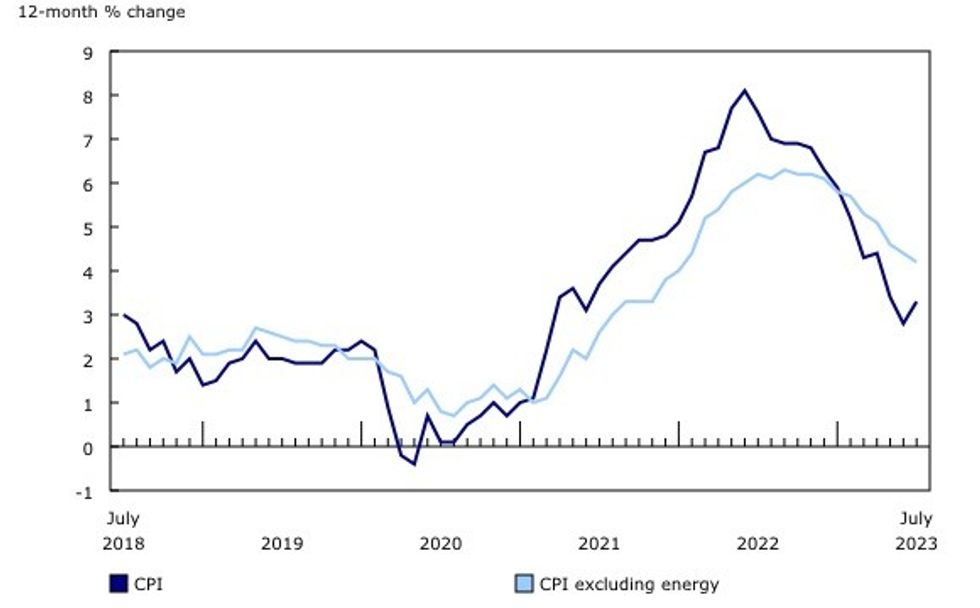

According to Statistics Canada's latest Consumer Price Index (CPI), inflation rose 3.3% year-over-year in July, up from 2.8% in June.

The largest contributor to headline inflation in July was the mortgage cost index, which increased 30.6% annually as an increasing number of Canadians renew or initiate at a higher rate. The rise follows a 30.1% jump in June, and marks the fifth consecutive month to register the largest increase on record. Excluding the mortgage interest cost, headline CPI rose 2.4% in July.

Following the Bank of Canada's back-to-back interest rate hikes this summer, the trend is likely to continue for the foreseeable future. In June, Jerome Trail, owner and broker of record at The Mortgage Trail, told STOREYS, the "real test" will come in 2025 and 2026, when the five-year terms initiated in 2020 and 2021, when interest rates were up to 4.75% lower, mature.

The acceleration in headline CPI, though, was largely attributable to a base-year effect on gas prices. Although they rose just 0.9% on a monthly basis in July, and were down 12.9% annually, a significant monthly decline (9.2%) seen in July 2022 is no longer impacting the 12-month price movement, which has put upward pressure on the year-over-year figure.

The base-year effect, which refers to the impact that price movements from a year ago have on the current month’s calculation, also had an impact on electricity prices, which rose 11.7% annually in July compared to a 5.8% jump in June.

The rise was largely due to a 127.8% increase in electricity prices in Alberta; policy interventions that were introduced in July 2022 — and led to a 24.4% monthly price reduction at the time — have ended, and last year’s price drop has fallen out of the 12-month calculation. Similarly, natural gas prices fell 15.7% in July, up from the 5.8% decline in June. The drop was mainly attributable to a base-year effect in Ontario, where prices rose 22.6% on a monthly basis. Overall, energy prices declined 8.2% in July, following a 14.6% drop in June. Although still elevated, grocery prices grew at a slower annual pace in July, rising 8.5% compared to a 9.1% increase in June.

The deceleration was driven by the price of fresh fruit, which rose 4.1% annually in July compared to a 10.4% increase in June. Prices fell 6.5% on a monthly basis, the largest decline since February 2008, as the cost of grapes fell 40.9% and the price of oranges dipped 1.8%.