Overall consumer debt has soared to $2.08T (as in trillion) thanks to unprecedented levels of new mortgage volumes.

According to Equifax Canada’s most recent report on consumer credit conditions, while most Canadian consumers are pulling back on their credit card debt, new mortgages are soaring.

New mortgages are up 41.2% in Q1 compared to Q1 2020, and the average limit on new mortgages grew by 20.5% to $326,930. This moves total consumer debt up 0.62% from last quarter and up 4.78% from Q1 2020.

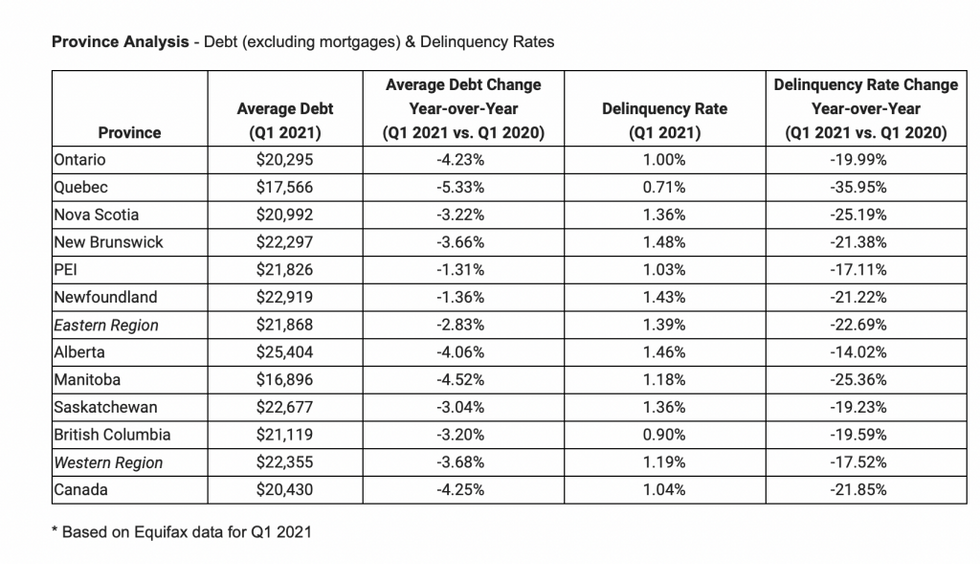

Not surprisingly, much of the new mortgage growth adding to the debt load was driven by BC and Ontario, where prices for single-family homes have climbed so high that they’re virtually unattainable to would-be first-time homebuyers. BC saw a jump in volume of 52.9% compared to Q1 2020, while Ontario’s mortgage volume grew 44.3%.

“Low interest rates and speculation around U.S. inflation impacting our interest rates has fuelled mortgage volumes as consumers fear future interest rate hikes,” said Rebecca Oakes, AVP of Advanced Analytics at Equifax Canada. “Competition among homebuyers is fierce in many markets across the country. We’ll monitor whether the new mortgage stress test helps to cool off the hot housing market.”

As of June 1, new stress test rules set the qualifying rate on uninsured mortgages at a contracted rate plus two percentage points, or 5.25%, whichever is higher. This move will limit the purchasing capacity of many buyers, with an agenda to slow down the overheated mortgage market.

Despite Canada’s red-hot housing scene, the report found that credit card debt has actually continuously declined since the start of the pandemic. In fact, credit card debt is now at its lowest level in six years, as consumers are paying off debts more than they are spending. On average, credit card balances dropped by 9.9% in Q1 of this year compared to last year and by 4.2% compared to the last quarter of 2020.

“Lower interest rates, multiple lockdowns, and higher unemployment rates have led to changes in consumer behaviour, which has slowed overall credit card growth during the pandemic,” said Oakes. “While deferral programs have come to an end for most consumers, government incentives are still in place, which has helped consumers in paying down their credit card debt.

Consumers are moving away from multiple cards and being more careful with their credit. The number of credit cards per consumer has been on a downward trajectory since 2016. Younger consumers who are historically more likely to miss payments on credit cards have also seen a drop in their spend-to-payment ratio. Likewise, Gen Z has managed to reverse this ratio and are also paying off their credit card debt. This could perhaps be facilitated by pandemic-inspired moves back home with the parents.

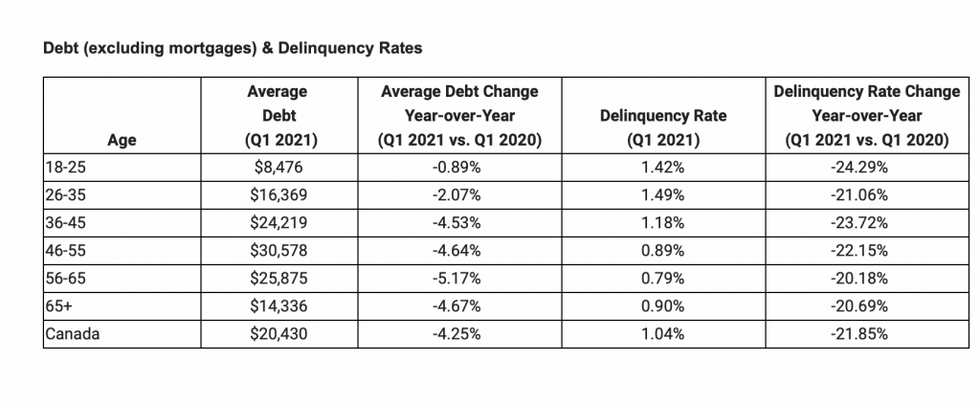

In total, the average consumer debt (excluding mortgages) dropped again this quarter to $20,430, which is a year-over-year decrease of 4.2% from Q1 2020.

In other positive news, mortgage delinquencies saw a year-over-year decline of 21.8% and a quarter-over-quarter decline of 4.0%, with credit cards and non-bank auto loans showing the biggest drop.

The 90+ day mortgage delinquency rate dropped by 19.0% compared to Q1 2020 and by 7.4% versus Q4 2020. Mortgage delinquency rates are at an all-time low, but there are some telling variations across cities and provinces. Most provinces and cities have shown a decline in mortgage delinquencies except for Vancouver and Fort McMurray. Vancouver showed a worrisome 14.6% increase in the 90+ day mortgage delinquency rate compared to Q1 2020, while Fort McMurray showed the biggest spike with a significant 38% increase compared to the previous year.

“The road to recovery continues to be uneven with non-mortgage delinquency rates among younger consumers (under 35) on the rise since last quarter, but older consumers have managed to keep their non-mortgage delinquencies at lower levels,” added Oakes. “Successful vaccine rollouts will be the critical factor in opening up the economy, which will have a big impact on consumer spending and debt management. Canadians should be preparing themselves for a point in time, which will likely come in this calendar year, when governments begin to rein in support mechanisms.

Perhaps the most telling signs of the times on the mortgage front are still to come.