August was another hot month for real estate sales in the Greater Toronto Area, proof positive that previous measures to cool the market are starting to lose their lustre.

A total of 7,711 transactions occurred across the region tracked by the Toronto Real Estate Board over the course of the month, a strong year-over-year increase of 13.4 per cent. The supply of new listings, however, shrank by -3 per cent over the same timeline, leading to scant supply for buyers. It’s also putting upward pressure on prices – the region’s average ticked up by 3.6 per cent year-over-year to $792,611.

READ: Bank Of Canada Keeps Rates Steady Amidst Escalating Trade Conflict

More House Sales In the Mix

The value of homes sold has also increased, reflected by 4.9 per cent annual growth on the MLS Home Price Index; this is likely the result of a greater proportion of higher-priced single-family and low-rise homes being sold, following the segment’s slowdown in recent years. However, while it’s promising that buyers are returning to the upper end of the market – especially following the fallout from the federal mortgage stress test – the market hasn’t yet rebounded to its peak, says TREB President Michael Collins.

“GTA-wide sales were up on a year-over-year basis for all major market segments, with annual rates of sales growth strongest for low-rise home types including detached houses. This reflects the fact that demand for more expensive home types was very low in 2018 and has rebounded to a certain degree in 2019, albeit not back to the record levels experienced in 2016 and the first quarter of 2017,” he states. “The OSFI mortgage stress test continues to keep some would-be home buyers on the sidelines.”

