Absorption Rate

Explore absorption rate in Canadian real estate — what it measures, how it's calculated, and why it matters to market analysis.

July 11, 2025

What is Absorption Rate?

Absorption rate is a metric that measures the rate at which available properties are sold or leased in a specific market over a given period.

Why Absorption Rate Matters in Real Estate

In Canadian real estate, absorption rate indicates market health, demand, and pricing trends, and is used by developers, investors, and agents.

Calculation:

- (Number of properties sold ÷ total available properties) × 100

- Expressed as a monthly or annual rate

High absorption rates suggest strong demand and a seller’s market, while low rates may indicate oversupply.

Example of Absorption Rate in Action

The city’s absorption rate for new condos rose sharply, reflecting strong demand and declining inventory.

Key Takeaways

- Measures how quickly properties sell

- Indicates market demand and health

- Guides pricing and development decisions

- High rates reflect strong demand

- Low rates signal oversupply

Related Terms

- Market Trends

- Housing Inventory

- Sales-To-New-Listings Ratio (SNLR)

- Sellers' Market

- Buyers' Market

Renderings of the 65-storey tower previously proposed for 145 Wellington Street West. (Partisans with Turner Fleischer / SKYGRiD)

Renderings of the 65-storey tower previously proposed for 145 Wellington Street West. (Partisans with Turner Fleischer / SKYGRiD)

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

Christine Boyle and Gregor Robertson. (Government of British Columbia)

Christine Boyle and Gregor Robertson. (Government of British Columbia)

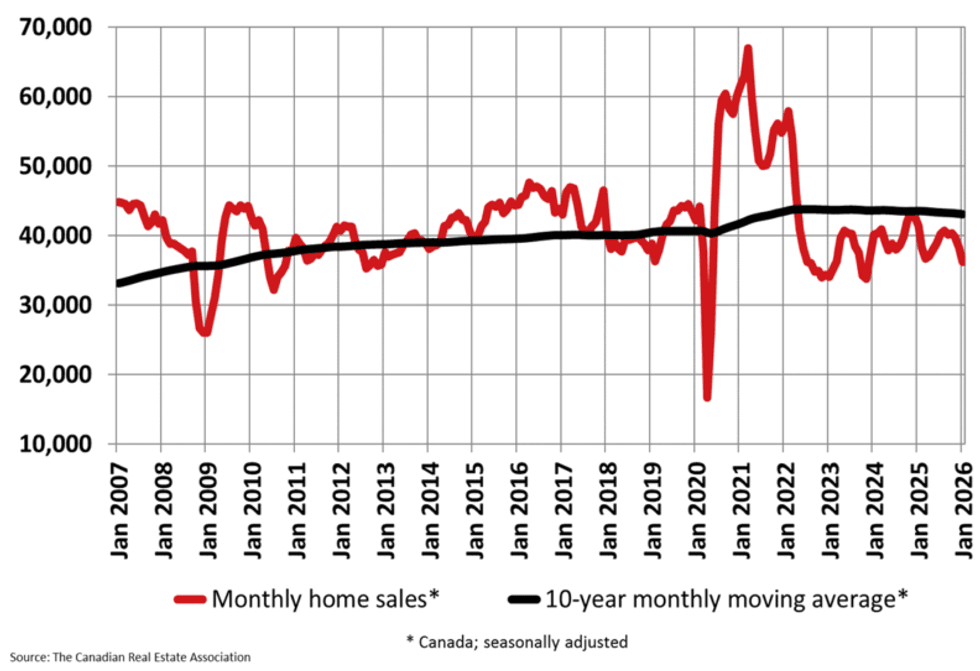

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)