Despite rising prices, the Canadian dream of owning a home is alive and well as homebuyers are determined as ever to buy a home.

But, as we all know, the process of buying a home can't begin without a down payment, and how much you need to put down varies from coast to coast.

When purchasing a home in Canada, the required down payment for a mortgage is determined by the home's purchase price. Therefore, you're required to put down a certain percentage (or more) of the total buying price of your home.

The minimum down payment across Canada for homes worth $500,000 or less is 5%, regardless of whether you are a first-time buyer or buying your second property. In other words, a $500,000 home would require a $25,000 down payment.

READ: Canada’s First-Time Home Buyer Incentive is Hardly Helping Anyone in Big Cities

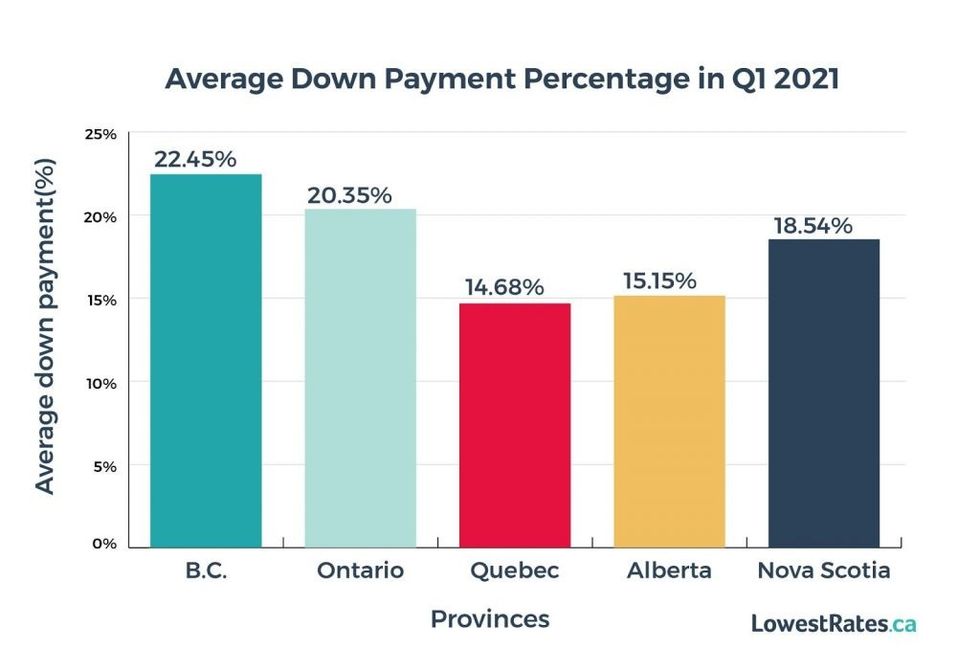

On average, homebuyers in Ontario and BC are putting down the most to secure a home, with down payments ranging between 20% and 22%, respectively, according to the latest Canadian Real Estate & Housing Market Forecast from LowestRates.ca, which analyzed data from the five provinces where it sees the most mortgage quotes.

The report revealed Ontario homebuyers paid an average of $140,215.37 -- or 20.35% -- in down payments in Q1 of this year, trailing behind BC, where homebuyers spent an average of $159,762.64 -- or 22.45% in down payments.

The report said the average down payments in Ontario and BC sit around 20% because the average home price in those provinces is close to $1 million. A home worth $1 million or more is not eligible for CMHC mortgage insurance, so the down payment must be at least 20%.

Homebuyers in Ontario paid an average of over $81,000 more in down payments than homebuyers in Quebec, which boasted the lowest average down payment rate of the five provinces measured at 14.68% ($58,571.68).

In comparison, Nova Scotians are putting an average payment of 18.54% ($57,781.46) down, while Albertans are paying around 15.15% ($62,929.45)

As prices for Canadian homes continue to rise, both down payments and mortgages will subsequently increase.

According to the report, new mortgage borrowing across Canada increased 41% year-over-year in Q1-2021, and the average amount for which borrowers were approved on new mortgages grew by 20.5% to $326,930, according to newly released data from Equifax.

And despite a decline in Canadians’ credit card balances (their lowest point in six years), the number and amount of mortgages taken out by Canadians have sent the country's consumer debt soaring to roughly $2.1 trillion.

However, the new changes to the mortgage stress test are expected to help cool the market and decrease the pool of qualified borrowers. Under the revised test, the minimum qualifying rate for uninsured mortgages — residential mortgages with a down payment of 20% or more — will rise to either the contracted rate plus two percentage points or 5.25%, whichever is higher, which is a slight increase from the previous threshold of 4.79%.

Though, despite the recent changes, some argue that the new measures aren't enough to balance Canada's red hot housing market and more work needs to be done to see any significant price reductions.