READ: 40 Per Cent Of First-Time Buyers Would Sacrifice Finances To Own A Home

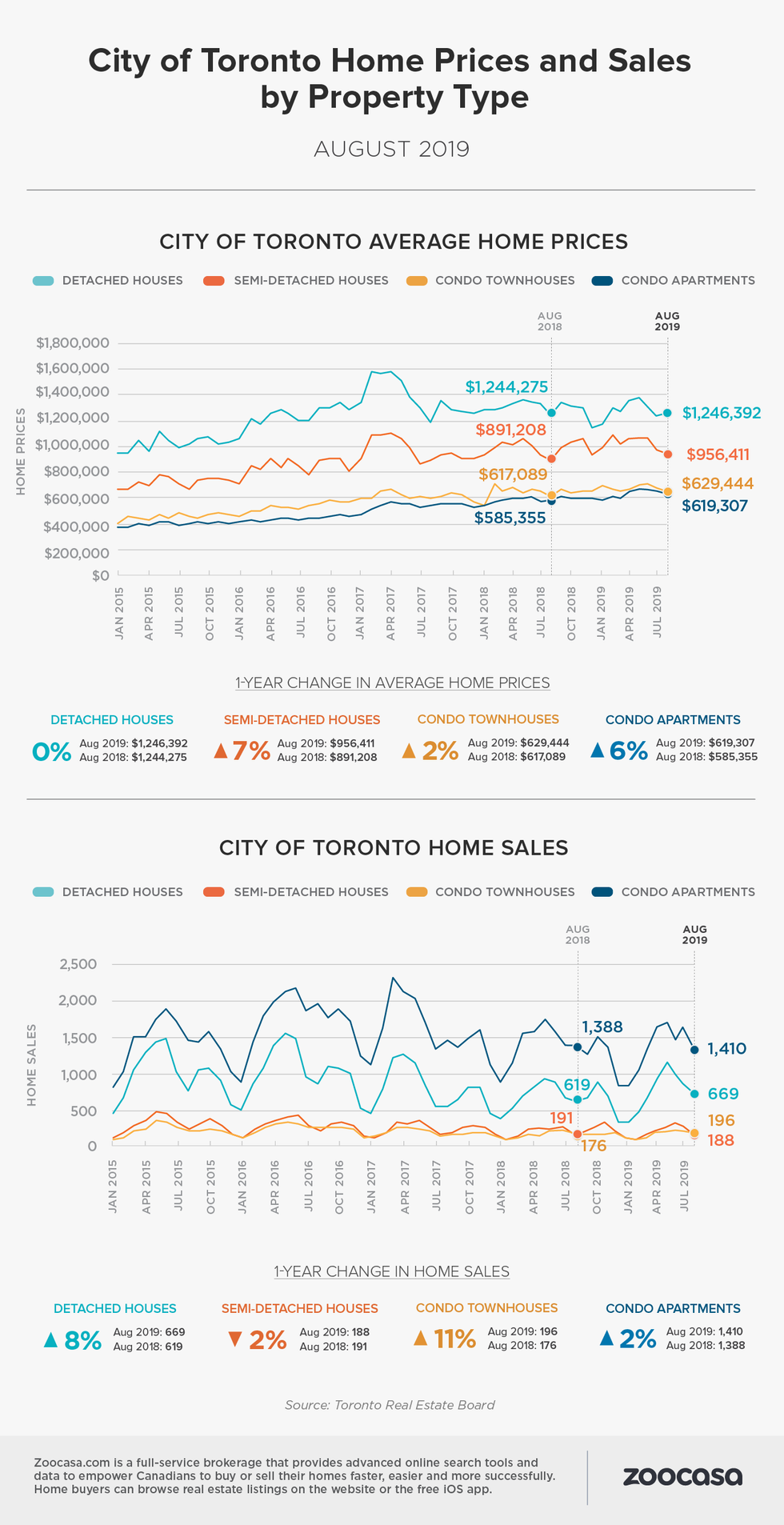

This is also evident in that the strongest price continues to be felt in the condo and townhouse segments, as home buyers are still flocking to the most affordable options available due to limited affordability.

Not Enough Supply Prompts Price Fears

Too-little supply has been a steadily growing point of concern, and August was no exception; TREB points out that, year-to-date, sales have easily outpaced the number of new listings coming to market, which has really tightened up conditions for buyers. The sales-to-new-listings ratio for the region – a measure that gauges how friendly a market is for buyers – currently sits at 65 per cent. This indicates a steep sellers’ market; a range between 40 to 60 per cent is considered balanced, with above and below that threshold indicating sellers’ and buyers’ conditions, respectively. As last year’s ratio sat at 56 per cent, this shows the market has heated up from balanced territory in the space of a year.

In the City of Toronto, where sales rose 5.1 per cent with 2,553 transactions and listings stayed flat at -0.6 per cent, prices rose 4.2 per cent to $818,715, with a steep SNLR of 68 per cent.

READ: Canadian Mortgage Rates Among The World’s Highest: Report

A similar scenario played out in surrounding “905” housing markets. For example, activity for condos and houses for sale in Mississauga rose a robust 9.7 per cent, while listings grew 2.3 per cent and prices by 7 per cent to $732,549. The municipality also remains in sellers’ territory with an SNLR of 67 per cent. In Halton Region, which includes Burlington and Oakville houses for sale, sales rose by a more moderate 3.7 per cent; new listings dipped by -7.5 per cent, while prices stayed flat at $857,417 (up 0.6 per cent). However, the region is in a steep sellers’ market with an SNLR of 74 per cent.

Calls Grow For New Housing Creation

These pervasive sellers’ conditions throughout the TREB region are leading to growing concerns that the stage may be set for unsustainable price growth once more, says Jason Mercer, TREB’s chief market analyst.

“This year’s market through August has been characterized by receding listings and increasing sales relative to 2018,” he stated. “Competition between buyers has increased, which has led to stronger annual rates of price growth, most notably during this past spring and summer. Right now, the overall pace of price growth is moderate. However, if demand for ownership housing continues to increase relative to the supply of listings, the annual rate of price growth will accelerate further.”

He adds, “This underpins the importance of solving this region’s housing supply issues, which will go a long way to insuring a sustainable pace of price growth over the long term.”

Check out the infographic below to see how sales and price trends have changed year over year in the City of Toronto in August.