Anchor Tenant

Learn what an anchor tenant is in Canadian commercial real estate and how these key retailers affect leasing, traffic, and property value.

June 09, 2025

What is an Anchor Tenant?

An anchor tenant is a large, well-known retailer or business that occupies a significant portion of a shopping centre or commercial development and attracts customer traffic to the area.

Why Anchor Tenants Matter in Real Estate

In Canadian commercial real estate, anchor tenants increase the visibility, stability, and desirability of retail plazas or malls for both consumers and other businesses.

Characteristics of anchor tenants:

- National or multinational chains (e.g., grocery stores, department stores)

- Long-term lease agreements

- Preferential lease rates or build-to-suit arrangements

Anchor tenants help drive foot traffic, making it easier to lease adjacent smaller retail units. Their presence may also boost property values and financing opportunities for landlords.

Understanding anchor tenants is key to evaluating retail site viability and investment potential.

Example of an Anchor Tenant in Action

A major grocery store serves as the anchor tenant in a suburban plaza, drawing shoppers to smaller retail stores in the same complex.

Key Takeaways

- Drives traffic to commercial developments

- Typically a large, well-known retailer

- Often receives lease incentives

- Increases leasing success for smaller tenants

- *Boosts property valuation and stability

Related Terms

- Outparcels

- Commercial Lease

- Tenant Mix

- Triple Net Lease

- Retail Zoning

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

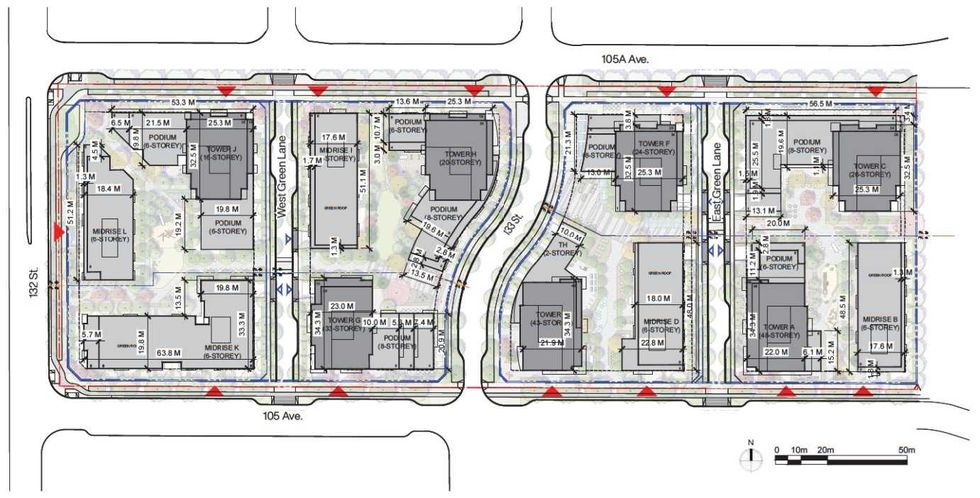

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group)

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group) An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) A rendering of the project at full build out. (Arcadis, Onni Group)

A rendering of the project at full build out. (Arcadis, Onni Group)